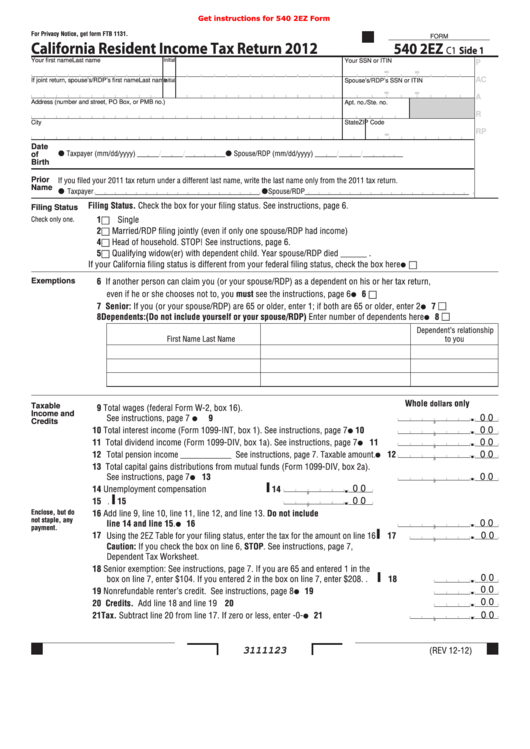

Get instructions for 540 2EZ Form

For Privacy Notice, get form FTB 1131.

FORM

California Resident Income Tax Return 2012

540 2EZ

C1 Side 1

Initial

Your first name

Last name

Your SSN or ITIN

P

-

-

AC

Initial

If joint return, spouse’s/RDP’s first name

Last name

Spouse’s/RDP’s SSN or ITIN

-

-

A

Address (number and street, PO Box, or PMB no.)

Apt. no./Ste. no.

R

City

State

ZIP Code

-

RP

Date

Taxpayer (mm/dd/yyyy) ______/______/___________

Spouse/RDP (mm/dd/yyyy) ______/______/___________

of

Birth

If you filed your 2011 tax return under a different last name, write the last name only from the 2011 tax return.

Prior

Name

Taxpayer _____________________________________________

Spouse/RDP_____________________________________________

Filing Status. Check the box for your filing status. See instructions, page 6.

Filing Status

1

m

Single

Check only one.

2

m

Married/RDP filing jointly (even if only one spouse/RDP had income)

4

m

Head of household. STOP! See instructions, page 6.

5

m

Qualifying widow(er) with dependent child. Year spouse/RDP died ______ .

m

If your California filing status is different from your federal filing status, check the box here. . . . . . . . . . . .

6 If another person can claim you (or your spouse/RDP) as a dependent on his or her tax return,

Exemptions

even if he or she chooses not to, you must see the instructions, page 6 . . . . . . . . . . . . . . . . . . . . . . . . . .

6

m

m

7 Senior: If you (or your spouse/RDP) are 65 or older, enter 1; if both are 65 or older, enter 2 . . . . . . . . . .

7

m

8 Dependents: (Do not include yourself or your spouse/RDP) Enter number of dependents here. . . . . . . .

8

Dependent’s relationship

First Name

Last Name

to you

Whole

only

dollars

9 Total wages (federal Form W-2, box 16).

Taxable

Income and

.

See instructions, page 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

,

0 0

Credits

.

10 Total interest income (Form 1099-INT, box 1). See instructions, page 7 . . . . . .

10

,

0 0

.

11 Total dividend income (Form 1099-DIV, box 1a). See instructions, page 7. . . . .

11

,

0 0

.

12 Total pension income ____________ See instructions, page 7. Taxable amount.

12

,

0 0

13 Total capital gains distributions from mutual funds (Form 1099-DIV, box 2a).

.

13

See instructions, page 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

,

0 0

14 Unemployment compensation . . . . . . . . . . . . . ▌ 14

.

,

0 0

▌ 15

.

15

U.S. social security or railroad retirement benefits .

,

0 0

Enclose, but do

16 Add line 9, line 10, line 11, line 12, and line 13. Do not include

not staple, any

.

line 14 and line 15. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16

,

0 0

payment.

17 Using the 2EZ Table for your filing status, enter the tax for the amount on line 16 . ▌ 17

.

,

0 0

Caution: If you check the box on line 6, STOP. See instructions, page 7,

Dependent Tax Worksheet.

18 Senior exemption: See instructions, page 7. If you are 65 and entered 1 in the

▌ 18

.

box on line 7, enter $104. If you entered 2 in the box on line 7, enter $208 . .

0 0

.

19 Nonrefundable renter’s credit. See instructions, page 8 . . . . . . . . . . . . . . . . . .

19

0 0

.

20 Credits. Add line 18 and line 19 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20

0 0

.

21 Tax. Subtract line 20 from line 17. If zero or less, enter -0- . . . . . . . . . . . . . . . .

21

,

0 0

(REV 12-12)

3111123

1

1 2

2