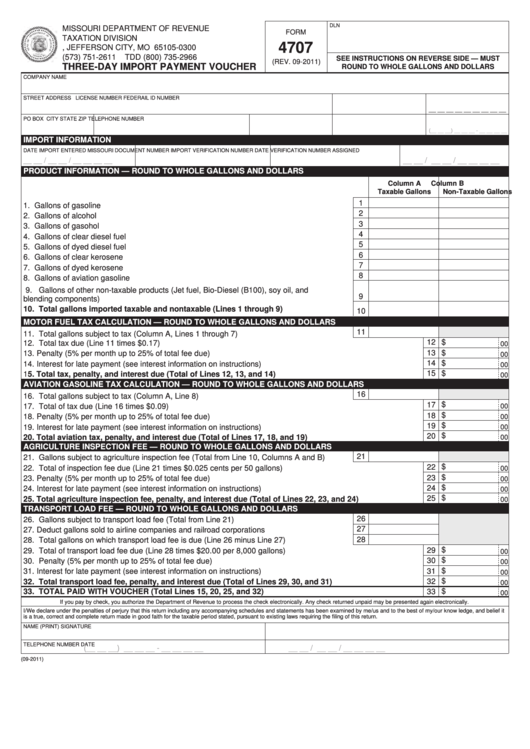

DLN

MISSOURI DEPARTMENT OF REVENUE

FORM

TAXATION DIVISION

4707

P.O. BOX 300, JEFFERSON CITY, MO 65105-0300

(573) 751-2611

TDD (800) 735-2966

SEE INSTRUCTIONS ON REVERSE SIDE — MUST

(REV. 09-2011)

THREE-DAY IMPORT PAYMENT VOUCHER

ROUND TO WHOLE GALLONS AND DOLLARS

COMPANY NAME

STREET ADDRESS

LICENSE NUMBER

FEDERAIL ID NUMBER

__ __ __ __ __ __ __ __ __

PO BOX

CITY

STATE

ZIP

TELEPHONE NUMBER

(__ __ __) __ __ __ - __ __ __ __

IMPORT INFORMATION

DATE IMPORT ENTERED MISSOURI

DOCUMENT NUMBER

IMPORT VERIFICATION NUMBER

DATE VERIFICATION NUMBER ASSIGNED

__ __ / __ __ / __ __ __ __

__ __ / __ __ / __ __ __ __

PRODUCT INFORMATION — ROUND TO WHOLE GALLONS AND DOLLARS

Column A

Column B

Taxable Gallons

Non-Taxable Gallons

1

1. Gallons of gasoline ................................................................................................................

2

2. Gallons of alcohol ...................................................................................................................

3

3. Gallons of gasohol .................................................................................................................

4

4. Gallons of clear diesel fuel ......................................................................................................

5

5. Gallons of dyed diesel fuel .....................................................................................................

6

6. Gallons of clear kerosene ......................................................................................................

7

7. Gallons of dyed kerosene ......................................................................................................

8

8. Gallons of aviation gasoline ....................................................................................................

9. Gallons of other non-taxable products (Jet fuel, Bio-Diesel (B100), soy oil, and

9

blending components) ............................................................................................................

10. Total gallons imported taxable and nontaxable (Lines 1 through 9) ..............................

10

MOTOR FUEL TAX CALCULATION — ROUND TO WHOLE GALLONS AND DOLLARS

11

11. Total gallons subject to tax (Column A, Lines 1 through 7) ....................................................

12

$

12. Total tax due (Line 11 times $0.17) ........................................................................................................................

00

13

$

13. Penalty (5% per month up to 25% of total fee due) ...............................................................................................

00

14

$

14. Interest for late payment (see interest information on instructions) ........................................................................

00

15

$

15. Total tax, penalty, and interest due (Total of Lines 12, 13, and 14) .................................................................

00

AVIATION GASOLINE TAX CALCULATION — ROUND TO WHOLE GALLONS AND DOLLARS

16

16. Total gallons subject to tax (Column A, Line 8) .....................................................................

$

17

17. Total of tax due (Line 16 times $0.09) ....................................................................................................................

00

18

$

18. Penalty (5% per month up to 25% of total fee due) ...............................................................................................

00

$

19

19. Interest for late payment (see interest information on instructions) .......................................................................

00

$

20

20. Total aviation tax, penalty, and interest due (Total of Lines 17, 18, and 19) ...................................................

00

AGRICULTURE INSPECTION FEE — ROUND TO WHOLE GALLONS AND DOLLARS

21

21. Gallons subject to agriculture inspection fee (Total from Line 10, Columns A and B) ............

$

22

22. Total of inspection fee due (Line 21 times $0.025 cents per 50 gallons) ...............................................................

00

$

23

23. Penalty (5% per month up to 25% of total fee due) ................................................................................................

00

$

24

24. Interest for late payment (see interest information on instructions) ........................................................................

00

$

25

25. Total agriculture inspection fee, penalty, and interest due (Total of Lines 22, 23, and 24) ...........................

00

TRANSPORT LOAD FEE — ROUND TO WHOLE GALLONS AND DOLLARS

26

26. Gallons subject to transport load fee (Total from Line 21) ......................................................

27

27. Deduct gallons sold to airline companies and railroad corporations ......................................

28

28. Total gallons on which transport load fee is due (Line 26 minus Line 27) ..............................

$

29

29. Total of transport load fee due (Line 28 times $20.00 per 8,000 gallons) ..............................................................

00

$

30

30. Penalty (5% per month up to 25% of total fee due) ................................................................................................

00

$

31. Interest for late payment (see interest information on instructions) ........................................................................

31

00

32

$

32. Total transport load fee, penalty, and interest due (Total of Lines 29, 30, and 31) ........................................

00

$

33. TOTAL PAID WITH VOUCHER (Total Lines 15, 20, 25, and 32) ........................................................................

33

00

If you pay by check, you authorize the Department of Revenue to process the check electronically. Any check returned unpaid may be presented again electronically.

I/We declare under the penalties of perjury that this return including any accompanying schedules and statements has been examined by me/us and to the best of my/our know ledge, and belief it

is a true, correct and complete return made in good faith for the taxable period stated, pursuant to existing laws requiring the filing of this return.

NAME (PRINT)

SIGNATURE

TELEPHONE NUMBER

DATE

(__ __ __) __ __ __ - __ __ __ __

__ __ / __ __ / __ __ __ __

(09-2011)

1

1 2

2