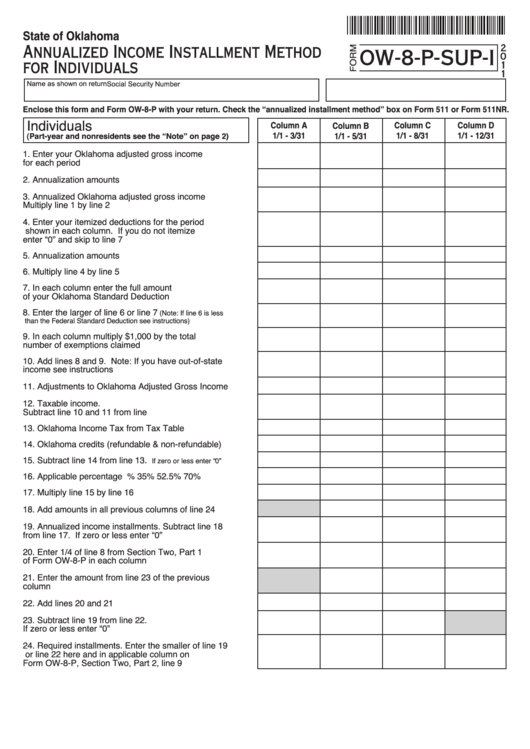

State of Oklahoma

Annualized Income Installment Method

2

OW-8-P-SUP-I

0

for Individuals

1

1

Name as shown on return

Social Security Number

Enclose this form and Form OW-8-P with your return. Check the “annualized installment method” box on Form 511 or Form 511NR.

Individuals

Column A

Column C

Column D

Column B

1/1 - 3/31

1/1 - 8/31

1/1 - 12/31

1/1 - 5/31

(Part-year and nonresidents see the “Note” on page 2)

1. Enter your Oklahoma adjusted gross income

for each period ........................................................... 1

2. Annualization amounts . .............................................. 2

4

2.4

1.5

1

3. Annualized Oklahoma adjusted gross income

Multiply line 1 by line 2 . ............................................... 3

4. Enter your itemized deductions for the period

shown in each column. If you do not itemize

enter “0” and skip to line 7 .......................................... 4

5. Annualization amounts . ............................................... 5

4

2.4

1.5

1

6. Multiply line 4 by line 5 . ............................................... 6

7. In each column enter the full amount

of your Oklahoma Standard Deduction . ..................... 7

8. Enter the larger of line 6 or line 7

(Note: If line 6 is less

.............. 8

than the Federal Standard Deduction see instructions)

9. In each column multiply $1,000 by the total

number of exemptions claimed ................................... 9

10. Add lines 8 and 9. Note: If you have out-of-state

income see instructions ............................................ 10

11. Adjustments to Oklahoma Adjusted Gross Income . ...11

12. Taxable income.

Subtract line 10 and 11 from line 3............................ 12

13. Oklahoma Income Tax from Tax Table ...................... 13

14. Oklahoma credits (refundable & non-refundable) ..... 14

15. Subtract line 14 from line 13.

.... 15

If zero or less enter “0”

16. Applicable percentage .............................................. 16

17.5%

35%

52.5%

70%

17. Multiply line 15 by line 16 . ......................................... 17

18. Add amounts in all previous columns of line 24 . ....... 18

19. Annualized income installments. Subtract line 18

from line 17. If zero or less enter “0” ........................ 19

20. Enter 1/4 of line 8 from Section Two, Part 1

of Form OW-8-P in each column . .............................. 20

21. Enter the amount from line 23 of the previous

column ..................................................................... 21

22. Add lines 20 and 21 .................................................. 22

23. Subtract line 19 from line 22.

If zero or less enter “0” . ............................................ 23

24. Required installments. Enter the smaller of line 19

or line 22 here and in applicable column on

Form OW-8-P, Section Two, Part 2, line 9 ................ 24

1

1 2

2