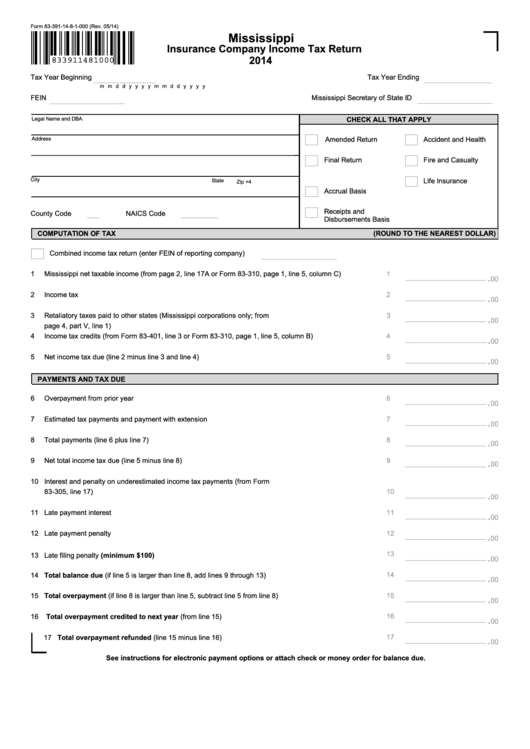

Form 83-391-14-8-1-000 (Rev. 05/14)

Mississippi

Insurance Company Income Tax Return

833911481000

2014

Tax Year Beginning

Tax Year Ending

m m d d y y y y

m m d d y y y y

FEIN

Mississippi Secretary of State ID

Legal Name and DBA

CHECK ALL THAT APPLY

Address

Amended Return

Accident and Health

Final Return

Fire and Casualty

City

State

Life Insurance

Zip +4

Accrual Basis

Receipts and

County Code

NAICS Code

Disbursements Basis

(ROUND TO THE NEAREST DOLLAR)

COMPUTATION OF TAX

Combined income tax return (enter FEIN of reporting company)

1

Mississippi net taxable income (from page 2, line 17A or Form 83-310, page 1, line 5, column C)

1

.

00

2

Income tax

2

.

00

3

Retaliatory taxes paid to other states (Mississippi corporations only; from

3

.

00

page 4, part V, line 1)

4

Income tax credits (from Form 83-401, line 3 or Form 83-310, page 1, line 5, column B)

4

.

00

5

Net income tax due (line 2 minus line 3 and line 4)

5

.

00

PAYMENTS AND TAX DUE

6

Overpayment from prior year

6

.

00

7

Estimated tax payments and payment with extension

7

.

00

8

Total payments (line 6 plus line 7)

8

.

00

9

Net total income tax due (line 5 minus line 8)

9

.

00

10 Interest and penalty on underestimated income tax payments (from Form

83-305, line 17)

10

.

00

11 Late payment interest

11

.

00

12 Late payment penalty

12

.

00

13

13 Late filing penalty (minimum $100)

.

00

14

14 Total balance due (if line 5 is larger than line 8, add lines 9 through 13)

.

00

15 Total overpayment (if line 8 is larger than line 5, subtract line 5 from line 8)

15

.

00

16

16

Total overpayment credited to next year (from line 15)

.

00

17 Total overpayment refunded (line 15 minus line 16)

17

.

00

See instructions for electronic payment options or attach check or money order for balance due.

1

1 2

2 3

3 4

4