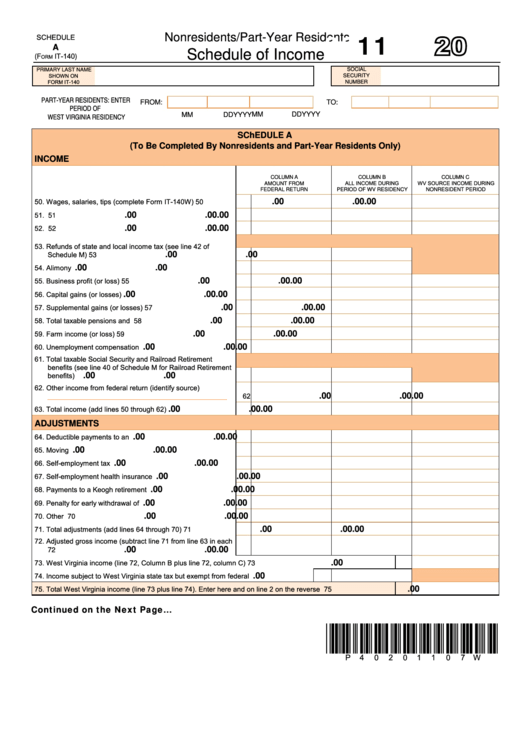

Schedule A (Form It-140) - West Virginia Nonresidents/part-Year Residents Schedule Of Income - 2011

ADVERTISEMENT

2011

SCHEDULE

Nonresidents/Part-Year Residents

A

Schedule of Income

IT-140)

(F

orm

SOCIAL

PRIMARY LAST NAME

SHOWN ON

SECURITY

FORM IT-140

NUMBER

PART-YEAR RESIDENTS: ENTER

FROM:

TO:

PERIOD OF

MM

DD

YYYY

WEST VIRGINIA RESIDENCY

MM

DD

YYYY

SChEDULE A

(To Be Completed By Nonresidents and Part-Year Residents Only)

INCOME

COLUMN A

COLUMN B

COLUMN C

ALL INCOME DURING

WV SOURCE INCOME DURING

AMOUNT FROM

FEDERAL RETURN

PERIOD OF WV RESIDENCY

NONRESIDENT PERIOD

50. Wages, salaries, tips (complete Form IT-140W).....................

.00

.00

.00

50

51. Interest..................................................................................... 51

.00

.00

.00

52. Dividends................................................................................. 52

.00

.00

.00

53. Refunds of state and local income tax (see line 42 of

Schedule M)............................................................................

.00

.00

53

54. Alimony received...................................................................... 54

.00

.00

55. Business profit (or loss)........................................................... 55

.00

.00

.00

56. Capital gains (or losses).......................................................... 56

.00

.00

.00

57. Supplemental gains (or losses)...............................................

.00

.00

.00

57

58. Total taxable pensions and annuities....................................... 58

.00

.00

.00

59. Farm income (or loss).............................................................

.00

.00

.00

59

60. Unemployment compensation insurance................................

60

.00

.00

.00

61. Total taxable Social Security and Railroad Retirement

benefits (see line 40 of Schedule M for Railroad Retirement

benefits)..................................................................................

61

.00

.00

62. Other income from federal return (identify source)

62

.00

.00

.00

______________________________________________

63. Total income (add lines 50 through 62)...................................

63

.00

.00

.00

ADJUSTMENTS

64. Deductible payments to an IRA................................................ 64

.00

.00

.00

65. Moving expenses..................................................................... 65

.00

.00

.00

66. Self-employment tax deduction................................................ 66

.00

.00

.00

67. Self-employment health insurance deduction.......................... 67

.00

.00

.00

68. Payments to a Keogh retirement plan...................................... 68

.00

.00

.00

69. Penalty for early withdrawal of savings.................................... 69

.00

.00

.00

70. Other adjustments...................................................................

.00

.00

.00

70

71. Total adjustments (add lines 64 through 70)...........................

.00

.00

.00

71

72. Adjusted gross income (subtract line 71 from line 63 in each

column..................................................................................... 72

.00

.00

.00

73. West Virginia income (line 72, Column B plus line 72, column C).............................................................................

.00

73

74. Income subject to West Virginia state tax but exempt from federal tax.............................

74

.00

75. Total West Virginia income (line 73 plus line 74). Enter here and on line 2 on the reverse side.................................

.00

75

Continued on the Next Page…

*p40201107W*

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2