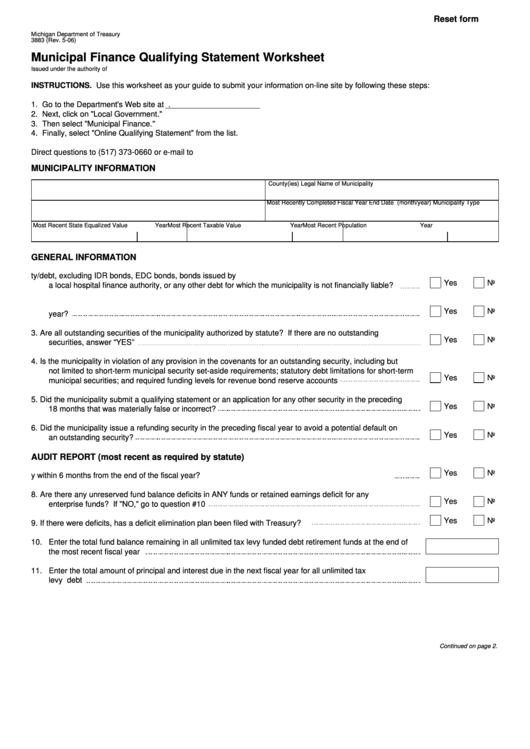

Reset form

Michigan Department of Treasury

3883 (Rev. 5-06)

Municipal Finance Qualifying Statement Worksheet

Issued under the authority of P.A. 34 of 2001.

INSTRUCTIONS. Use this worksheet as your guide to submit your information on-line site by following these steps:

1. Go to the Department's Web site at

2. Next, click on "Local Government."

3. Then select "Municipal Finance."

4. Finally, select "Online Qualifying Statement" from the list.

Direct questions to (517) 373-0660 or e-mail to Treas_MunicipalFinance@michigan.gov

MUNICIPALITY INFORMATION

Legal Name of Municipality

County(ies)

Municipality Type

Most Recently Completed Fiscal Year End Date (month/year)

Most Recent State Equalized Value

Year

Most Recent Taxable Value

Year

Most Recent Population

Year

GENERAL INFORMATION

1.

Has the local unit been in default on any security/debt, excluding IDR bonds, EDC bonds, bonds issued by

Yes

No

a local hospital finance authority, or any other debt for which the municipality is not financially liable?

2.

Was the local unit required to levy a tax as a result of a court order or judgment during the preceding fiscal

Yes

No

year?

3.

Are all outstanding securities of the municipality authorized by statute? If there are no outstanding

Yes

No

securities, answer “YES”

4.

Is the municipality in violation of any provision in the covenants for an outstanding security, including but

not limited to short-term municipal security set-aside requirements; statutory debt limitations for short-term

Yes

No

municipal securities; and required funding levels for revenue bond reserve accounts

5.

Did the municipality submit a qualifying statement or an application for any other security in the preceding

Yes

No

18 months that was materially false or incorrect?

6.

Did the municipality issue a refunding security in the preceding fiscal year to avoid a potential default on

Yes

No

an outstanding security?

AUDIT REPORT (most recent as required by statute)

Yes

No

7.

Was the most recent audit report filed with Treasury within 6 months from the end of the fiscal year?

8.

Are there any unreserved fund balance deficits in ANY funds or retained earnings deficit for any

Yes

No

enterprise funds? If "NO," go to question #10

Yes

No

9.

If there were deficits, has a deficit elimination plan been filed with Treasury?

10. Enter the total fund balance remaining in all unlimited tax levy funded debt retirement funds at the end of

the most recent fiscal year

11. Enter the total amount of principal and interest due in the next fiscal year for all unlimited tax

levy debt

Continued on page 2.

1

1 2

2