*130680200*

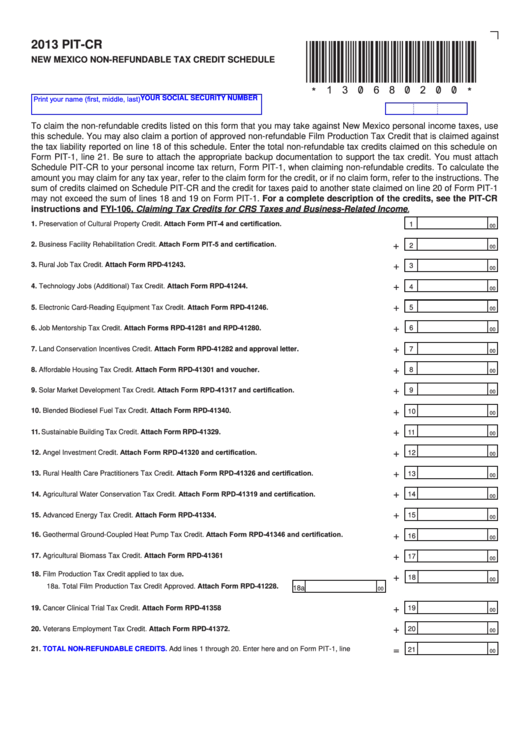

2013 PIT-CR

NEW MEXICO NON-REFUNDABLE TAX CREDIT SCHEDULE

Print your name (first, middle, last)

YOUR SOCIAL SECURITY NUMBER

To claim the non-refundable credits listed on this form that you may take against New Mexico personal income taxes, use

this schedule. You may also claim a portion of approved non-refundable Film Production Tax Credit that is claimed against

the tax liability reported on line 18 of this schedule. Enter the total non-refundable tax credits claimed on this schedule on

Form PIT-1, line 21. Be sure to attach the appropriate backup documentation to support the tax credit. You must attach

Schedule PIT-CR to your personal income tax return, Form PIT-1, when claiming non-refundable credits. To calculate the

amount you may claim for any tax year, refer to the claim form for the credit, or if no claim form, refer to the instructions. The

sum of credits claimed on Schedule PIT-CR and the credit for taxes paid to another state claimed on line 20 of Form PIT-1

may not exceed the sum of lines 18 and 19 on Form PIT-1. For a complete description of the credits, see the PIT-CR

instructions and FYI-106, Claiming Tax Credits for CRS Taxes and Business-Related Income.

Preservation of Cultural Property Credit. Attach Form PIT-4 and certification. ...................................................

1.

1

00

Business Facility Rehabilitation Credit. Attach Form PIT-5 and certification.......................................................

2.

+

2

00

3.

Rural Job Tax Credit. Attach Form RPD-41243......................................................................................................

+

3

00

Technology Jobs (Additional) Tax Credit. Attach Form RPD-41244.......................................................................

+

4.

4

00

+

5.

Electronic Card-Reading Equipment Tax Credit. Attach Form RPD-41246...........................................................

5

00

+

6.

Job Mentorship Tax Credit. Attach Forms RPD-41281 and RPD-41280...............................................................

6

00

+

7.

Land Conservation Incentives Credit. Attach Form RPD-41282 and approval letter...........................................

7

00

+

8.

Affordable Housing Tax Credit. Attach Form RPD-41301 and voucher................................................................

8

00

Solar Market Development Tax Credit. Attach Form RPD-41317 and certification..............................................

+

9.

9

00

10. Blended Biodiesel Fuel Tax Credit. Attach Form RPD-41340................................................................................

+

10

00

+

11. Sustainable Building Tax Credit. Attach Form RPD-41329.....................................................................................

11

00

12. Angel Investment Credit. Attach Form RPD-41320 and certification...................................................................

+

12

00

13. Rural Health Care Practitioners Tax Credit. Attach Form RPD-41326 and certification......................................

+

13

00

14. Agricultural Water Conservation Tax Credit. Attach Form RPD-41319 and certification.....................................

+

14

00

+

15. Advanced Energy Tax Credit. Attach Form RPD-41334........................................................................................

15

00

16. Geothermal Ground-Coupled Heat Pump Tax Credit. Attach Form RPD-41346 and certification.......................

+

16

00

+

17. Agricultural Biomass Tax Credit. Attach Form RPD-41361....................................................................................

17

00

18. Film Production Tax Credit applied to tax due. ........................................................................................................

+

18

00

18a. Total Film Production Tax Credit Approved. Attach Form RPD-41228.......

18a

00

+

19. Cancer Clinical Trial Tax Credit. Attach Form RPD-41358 ....................................................................................

19

00

+

20. Veterans Employment Tax Credit. Attach Form RPD-41372. ................................................................................

20

00

=

21.

TOTAL NON-REFUNDABLE CREDITS.

Add lines 1 through 20. Enter here and on Form PIT-1, line 21.............

21

00

1

1