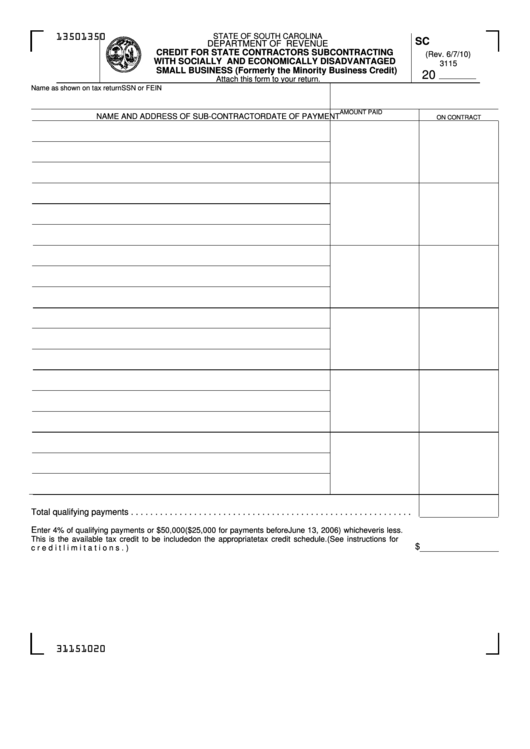

Form Sc Sch.tc-2 - South Carolina Credit For State Contractors Subcontracting With Socially And Economically Disadvantaged

ADVERTISEMENT

STATE OF SOUTH CAROLINA

1350

1350

SC SCH.TC-2

DEPARTMENT OF REVENUE

CREDIT FOR STATE CONTRACTORS SUBCONTRACTING

(Rev. 6/7/10)

WITH SOCIALLY AND ECONOMICALLY DISADVANTAGED

3115

SMALL BUSINESS (Formerly the Minority Business Credit)

20

Attach this form to your return.

Name as shown on tax return

SSN or FEIN

AMOUNT PAID

NAME AND ADDRESS OF SUB-CONTRACTOR

DATE OF PAYMENT

ON CONTRACT

Total qualifying payments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

E

nter 4% of qualifying payments or $50,000 ($25,000 for payments before June 13, 2006) whichever is less.

This is the available tax credit to be included on the appropriate tax credit schedule. (See instructions for

$

credit limitations.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

31151020

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2