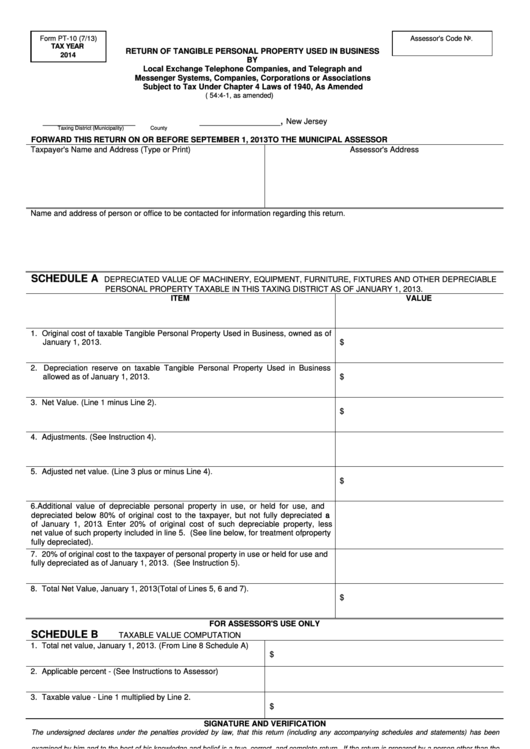

Form PT-10 (7/13)

Assessor's Code No.

TAX YEAR

RETURN OF TANGIBLE PERSONAL PROPERTY USED IN BUSINESS

2014

BY

Local Exchange Telephone Companies, and Telegraph and

Messenger Systems, Companies, Corporations or Associations

Subject to Tax Under Chapter 4 Laws of 1940, As Amended

(N.J.S.A. 54:4-1, as amended)

________________

______________,

New Jersey

Taxing District (Municipality)

County

FORWARD THIS RETURN ON OR BEFORE SEPTEMBER 1, 2013 TO THE MUNICIPAL ASSESSOR

Taxpayer's Name and Address (Type or Print)

Assessor's Address

Name and address of person or office to be contacted for information regarding this return.

SCHEDULE A

DEPRECIATED VALUE OF MACHINERY, EQUIPMENT, FURNITURE, FIXTURES AND OTHER DEPRECIABLE

PERSONAL PROPERTY TAXABLE IN THIS TAXING DISTRICT AS OF JANUARY 1, 2013.

ITEM

VALUE

1. Original cost of taxable Tangible Personal Property Used in Business, owned as of

January 1, 2013.

$

2. Depreciation reserve on taxable Tangible Personal Property Used in Business

allowed as of January 1, 2013.

$

3. Net Value. (Line 1 minus Line 2).

$

4. Adjustments. (See Instruction 4).

5. Adjusted net value. (Line 3 plus or minus Line 4).

$

6. Additional value of depreciable personal property in use, or held for use, and

depreciated below 80% of original cost to the taxpayer, but not fully depreciated as

of January 1, 2013. Enter 20% of original cost of such depreciable property, less

net value of such property included in line 5. (See line below, for treatment of property

fully depreciated).

7. 20% of original cost to the taxpayer of personal property in use or held for use and

fully depreciated as of January 1, 2013. (See Instruction 5).

8. Total Net Value, January 1, 2013 (Total of Lines 5, 6 and 7).

$

FOR ASSESSOR'S USE ONLY

SCHEDULE B

TAXABLE VALUE COMPUTATION

1. Total net value, January 1, 2013. (From Line 8 Schedule A)

$

2. Applicable percent - (See Instructions to Assessor)

3. Taxable value - Line 1 multiplied by Line 2.

$

SIGNATURE AND VERIFICATION

The undersigned declares under the penalties provided by law, that this return (including any accompanying schedules and statements) has been

examined by him and to the best of his knowledge and belief is a true, correct, and complete return. If the return is prepared by a person other than the

taxpayer, his declaration is based on all the information relating to the matters required to be reported in the return of which he has knowledge.

_________________________

_______________________________________________

______________________________________

(Date)

(Signature of Taxpayer or Officer of Taxpayer)

(Title)

_________________________

_______________________________________________

______________________________________

(Date)

(Signature of Individual or Firm Preparing Return)

(Address)

PENALTIES - TO AVOID PENALTIES EVERY TAXPAYER MUST FILE THIS RETURN WITH THE ASSESSOR

ON OR BEFORE SEPTEMBER 1, 2013. (See Instruction 9).

NOTICE:

This is the official form promulgated by the New Jersey Division of Taxation.

PT-10

1

1 2

2