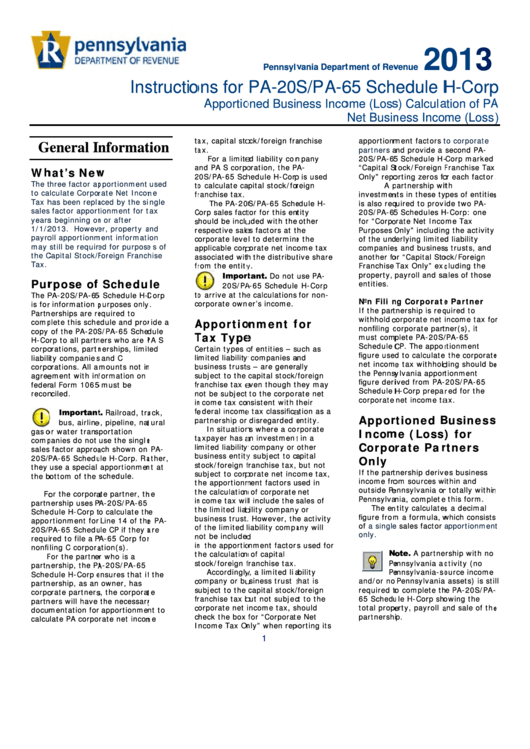

Instructions For Pa-20s/pa-65 Schedule H-Corp - 2013

ADVERTISEMENT

20

013

Pennsylv

vania Depart

tment of Rev

venue

Ins

structio

ons for

PA-20

S/PA-6

65 Sch

edule H

H-Corp

p

Apportio

oned Busi

ness Inco

ome (Loss

s) Calcula

ation of PA

A

Net Busin

ness Inco

me (Loss

)

ta

ax, capital sto

ock/foreign fra

anchise

apportionm

ment factors

t

to corporate

G

eneral In

nformat

tion

ta

ax.

partners

a

and provide a

second PA-

For a limite

ed liability com

mpany

20S/PA-65

5 Schedule H-

-Corp marked

a

and PA S corpo

oration, the PA

A-

“Capital St

tock/Foreign F

Franchise Tax

Wh

hat’s New

w

2

20S/PA-65 Sch

hedule H-Corp

p is used

Only” repo

orting zeros fo

or each factor

.

The t

three factor ap

pportionment

used

to

o calculate ca

pital stock/for

reign

A p

partnership wit

th

to ca

lculate Corpor

rate Net Incom

me

fr

ranchise tax.

investmen

nts in these ty

ypes of entities

s

Tax h

has been repla

aced by the si

ngle

The PA-20

0S/PA-65 Sche

edule H-

is also req

quired to provi

ide two PA-

sales

s factor apport

tionment for t

tax

C

Corp sales fact

tor for this en

ntity

20S/PA-65

5 Schedules H

H-Corp: one

years

s beginning on

n or after

s

should be inclu

uded with the

other

for “Corpo

orate Net Inco

me Tax

1/1/2

2013. Howev

er, property a

and

r

espective sale

es factors at t

he

Purposes O

Only” includin

g the activity

payro

oll apportionm

ment informati

on

c

corporate leve

l to determine

e the

of the und

derlying limited

d liability

may

still be requir

ed for purpos

es of

a

applicable corp

porate net inc

come tax

companies

s and business

s trusts, and

the C

Capital Stock/F

Foreign Franc

hise

a

associated with

h the distribut

tive share

another fo

or “Capital Sto

ock/Foreign

Tax.

fr

rom the entity

y.

Franchise

Tax Only” exc

cluding the

Import

tant.

property,

payroll and sa

ales of those

Do not

use PA-

Pur

rpose of

f Schedu

le

entities.

20S/PA

A-65 Schedule

e H-Corp

to

o arrive at the

e calculations

for non-

The P

PA-20S/PA-65

5 Schedule H-C

Corp

Non Filin

ng Corporate

e Partner

c

corporate own

er’s income.

is for

r information p

purposes only

y.

