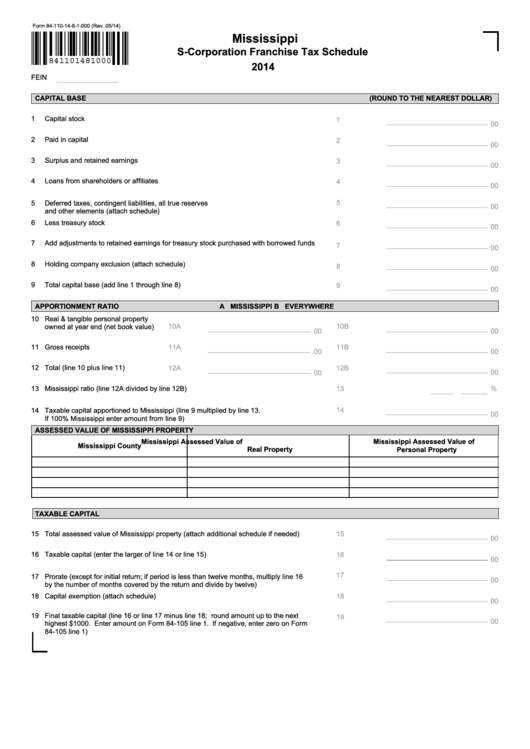

Form 84-110-14-8-1-000 (Rev. 05/14)

Mississippi

S-Corporation Franchise Tax Schedule

841101481000

2014

FEIN

(ROUND TO THE NEAREST DOLLAR)

CAPITAL BASE

1

Capital stock

1

00

2

Paid in capital

2

00

3

Surplus and retained earnings

3

00

4

Loans from shareholders or affiliates

4

00

5

5

Deferred taxes, contingent liabilities, all true reserves

00

and other elements (attach schedule)

6

Less treasury stock

6

00

7

Add adjustments to retained earnings for treasury stock purchased with borrowed funds

7

00

8

Holding company exclusion (attach schedule)

8

00

9

Total capital base (add line 1 through line 8)

9

00

A MISSISSIPPI

B EVERYWHERE

APPORTIONMENT RATIO

10 Real & tangible personal property

owned at year end (net book value)

10A

10B

00

00

11 Gross receipts

11A

11B

00

00

12 Total (line 10 plus line 11)

12A

12B

00

00

13 Mississippi ratio (line 12A divided by line 12B)

13

%

14

14 Taxable capital apportioned to Mississippi (line 9 multiplied by line 13.

00

If 100% Mississippi enter amount from line 9)

ASSESSED VALUE OF MISSISSIPPI PROPERTY

Mississippi Assessed Value of

Mississippi Assessed Value of

Mississippi County

Real Property

Personal Property

TAXABLE CAPITAL

15 Total assessed value of Mississippi property (attach additional schedule if needed)

15

00

16 Taxable capital (enter the larger of line 14 or line 15)

16

00

17

17 Prorate (except for initial return; if period is less than twelve months, multiply line 16

00

by the number of months covered by the return and divide by twelve)

18 Capital exemption (attach schedule)

18

00

19 Final taxable capital (line 16 or line 17 minus line 18; round amount up to the next

19

00

highest $1000. Enter amount on Form 84-105 line 1. If negative, enter zero on Form

84-105 line 1)

1

1