Tennessee Sales Or Use Tax Certificate Of Exemption - Tennessee Department Of Revenue

ADVERTISEMENT

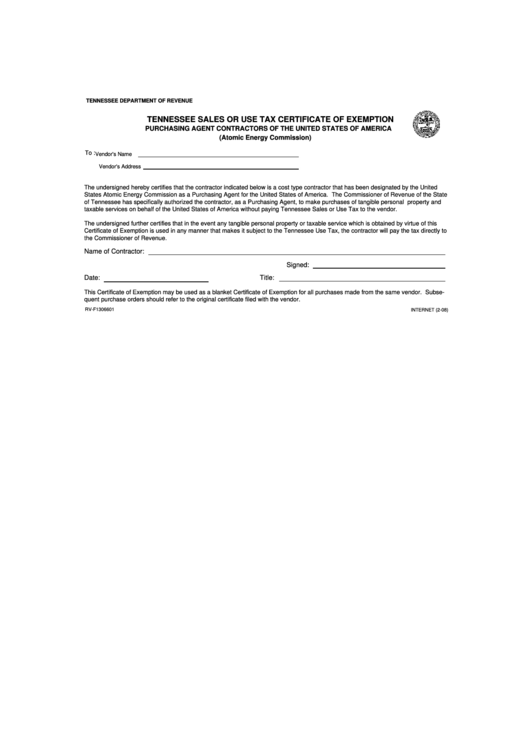

TENNESSEE DEPARTMENT OF REVENUE

TENNESSEE SALES OR USE TAX CERTIFICATE OF EXEMPTION

PURCHASING AGENT CONTRACTORS OF THE UNITED STATES OF AMERICA

(Atomic Energy Commission)

To :

Vendor's Name

Vendor's Address

The undersigned hereby certifies that the contractor indicated below is a cost type contractor that has been designated by the United

States Atomic Energy Commission as a Purchasing Agent for the United States of America. The Commissioner of Revenue of the State

of Tennessee has specifically authorized the contractor, as a Purchasing Agent, to make purchases of tangible personal property and

taxable services on behalf of the United States of America without paying Tennessee Sales or Use Tax to the vendor.

The undersigned further certifies that in the event any tangible personal property or taxable service which is obtained by virtue of this

Certificate of Exemption is used in any manner that makes it subject to the Tennessee Use Tax, the contractor will pay the tax directly to

the Commissioner of Revenue.

Name of Contractor:

Signed:

Date:

Title:

This Certificate of Exemption may be used as a blanket Certificate of Exemption for all purchases made from the same vendor. Subse-

quent purchase orders should refer to the original certificate filed with the vendor.

RV-F1306601

INTERNET (2-08)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1