Instructions For Sales/use Tax And Transient Employer Bond Forms

ADVERTISEMENT

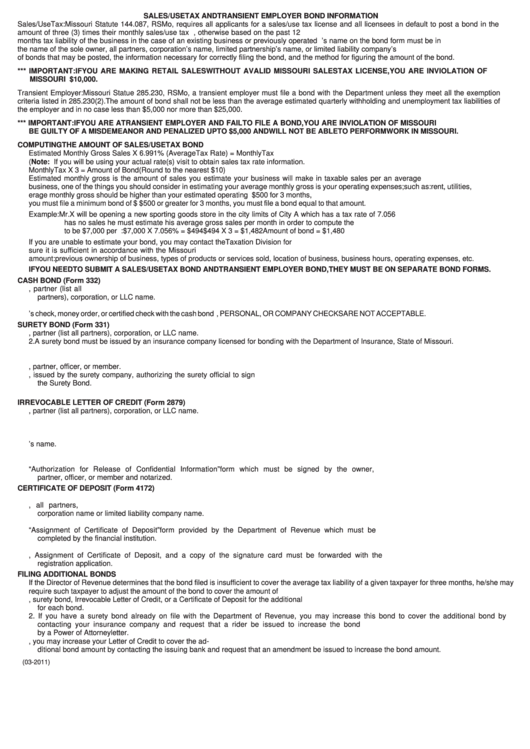

SALES/USE TAX AND TRANSIENT EMPLOYER BOND INFORMATION

Sales/Use Tax: Missouri Statute 144.087, RSMo, requires all applicants for a sales/use tax license and all licensees in default to post a bond in the

amount of three (3) times their monthly sales/use tax liability. This amount is estimated in the case of a new business, otherwise based on the past 12

months tax liability of the business in the case of an existing business or previously operated business. The owner’s name on the bond form must be in

the name of the sole owner, all partners, corporation’s name, limited partnership’s name, or limited liability company’s name. Listed below are the types

of bonds that may be posted, the information necessary for correctly filing the bond, and the method for figuring the amount of the bond.

*** IMPORTANT: IF YOU ARE MAKING RETAIL SALES WITHOUT A VALID MISSOURI SALES TAX LICENSE, YOU ARE IN VIOLATION OF

MISSOURI LAW. YOU MAY BE GUILTY OF A MISDEMEANOR AND PENALIZED UP TO $10,000.

Transient Employer: Missouri Statue 285.230, RSMo, a transient employer must file a bond with the Department unless they meet all the exemption

criteria listed in 285.230(2). The amount of bond shall not be less than the average estimated quarterly withholding and unemployment tax liabilities of

the employer and in no case less than $5,000 nor more than $25,000.

*** IMPORTANT: IF YOU ARE A TRANSIENT EMPLOYER AND FAIL TO FILE A BOND, YOU ARE IN VIOLATION OF MISSOURI LAW. YOU MAY

BE GUILTY OF A MISDEMEANOR AND PENALIZED UP TO $5,000 AND WILL NOT BE ABLE TO PERFORM WORK IN MISSOURI.

COMPUTING THE AMOUNT OF SALES/USE TAX BOND

Estimated Monthly Gross Sales X 6.991% (Average Tax Rate) = Monthly Tax

(Note: If you will be using your actual rate(s) visit to obtain sales tax rate information.

Monthly Tax X 3 = Amount of Bond (Round to the nearest $10)

Estimated monthly gross is the amount of sales you estimate your business will make in taxable sales per an average month. If you are a small

business, one of the things you should consider in estimating your average monthly gross is your operating expenses; such as: rent, utilities, etc.Your av-

erage monthly gross should be higher than your estimated operating expenses. If you compute your sales tax liability to be less than $500 for 3 months,

you must file a minimum bond of $25. If you compute your sales tax liability to be $500 or greater for 3 months, you must file a bond equal to that amount.

