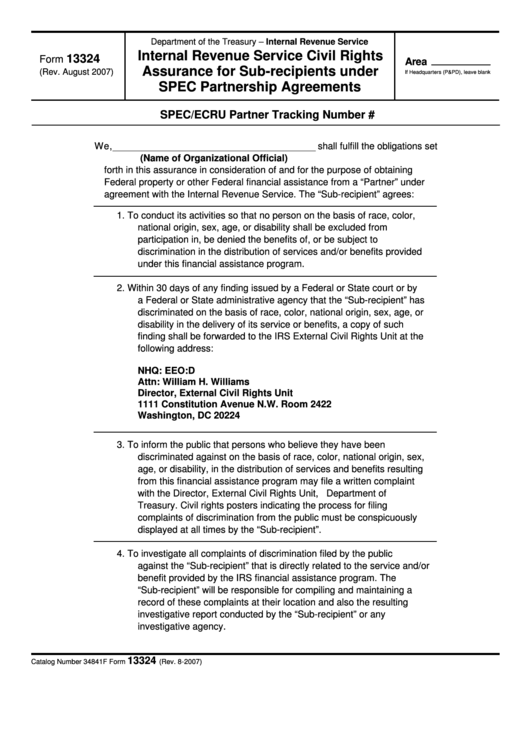

Department of the Treasury – Internal Revenue Service

Internal Revenue Service Civil Rights

13324

Form

Area

Assurance for Sub-recipients under

(Rev. August 2007)

If Headquarters (P&PD), leave blank

SPEC Partnership Agreements

SPEC/ECRU Partner Tracking Number #

We,

shall fulfill the obligations set

(Name of Organizational Official)

forth in this assurance in consideration of and for the purpose of obtaining

Federal property or other Federal financial assistance from a “Partner” under

agreement with the Internal Revenue Service. The “Sub-recipient” agrees:

1.

To conduct its activities so that no person on the basis of race, color,

national origin, sex, age, or disability shall be excluded from

participation in, be denied the benefits of, or be subject to

discrimination in the distribution of services and/or benefits provided

under this financial assistance program.

2.

Within 30 days of any finding issued by a Federal or State court or by

a Federal or State administrative agency that the “Sub-recipient” has

discriminated on the basis of race, color, national origin, sex, age, or

disability in the delivery of its service or benefits, a copy of such

finding shall be forwarded to the IRS External Civil Rights Unit at the

following address:

NHQ: EEO:D

Attn: William H. Williams

Director, External Civil Rights Unit

1111 Constitution Avenue N.W. Room 2422

Washington, DC 20224

3.

To inform the public that persons who believe they have been

discriminated against on the basis of race, color, national origin, sex,

age, or disability, in the distribution of services and benefits resulting

from this financial assistance program may file a written complaint

with the Director, External Civil Rights Unit, U.S. Department of

Treasury. Civil rights posters indicating the process for filing

complaints of discrimination from the public must be conspicuously

displayed at all times by the “Sub-recipient”.

4.

To investigate all complaints of discrimination filed by the public

against the “Sub-recipient” that is directly related to the service and/or

benefit provided by the IRS financial assistance program. The

“Sub-recipient” will be responsible for compiling and maintaining a

record of these complaints at their location and also the resulting

investigative report conducted by the “Sub-recipient” or any

investigative agency.

13324

Catalog Number 34841F

Form

(Rev. 8-2007)

1

1 2

2