Form Sc Sch.tc 4 - South Carolina New Jobs Credit

ADVERTISEMENT

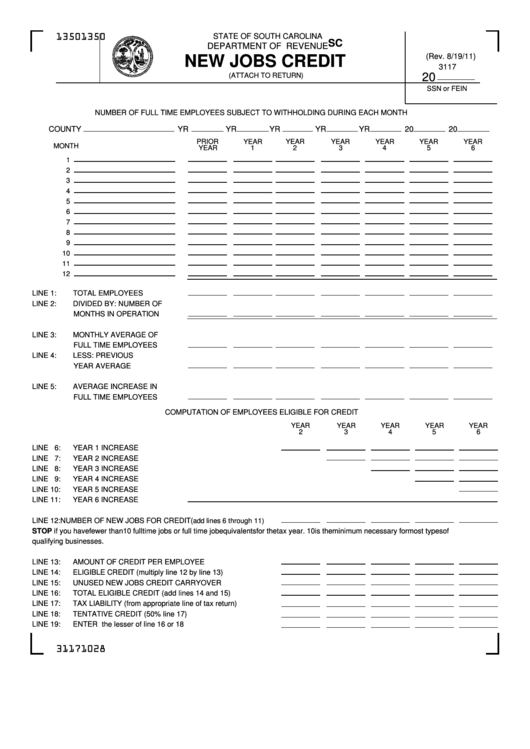

STATE OF SOUTH CAROLINA

1350

1350

SC SCH.TC 4

DEPARTMENT OF REVENUE

(Rev. 8/19/11)

NEW JOBS CREDIT

3117

20

(ATTACH TO RETURN)

SSN or FEIN

NUMBER OF FULL TIME EMPLOYEES SUBJECT TO WITHHOLDING DURING EACH MONTH

COUNTY

YR

YR

YR

YR

YR

20

20

PRIOR

YEAR

YEAR

YEAR

YEAR

YEAR

YEAR

MONTH

YEAR

1

2

3

4

5

6

1

2

3

4

5

6

7

8

9

10

11

12

LINE 1:

TOTAL EMPLOYEES

LINE 2:

DIVIDED BY: NUMBER OF

MONTHS IN OPERATION

LINE 3:

MONTHLY AVERAGE OF

FULL TIME EMPLOYEES

LINE 4:

LESS: PREVIOUS

YEAR AVERAGE

LINE 5:

AVERAGE INCREASE IN

FULL TIME EMPLOYEES

COMPUTATION OF EMPLOYEES ELIGIBLE FOR CREDIT

YEAR

YEAR

YEAR

YEAR

YEAR

2

3

4

5

6

LINE 6:

YEAR 1 INCREASE

LINE 7:

YEAR 2 INCREASE

LINE 8:

YEAR 3 INCREASE

LINE 9:

YEAR 4 INCREASE

LINE 10:

YEAR 5 INCREASE

LINE 11:

YEAR 6 INCREASE

LINE 12:

NUMBER OF NEW JOBS FOR CREDIT (

add lines 6 through 11)

STOP if you have fewer than 10 full time jobs or full time job equivalents for the tax year. 10 is the minimum necessary for most types of

qualifying businesses.

LINE 13:

AMOUNT OF CREDIT PER EMPLOYEE

LINE 14:

ELIGIBLE CREDIT (multiply line 12 by line 13)

LINE 15:

UNUSED NEW JOBS CREDIT CARRYOVER

LINE 16:

TOTAL ELIGIBLE CREDIT (add lines 14 and 15)

LINE 17:

TAX LIABILITY (from appropriate line of tax return)

LINE 18:

TENTATIVE CREDIT (50% line 17)

LINE 19:

ENTER the lesser of line 16 or 18

31171028

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9