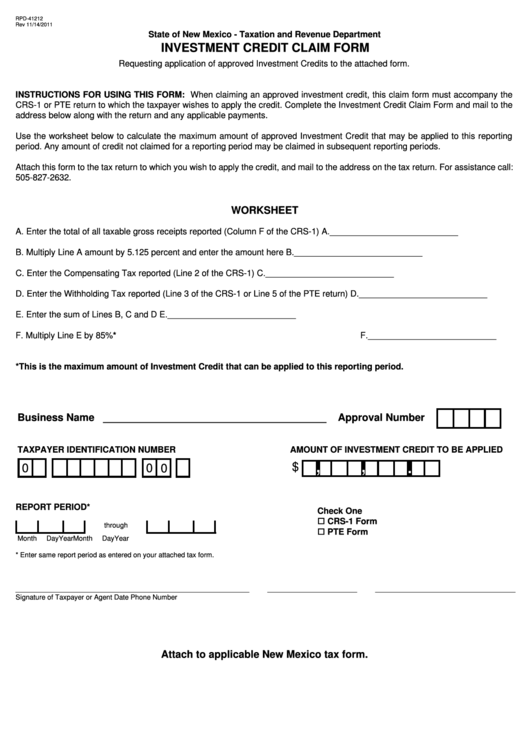

RPD-41212

Rev 11/14/2011

State of New Mexico - Taxation and Revenue Department

INVESTMENT CREDIT CLAIM FORM

Requesting application of approved Investment Credits to the attached form.

INSTRUCTIONS FOR USING THIS FORM: When claiming an approved investment credit, this claim form must accompany the

CRS-1 or PTE return to which the taxpayer wishes to apply the credit. Complete the Investment Credit Claim Form and mail to the

address below along with the return and any applicable payments.

Use the worksheet below to calculate the maximum amount of approved Investment Credit that may be applied to this reporting

period. Any amount of credit not claimed for a reporting period may be claimed in subsequent reporting periods.

Attach this form to the tax return to which you wish to apply the credit, and mail to the address on the tax return. For assistance call:

505-827-2632.

WORKSHEET

A. Enter the total of all taxable gross receipts reported (Column F of the CRS-1)

A.___________________________

B. Multiply Line A amount by 5.125 percent and enter the amount here

B.___________________________

C. Enter the Compensating Tax reported (Line 2 of the CRS-1)

C.___________________________

D. Enter the Withholding Tax reported (Line 3 of the CRS-1 or Line 5 of the PTE return)

D.___________________________

E. Enter the sum of Lines B, C and D

E.___________________________

F. Multiply Line E by 85%*

F.___________________________

*This is the maximum amount of Investment Credit that can be applied to this reporting period.

Business Name _______________________________________

Approval Number

TAXPAYER IDENTIFICATION NUMBER

AMOUNT OF INVESTMENT CREDIT TO BE APPLIED

,

,

.

$

0

0 0

REPORT PERIOD*

Check One

CRS-1 Form

through

PTE Form

Month

Day

Year

Month

Day

Year

* Enter same report period as entered on your attached tax form.

____________________________________________________________

_______________________

____________________________________

Signature of Taxpayer or Agent

Date

Phone Number

Attach to applicable New Mexico tax form.

1

1