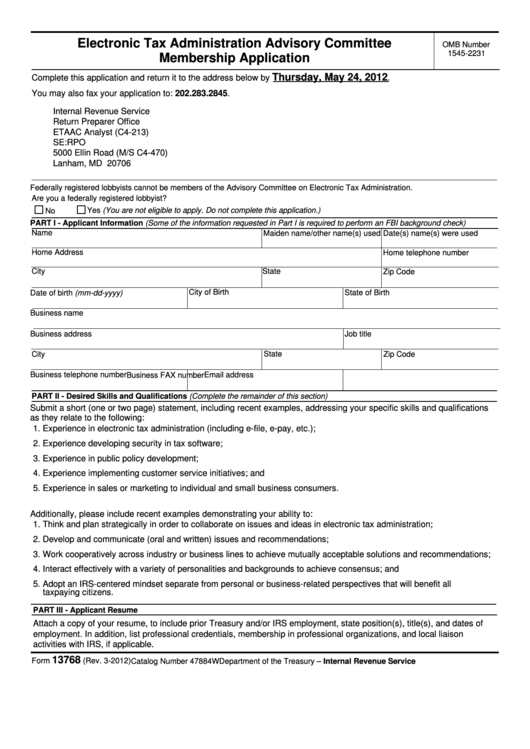

Electronic Tax Administration Advisory Committee

OMB Number

1545-2231

Membership Application

Thursday, May 24, 2012

Complete this application and return it to the address below by

.

You may also fax your application to: 202.283.2845.

Internal Revenue Service

Return Preparer Office

ETAAC Analyst (C4-213)

SE:RPO

5000 Ellin Road (M/S C4-470)

Lanham, MD 20706

Federally registered lobbyists cannot be members of the Advisory Committee on Electronic Tax Administration.

Are you a federally registered lobbyist?

No

Yes (You are not eligible to apply. Do not complete this application.)

PART I - Applicant Information (Some of the information requested in Part I is required to perform an FBI background check)

Name

Maiden name/other name(s) used

Date(s) name(s) were used

Home Address

Home telephone number

City

State

Zip Code

City of Birth

Date of birth (mm-dd-yyyy)

State of Birth

Business name

Job title

Business address

State

City

Zip Code

Business telephone number

Email address

Business FAX number

PART II - Desired Skills and Qualifications (Complete the remainder of this section)

Submit a short (one or two page) statement, including recent examples, addressing your specific skills and qualifications

as they relate to the following:

1. Experience in electronic tax administration (including e-file, e-pay, etc.);

2. Experience developing security in tax software;

3. Experience in public policy development;

4. Experience implementing customer service initiatives; and

5. Experience in sales or marketing to individual and small business consumers.

Additionally, please include recent examples demonstrating your ability to:

1. Think and plan strategically in order to collaborate on issues and ideas in electronic tax administration;

2. Develop and communicate (oral and written) issues and recommendations;

3. Work cooperatively across industry or business lines to achieve mutually acceptable solutions and recommendations;

4. Interact effectively with a variety of personalities and backgrounds to achieve consensus; and

5. Adopt an IRS-centered mindset separate from personal or business-related perspectives that will benefit all

taxpaying citizens.

PART III - Applicant Resume

Attach a copy of your resume, to include prior Treasury and/or IRS employment, state position(s), title(s), and dates of

employment. In addition, list professional credentials, membership in professional organizations, and local liaison

activities with IRS, if applicable.

13768

Form

(Rev. 3-2012)

Catalog Number 47884W

Department of the Treasury – Internal Revenue Service

1

1 2

2