Reset Form

Print Form

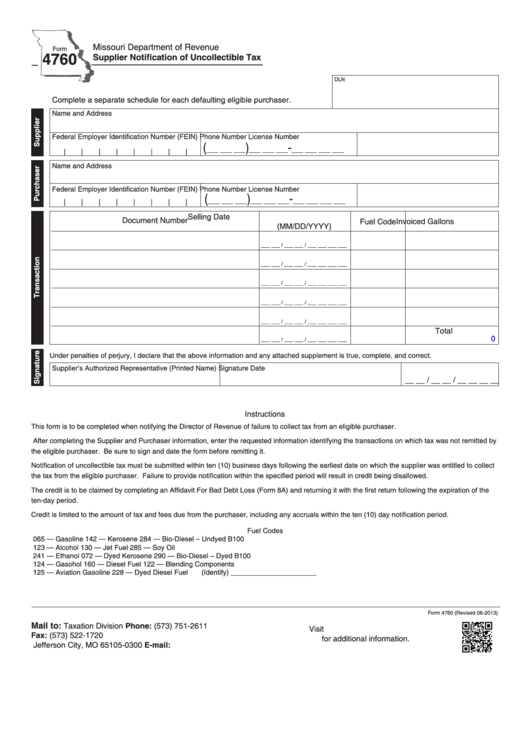

Missouri Department of Revenue

Form

4760

Supplier Notification of Uncollectible Tax

DLN

Complete a separate schedule for each defaulting eligible purchaser.

Name and Address

Federal Employer Identification Number (FEIN)

Phone Number

License Number

(

)

-

___ ___ ___

___ ___ ___

___ ___ ___ ___

|

|

|

|

|

|

|

|

Name and Address

Federal Employer Identification Number (FEIN)

Phone Number

License Number

(

)

-

___ ___ ___

___ ___ ___

___ ___ ___ ___

|

|

|

|

|

|

|

|

Selling Date

Document Number

Fuel Code

Invoiced Gallons

(MM/DD/YYYY)

___ ___ / ___ ___ / ___ ___ ___ ___

___ ___ / ___ ___ / ___ ___ ___ ___

___ ___ / ___ ___ / ___ ___ ___ ___

___ ___ / ___ ___ / ___ ___ ___ ___

___ ___ / ___ ___ / ___ ___ ___ ___

Total

0

___ ___ / ___ ___ / ___ ___ ___ ___

Under penalties of perjury, I declare that the above information and any attached supplement is true, complete, and correct.

Supplier’s Authorized Representative (Printed Name)

Signature

Date

__ __ / __ __ / __ __ __ __

Instructions

This form is to be completed when notifying the Director of Revenue of failure to collect tax from an eligible purchaser.

After completing the Supplier and Purchaser information, enter the requested information identifying the transactions on which tax was not remitted by

the eligible purchaser. Be sure to sign and date the form before remitting it.

Notification of uncollectible tax must be submitted within ten (10) business days following the earliest date on which the supplier was entitled to collect

the tax from the eligible purchaser. Failure to provide notification within the specified period will result in credit being disallowed.

The credit is to be claimed by completing an Affidavit For Bad Debt Loss (Form 8A) and returning it with the first return following the expiration of the

ten-day period.

Credit is limited to the amount of tax and fees due from the purchaser, including any accruals within the ten (10) day notification period.

Fuel Codes

065 — Gasoline

142 — Kerosene

284 — Bio-Diesel – Undyed B100

123 — Alcohol

130 — Jet Fuel

285 — Soy Oil

241 — Ethanol

072 — Dyed Kerosene

290 — Bio-Diesel – Dyed B100

124 — Gasohol

160 — Diesel Fuel

122 — Blending Components

125 — Aviation Gasoline

228 — Dyed Diesel Fuel

(Identify) ______________________

Form 4760 (Revised 06-2013)

Mail to:

Taxation Division

Phone: (573) 751-2611

Visit dor.mo.gov/business/fuel/

P.O. Box 300

Fax: (573) 522-1720

for additional information.

Jefferson City, MO 65105-0300

E-mail: excise@dor.mo.gov

1

1