Arizona Form 140 - Optional Tax Tables - 2013

ADVERTISEMENT

Arizona Form 140

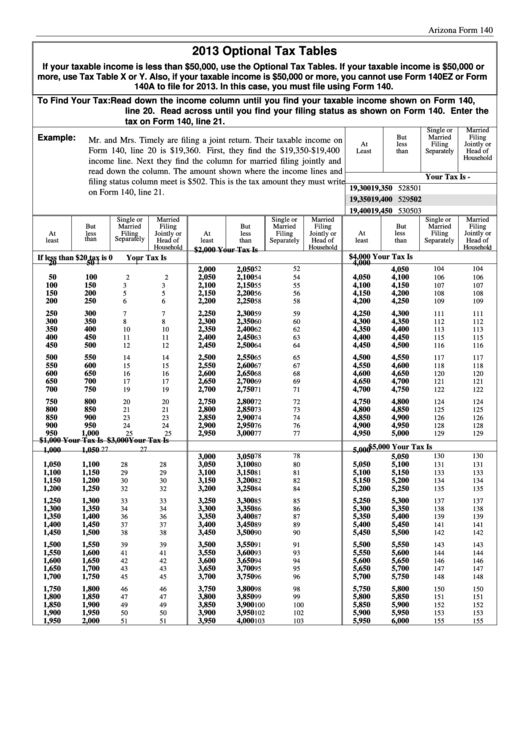

2013 Optional Tax Tables

If your taxable income is less than $50,000, use the Optional Tax Tables. If your taxable income is $50,000 or

more, use Tax Table X or Y. Also, if your taxable income is $50,000 or more, you cannot use Form 140EZ or Form

140A to file for 2013. In this case, you must file using Form 140.

To Find Your Tax:

Read down the income column until you find your taxable income shown on Form 140,

line 20. Read across until you find your filing status as shown on Form 140. Enter the

tax on Form 140, line 21.

Single or

Married

Example:

But

Married

Filing

Mr. and Mrs. Timely are filing a joint return. Their taxable income on

At

less

Filing

Jointly or

Form 140, line 20 is $19,360. First, they find the $19,350-$19,400

Least

than

Separately

Head of

Household

income line. Next they find the column for married filing jointly and

read down the column. The amount shown where the income lines and

Your Tax Is -

filing status column meet is $502. This is the tax amount they must write

19,300

19,350

528

501

on Form 140, line 21.

19,350

19,400

529

502

19,400

19,450

530

503

Single or

Married

Single or

Married

Single or

Married

But

Married

Filing

But

Married

Filing

But

Married

Filing

At

less

Filing

Jointly or

At

less

Filing

Jointly or

At

less

Filing

Jointly or

least

than

Separately

Head of

least

than

Separately

Head of

least

than

Separately

Head of

Household

Household

Household

$2,000

Your Tax Is

$4,000

Your Tax Is

If less than $20 tax is 0

Your Tax Is

1

1

52

52

104

104

20

50

2,000

2,050

4,000

4,050

50

100

2,050

2,100

4,050

4,100

2

2

54

54

106

106

100

150

2,100

2,150

4,100

4,150

3

3

55

55

107

107

150

200

2,150

2,200

4,150

4,200

5

5

56

56

108

108

200

250

2,200

2,250

4,200

4,250

6

6

58

58

109

109

250

300

2,250

2,300

4,250

4,300

7

7

59

59

111

111

300

350

2,300

2,350

4,300

4,350

8

8

60

60

112

112

350

400

2,350

2,400

4,350

4,400

10

10

62

62

113

113

400

450

2,400

2,450

4,400

4,450

11

11

63

63

115

115

450

500

2,450

2,500

4,450

4,500

12

12

64

64

116

116

500

550

2,500

2,550

4,500

4,550

14

14

65

65

117

117

550

600

2,550

2,600

4,550

4,600

15

15

67

67

118

118

600

650

2,600

2,650

4,600

4,650

16

16

68

68

120

120

650

700

2,650

2,700

4,650

4,700

17

17

69

69

121

121

700

750

2,700

2,750

4,700

4,750

19

19

71

71

122

122

750

800

2,750

2,800

4,750

4,800

20

20

72

72

124

124

800

850

2,800

2,850

4,800

4,850

21

21

73

73

125

125

850

900

2,850

2,900

4,850

4,900

23

23

74

74

126

126

900

950

2,900

2,950

4,900

4,950

24

24

76

76

128

128

950

1,000

2,950

3,000

4,950

5,000

25

25

77

77

129

129

$1,000

Your Tax Is

$3,000

Your Tax Is

$5,000

Your Tax Is

1,000

1,050

27

27

3,000

3,050

78

78

5,000

5,050

130

130

1,050

1,100

3,050

3,100

5,050

5,100

28

28

80

80

131

131

1,100

1,150

3,100

3,150

5,100

5,150

29

29

81

81

133

133

1,150

1,200

3,150

3,200

5,150

5,200

30

30

82

82

134

134

1,200

1,250

3,200

3,250

5,200

5,250

32

32

84

84

135

135

1,250

1,300

3,250

3,300

5,250

5,300

33

33

85

85

137

137

1,300

1,350

3,300

3,350

5,300

5,350

34

34

86

86

138

138

1,350

1,400

3,350

3,400

5,350

5,400

36

36

87

87

139

139

1,400

1,450

3,400

3,450

5,400

5,450

37

37

89

89

141

141

1,450

1,500

3,450

3,500

5,450

5,500

38

38

90

90

142

142

1,500

1,550

3,500

3,550

5,500

5,550

39

39

91

91

143

143

1,550

1,600

3,550

3,600

5,550

5,600

41

41

93

93

144

144

1,600

1,650

3,600

3,650

5,600

5,650

42

42

94

94

146

146

1,650

1,700

3,650

3,700

5,650

5,700

43

43

95

95

147

147

1,700

1,750

3,700

3,750

5,700

5,750

45

45

96

96

148

148

1,750

1,800

3,750

3,800

5,750

5,800

46

46

98

98

150

150

1,800

1,850

3,800

3,850

5,800

5,850

47

47

99

99

151

151

1,850

1,900

3,850

3,900

5,850

5,900

49

49

100

100

152

152

1,900

1,950

3,900

3,950

5,900

5,950

50

50

102

102

153

153

1,950

2,000

3,950

4,000

5,950

6,000

51

51

103

103

155

155

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6