Example: Mr. X will be opening a new sporting goods store in the city limits of City A which has a tax rate of 7.056 percent. Because the business

has no sales he must estimate his average gross sales per month in order to compute the bond. Mr. X estimated his average gross sales

to be $7,000 per month. This is how Mr. X computed his bond: $7,000 X 7.056% = $494

$494 X 3 = $1,482

Amount of bond = $1,480

If you are unable to estimate your bond, you may contact the Taxation Division for assistance. The Taxation Division reviews the bond amount to en-

sure it is sufficient in accordance with the Missouri Statutes. The following items are taken into consideration when determining a sufficient bond

amount: previous ownership of business, types of products or services sold, location of business, business hours, operating expenses, etc.

IF YOU NEED TO SUBMIT A SALES/USE TAX BOND AND TRANSIENT EMPLOYER BOND, THEY MUST BE ON SEPARATE BOND FORMS.

CASH BOND (Form 332)

1. Fully complete the cash bond form. Owners name must include owner and spouse if spouse is included on the application, partner (list all

partners), corporation, or LLC name.

2. Sign the cash bond form.

3. Forward a cashier’s check, money order, or certified check with the cash bond form. CASH, PERSONAL, OR COMPANY CHECKS ARE NOT ACCEPTABLE.

SURETY BOND (Form 331)

1. Owners name must include owner and spouse if spouse is included on the application, partner (list all partners), corporation, or LLC name.

2. A surety bond must be issued by an insurance company licensed for bonding with the Department of Insurance, State of Missouri.

3. It must be on the form provided by the Department of Revenue.

4. The form must bear the effective date.

5. It must be signed by an authorized representative of the surety company and the owner, partner, officer, or member.

6. The Surety Bond must be accompanied by a valid Power of Attorney letter, issued by the surety company, authorizing the surety official to sign

the Surety Bond.

7. It must be the original bond. A copy is not acceptable.

IRREVOCABLE LETTER OF CREDIT (Form 2879)

1. Owners name must include owner and spouse if spouse is included on the application, partner (list all partners), corporation, or LLC name.

2. The letter of credit must be issued by a financial banking institution located in the United States.

3. It must be on the form provided by the Department of Revenue.

4. It must be the original letter of credit. A copy is not acceptable.

5. It must state the owner’s name.

6. It must state the date of issuance.

7. It must be signed by a bank official and notarized.

8. It must be accompanied by an “Authorization for Release of Confidential Information” form which must be signed by the owner,

partner, officer, or member and notarized.

CERTIFICATE OF DEPOSIT (Form 4172)

1. The Certificate of Deposit must be issued by a state or federally chartered financial institution.

2. The Certificate of Deposit must be issued in the name of the Missouri Department of Revenue AND the owner, all partners,

corporation name or limited liability company name.

3. It must be issued for not less than 24 months.

4. It must be accompanied by the “Assignment of Certificate of Deposit” form provided by the Department of Revenue which must be

completed by the financial institution.

5. The Certificate of Deposit must be endorsed or accompanied by a signed withdrawal slip.

6. The actual Certificate of Deposit, Assignment of Certificate of Deposit, and a copy of the signature card must be forwarded with the

registration application.

FILING ADDITIONAL BONDS

If the Director of Revenue determines that the bond filed is insufficient to cover the average tax liability of a given taxpayer for three months, he/she may

require such taxpayer to adjust the amount of the bond to cover the amount of liability. The following methods may be used for filing an additional bond.

1. Filing a cash bond, surety bond, Irrevocable Letter of Credit, or a Certificate of Deposit for the additional amount. Refer to the above requirements

for each bond.

2. If you have a surety bond already on file with the Department of Revenue, you may increase this bond to cover the additional bond by

contacting your insurance company and request that a rider be issued to increase the bond amount. The rider must be accompanied

by a Power of Attorney letter.

3. If you have an Irrevocable Letter of Credit already on file with the Department of Revenue, you may increase your Letter of Credit to cover the ad-

ditional bond amount by contacting the issuing bank and request that an amendment be issued to increase the bond amount.

(03-2011)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1