Form R-1a - Instructions For Alcoholic Beverage Tax Reports

ADVERTISEMENT

STATE OF NEW JERSEY

R-1A

DIVISION OF TAXATION

Rev. 04-12

Alcoholic Beverage Tax

Instructions for Alcoholic Beverage Tax Reports.

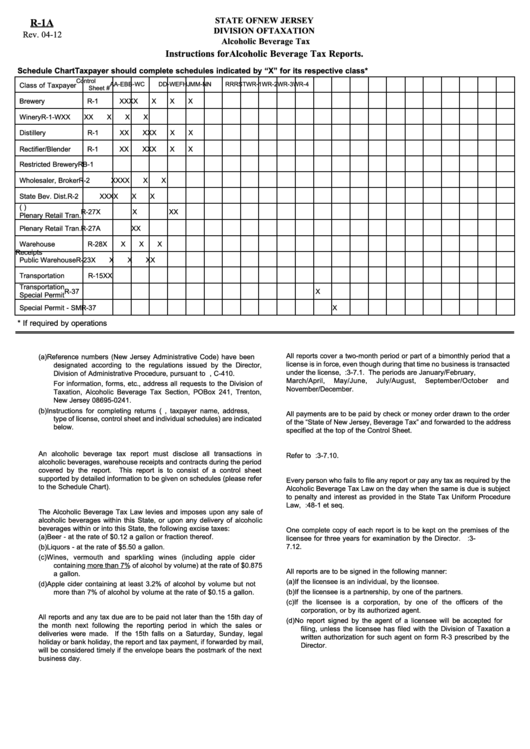

Schedule Chart

Taxpayer should complete schedules indicated by “X” for its respective class*

Control

A

A-E

B

B-W

C

D

D-W

E

F

H

J

M

M-N

N

R

RR

S

T

WR-1 WR-2 WR-3 WR-4

Class of Taxpayer

Sheet #

Brewery

R-1

X

X

X

X

X

X

X

Winery

R-1-W

X

X

X

X

X

X

X

Distillery

R-1

X

X

X

X

X

X

X

Rectifier/Blender

R-1

X

X

X

X

X

X

X

Restricted Brewery

RB-1

Wholesaler, Broker

R-2

X

X

X

X

X

X

State Bev. Dist.

R-2

X

X

X

X

X

X

(I.C.C. Carriers)

R-27

X

X

X

X

Plenary Retail Tran.

Plenary Retail Tran. R-27A

X

X

Warehouse

R-28

X

X

X

X

Receipts

Public Warehouse

R-23

X

X

X

X

X

Transportation

R-15

X

X

Transportation

R-37

X

Special Permit

Special Permit - SM R-37

X

* If required by operations

5. Reporting Period

1. Please read all instructions carefully before executing returns.

All reports cover a two-month period or part of a bimonthly period that a

(a) Reference numbers (New Jersey Administrative Code) have been

license is in force, even though during that time no business is transacted

designated according to the regulations issued by the Director,

under the license, N.J.A.C. 18:3-7.1. The periods are January/February,

Division of Administrative Procedure, pursuant to P.L. 1968, C-410.

March/April,

May/June,

July/August,

September/October

and

For information, forms, etc., address all requests to the Division of

November/December.

Taxation, Alcoholic Beverage Tax Section, PO Box 241, Trenton,

New Jersey 08695-0241.

6. Payment of Tax

(b) Instructions for completing returns (i.e., taxpayer name, address,

All payments are to be paid by check or money order drawn to the order

type of license, control sheet and individual schedules) are indicated

of the “State of New Jersey, Beverage Tax” and forwarded to the address

below.

specified at the top of the Control Sheet.

2. Reports in General

7. Consolidated Returns

An alcoholic beverage tax report must disclose all transactions in

Refer to N.J.A.C. 18:3-7.10.

alcoholic beverages, warehouse receipts and contracts during the period

covered by the report.

This report is to consist of a control sheet

8. Failure to File Report of Pay Tax

supported by detailed information to be given on schedules (please refer

Every person who fails to file any report or pay any tax as required by the

to the Schedule Chart).

Alcoholic Beverage Tax Law on the day when the same is due is subject

to penalty and interest as provided in the State Tax Uniform Procedure

3. Tax Rates

Law, N.J.S.A. 54:48-1 et seq.

The Alcoholic Beverage Tax Law levies and imposes upon any sale of

alcoholic beverages within this State, or upon any delivery of alcoholic

9. Preservation of Reports

beverages within or into this State, the following excise taxes:

One complete copy of each report is to be kept on the premises of the

(a) Beer - at the rate of $0.12 a gallon or fraction thereof.

licensee for three years for examination by the Director. N.J.A.C. 18:3-

7.12.

(b) Liquors - at the rate of $5.50 a gallon.

(c) Wines, vermouth and sparkling wines (including apple cider

10. Manner of Executing Reports

containing more than 7% of alcohol by volume) at the rate of $0.875

All reports are to be signed in the following manner:

a gallon.

(a) If the licensee is an individual, by the licensee.

(d) Apple cider containing at least 3.2% of alcohol by volume but not

more than 7% of alcohol by volume at the rate of $0.15 a gallon.

(b) If the licensee is a partnership, by one of the partners.

(c) If the licensee is a corporation, by one of the officers of the

4. Due Date of Tax and Reports

corporation, or by its authorized agent.

All reports and any tax due are to be paid not later than the 15th day of

(d) No report signed by the agent of a licensee will be accepted for

the month next following the reporting period in which the sales or

filing, unless the licensee has filed with the Division of Taxation a

deliveries were made. If the 15th falls on a Saturday, Sunday, legal

written authorization for such agent on form R-3 prescribed by the

holiday or bank holiday, the report and tax payment, if forwarded by mail,

Director.

will be considered timely if the envelope bears the postmark of the next

business day.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4