If the part

tnership is req

quired to

Partn

nerships are re

equired to

withhold c

corporate net

income tax fo

r

A

Apportio

onment f

for

comp

plete this sche

edule and prov

vide a

nonfiling c

corporate part

tner(s), it

copy

of the PA-20S

S/PA-65 Sche

dule

T

Tax Type

e

must comp

plete PA-20S/

/PA-65

H-Co

rp to all partn

ners who are P

PA S

Schedule C

CP. The appor

rtionment

corpo

orations, partn

nerships, limit

ted

C

Certain types o

of entities – s

uch as

figure used

d to calculate

the corporate

e

liabili

ity companies

s and C

li

imited liability

y companies a

and

net income

e tax withhold

ding should be

e

corpo

orations. All a

mounts not in

n

b

business trusts

s – are genera

ally

the Pennsy

ylvania appor

tionment

s

subject to the

capital stock/

/foreign

agree

ement with in

formation on

figure deri

ived from PA-

20S/PA-65

fr

ranchise tax e

even though t

hey may

feder

ral Form 1065

5 must be

Schedule H

H-Corp prepar

red for the

recon

nciled.

n

not be subject

to the corpor

rate net

corporate

net income ta

ax.

in

ncome tax con

nsistent with t

their

Important

t.

fe

ederal income

e tax classifica

ation as a

Railroad, tru

uck,

Appor

rtioned B

Business

s

p

partnership or

disregarded e

entity.

bus, airline

e, pipeline, nat

tural

In situation

ns where a co

rporate

gas o

or water trans

portation

Incom

me (Loss

) for

ta

axpayer has a

an investment

t in a

comp

panies do not

use the single

e

Corpo

rate Par

rtners

li

imited liability

y company or

other

sales

s factor approa

ach shown on

PA-

b

business entity

y subject to ca

apital

20S/

PA-65 Schedu

ule H-Corp. Ra

ather,

Only

s

stock/foreign f

franchise tax,

but not

they

use a special

apportionmen

nt at

If the part

tnership derive

es business

s

subject to corp

porate net inc

ome tax,

the b

bottom of the

schedule.

income fro

om sources wi

ithin and

t

he apportionm

ment factors u

used in

outside Pe

ennsylvania or

r totally within

n

t

he calculation

n of corporate

net

Fo

or the corpora

ate partner, th

he

Pennsylva

nia, complete

e this form.

in

ncome tax wil

l include the s

sales of

partn

nership uses P

PA-20S/PA-65

The en

ntity calculates

s a decimal

t

he limited liab

bility company

y or

Sche

dule H-Corp t

o calculate th

e

figure from

m a formula, w

which consists

s

b

business trust.

. However, th

e activity

appo

rtionment for

Line 14 of the

e PA-

of

a single

e

sales factor

a

apportionmen

t

o

of the limited l

liability compa

any will

20S/

PA-65 Schedu

ule CP if they a

are

only.

n

not be included

d

requi

red to file a P

PA-65 Corp for

r

in

n the apportio

onment factor

rs used for

nonfi

ling C corpora

ation(s).

No

ote.

A partne

ership with no

t

he calculation

n of capital

F

For the partne

er who is a

s

stock/foreign f

franchise tax.

Pe

ennsylvania ac

ctivity (no

partn

nership, the PA

A-20S/PA-65

Accordingly

y, a limited lia

ability

Pe

ennsylvania-so

ource income

Sche

dule H-Corp e

ensures that if

f the

c

company or bu

usiness trust t

that is

and/or no

Pennsylvania

assets) is sti

ll

partn

nership, as an

owner, has

s

subject to the

capital stock/

/foreign

required to

o complete th

he PA-20S/PA-

-

corpo

orate partners

s, the corporat

te

fr

ranchise tax b

but not subjec

ct to the

65 Schedu

ule H-Corp sho

owing the

partn

ners will have

the necessary

y

c

corporate net

income tax, s

hould

total prope

erty, payroll a

and sale of the

e

docum

mentation for

r apportionme

nt to

c

check the box

for “Corporat

te Net

partnershi

p.

calcu

late PA corpo

rate net incom

me

I

ncome Tax On

nly” when rep

porting its

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3