*130280200*

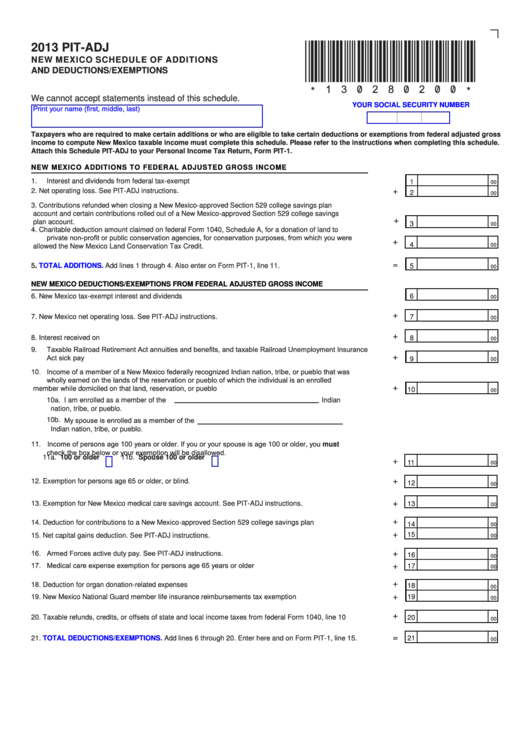

2013 PIT-ADJ

NEW MEXICO SCHEDULE OF ADDITIONS

AND DEDUCTIONS/EXEMPTIONS

We cannot accept statements instead of this schedule.

YOUR SOCIAL SECURITY NUMBER

Print your name (first, middle, last)

Taxpayers who are required to make certain additions or who are eligible to take certain deductions or exemptions from federal adjusted gross

income to compute New Mexico taxable income must complete this schedule. Please refer to the instructions when completing this schedule.

Attach this Schedule PIT-ADJ to your Personal Income Tax Return, Form PIT-1.

NEW MEXICO ADDITIONS TO FEDERAL ADJUSTED GROSS INCOME

1.

Interest and dividends from federal tax-exempt bonds...........................................................................................

1

00

+

2.

Net operating loss. See PIT-ADJ instructions. .......................................................................................................

2

00

3.

Contributions refunded when closing a New Mexico-approved Section 529 college savings plan

account and certain contributions rolled out of a New Mexico-approved Section 529 college savings

+

plan account. ..........................................................................................................................................................

3

00

4.

Charitable deduction amount claimed on federal Form 1040, Schedule A, for a donation of land to

private non-profit or public conservation agencies, for conservation purposes, from which you were

+

4

00

allowed the New Mexico Land Conservation Tax Credit. .......................................................................................

=

5.

TOTAL ADDITIONS.

Add lines 1 through 4. Also enter on Form PIT-1, line 11. ....................................................

5

00

NEW MEXICO DEDUCTIONS/EXEMPTIONS FROM FEDERAL ADJUSTED GROSS INCOME

6.

New Mexico tax-exempt interest and dividends .....................................................................................................

6

00

+

7.

New Mexico net operating loss. See PIT-ADJ instructions. ...................................................................................

7

00

+

8.

Interest received on U.S. Government obligations .................................................................................................

8

00

9.

Taxable Railroad Retirement Act annuities and benefits, and taxable Railroad Unemployment Insurance

Act sick pay ............................................................................................................................................................

+

9

00

10. Income of a member of a New Mexico federally recognized Indian nation, tribe, or pueblo that was

wholly earned on the lands of the reservation or pueblo of which the individual is an enrolled

+

member while domiciled on that land, reservation, or pueblo ................................................................................

10

00

10a. I am enrolled as a member of the

Indian

nation, tribe, or pueblo.

10b. My spouse is enrolled as a member of the

Indian nation, tribe, or pueblo.

11. Income of persons age 100 years or older. If you or your spouse is age 100 or older, you must

check the box below or your exemption will be disallowed.

+

11a. 100 or older

11b. Spouse 100 or older

...................................................................................

11

00

+

12. Exemption for persons age 65 or older, or blind. ....................................................................................................

12

00

+

13. Exemption for New Mexico medical care savings account. See PIT-ADJ instructions. .........................................

13

00

+

14. Deduction for contributions to a New Mexico-approved Section 529 college savings plan ...................................

14

00

+

15. Net capital gains deduction. See PIT-ADJ instructions. .........................................................................................

15

00

16. Armed Forces active duty pay. See PIT-ADJ instructions. .....................................................................................

+

16

00

17. Medical care expense exemption for persons age 65 years or older .....................................................................

+

17

00

+

18. Deduction for organ donation-related expenses ....................................................................................................

18

00

+

19. New Mexico National Guard member life insurance reimbursements tax exemption ............................................

19

00

+

20. Taxable refunds, credits, or offsets of state and local income taxes from federal Form 1040, line 10 ...................

20

00

=

21.

TOTAL DEDUCTIONS/EXEMPTIONS.

Add lines 6 through 20. Enter here and on Form PIT-1, line 15. .............

21

00

1

1