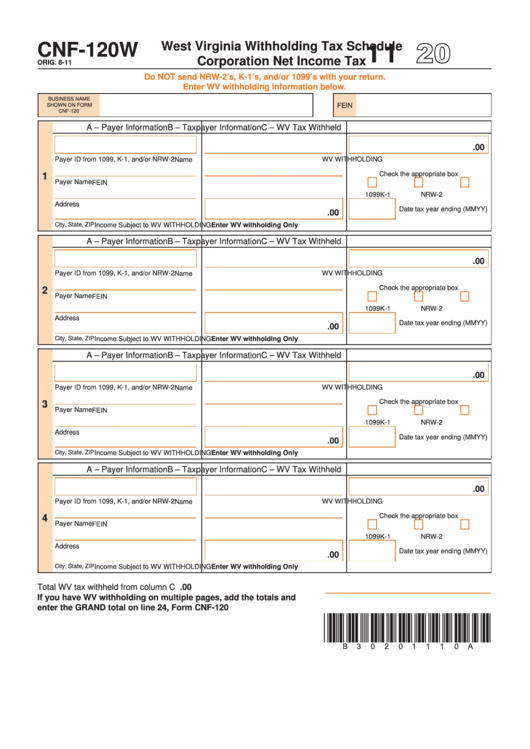

Form Cnf-120w - West Virginia Withholding Tax Schedule Corporation Net Income Tax - 2011

ADVERTISEMENT

11

West Virginia Withholding Tax Schedule

CNF-120W

Corporation Net income Tax

ORig. 8-11

Do NOT send NRW-2’s, K-1’s, and/or 1099’s with your return.

Enter WV withholding information below.

BuSINESS NaME

FEIN

SHOWN ON FORM

CNF-120

a – Payer Information

B – Taxpayer Information

C – WV Tax Withheld

.00

Payer Id from 1099, K-1, and/or NRW-2

WV WITHHOLdING

Name

1

Check the appropriate box

Payer Name

FEIN

1099

K-1

NRW-2

address

date tax year ending (MMYY)

.00

City, State, ZIP

Income Subject to WV WITHHOLdING

Enter WV withholding Only

a – Payer Information

B – Taxpayer Information

C – WV Tax Withheld

.00

Payer Id from 1099, K-1, and/or NRW-2

WV WITHHOLdING

Name

2

Check the appropriate box

Payer Name

FEIN

1099

K-1

NRW-2

address

date tax year ending (MMYY)

.00

City, State, ZIP

Income Subject to WV WITHHOLdING

Enter WV withholding Only

a – Payer Information

B – Taxpayer Information

C – WV Tax Withheld

.00

Payer Id from 1099, K-1, and/or NRW-2

Name

WV WITHHOLdING

3

Check the appropriate box

Payer Name

FEIN

1099

K-1

NRW-2

address

date tax year ending (MMYY)

.00

City, State, ZIP

Income Subject to WV WITHHOLdING

Enter WV withholding Only

a – Payer Information

B – Taxpayer Information

C – WV Tax Withheld

.00

Payer Id from 1099, K-1, and/or NRW-2

WV WITHHOLdING

Name

4

Check the appropriate box

Payer Name

FEIN

1099

K-1

NRW-2

address

date tax year ending (MMYY)

.00

City, State, ZIP

Income Subject to WV WITHHOLdING

Enter WV withholding Only

Total WV tax withheld from column C above....................................................

.00

if you have WV withholding on multiple pages, add the totals and

enter the gRAND total on line 24, Form CNF-120

*B30201110a*

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1