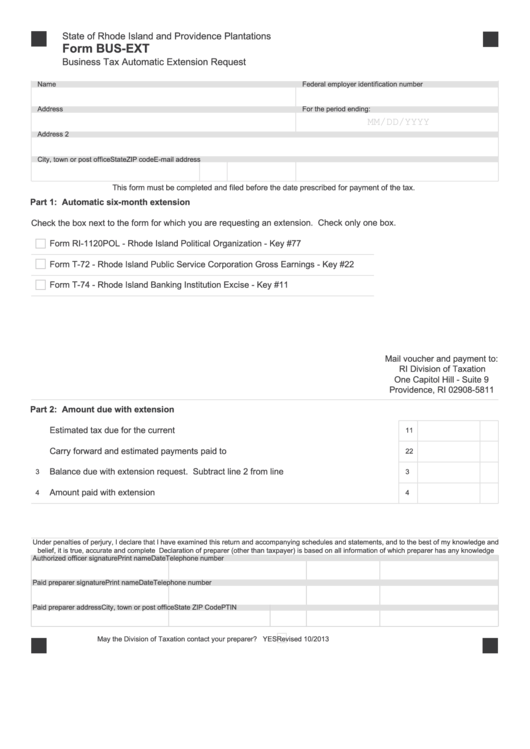

State of Rhode Island and Providence Plantations

Form BUS-EXT

Business Tax Automatic Extension Request

Name

Federal employer identification number

Address

For the period ending:

MM/DD/YYYY

Address 2

City, town or post office

State

ZIP code

E-mail address

This form must be completed and filed before the date prescribed for payment of the tax.

Part 1: Automatic six-month extension

Form RI-1120POL - Rhode Island Political Organization - Key #77

Form T-72 - Rhode Island Public Service Corporation Gross Earnings - Key #22

Form T-74 - Rhode Island Banking Institution Excise - Key #11

Mail voucher and payment to:

RI Division of Taxation

One Capitol Hill - Suite 9

Providence, RI 02908-5811

Part 2: Amount due with extension

Estimated tax due for the current year.....................................................................................

1

1

Carry forward and estimated payments paid to date...............................................................

2

2

Balance due with extension request. Subtract line 2 from line 1............................................

3

3

Amount paid with extension request........................................................................................

4

4

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and

belief, it is true, accurate and complete Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge

Authorized officer signature

Print name

Date

Telephone number

Paid preparer signature

Print name

Date

Telephone number

Paid preparer address

City, town or post office

State

ZIP Code

PTIN

May the Division of Taxation contact your preparer? YES

Revised 10/2013

1

1