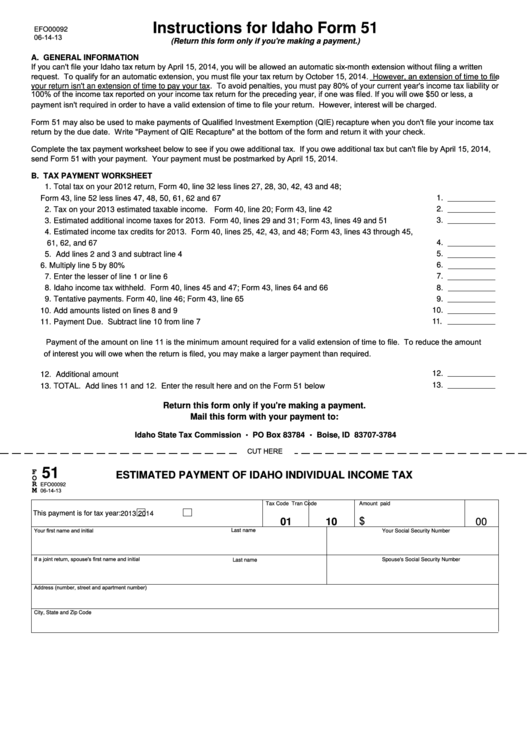

Instructions for Idaho Form 51

EFO00092

06-14-13

(Return this form only if you're making a payment.)

A. GENERAL INFORMATION

If you can't file your Idaho tax return by April 15, 2014, you will be allowed an automatic six-month extension without filing a written

request. To qualify for an automatic extension, you must file your tax return by October 15, 2014. However, an extension of time to file

your return isn't an extension of time to pay your tax. To avoid penalties, you must pay 80% of your current year's income tax liability or

100% of the income tax reported on your income tax return for the preceding year, if one was filed. If you will owe $50 or less, a

payment isn't required in order to have a valid extension of time to file your return. However, interest will be charged.

Form 51 may also be used to make payments of Qualified Investment Exemption (QIE) recapture when you don't file your income tax

return by the due date. Write "Payment of QIE Recapture" at the bottom of the form and return it with your check.

Complete the tax payment worksheet below to see if you owe additional tax. If you owe additional tax but can't file by April 15, 2014,

send Form 51 with your payment. Your payment must be postmarked by April 15, 2014.

B. TAX PAYMENT WORKSHEET

1. Total tax on your 2012 return, Form 40, line 32 less lines 27, 28, 30, 42, 43 and 48;

1.

Form 43, line 52 less lines 47, 48, 50, 61, 62 and 67 ........................................................................................

2.

2. Tax on your 2013 estimated taxable income. Form 40, line 20; Form 43, line 42 ...........................................

3.

3. Estimated additional income taxes for 2013. Form 40, lines 29 and 31; Form 43, lines 49 and 51 .................

4. Estimated income tax credits for 2013. Form 40, lines 25, 42, 43, and 48; Form 43, lines 43 through 45,

61, 62, and 67 ....................................................................................................................................................

4.

5.

5. Add lines 2 and 3 and subtract line 4 .................................................................................................................

6.

6. Multiply line 5 by 80% ........................................................................................................................................

7.

7. Enter the lesser of line 1 or line 6 ......................................................................................................................

8.

8. Idaho income tax withheld. Form 40, lines 45 and 47; Form 43, lines 64 and 66 ............................................

9.

9. Tentative payments. Form 40, line 46; Form 43, line 65 ...................................................................................

10. Add amounts listed on lines 8 and 9 .................................................................................................................

10.

11.

11. Payment Due. Subtract line 10 from line 7 .......................................................................................................

Payment of the amount on line 11 is the minimum amount required for a valid extension of time to file. To reduce the amount

of interest you will owe when the return is filed, you may make a larger payment than required.

12.

12. Additional amount ..............................................................................................................................................

13.

13. TOTAL. Add lines 11 and 12. Enter the result here and on the Form 51 below ..............................................

Return this form only if you're making a payment.

Mail this form with your payment to:

.

.

Idaho State Tax Commission

PO Box 83784

Boise, ID 83707-3784

CUT HERE

51

F

ESTIMATED PAYMENT OF IDAHO INDIVIDUAL INCOME TAX

O

R

EFO00092

06-14-13

M

Tax Code

Tran Code

Amount paid

This payment is for tax year:

2013

2014

$

01

10

00

Your first name and initial

Last name

Your Social Security Number

If a joint return, spouse's first name and initial

Last name

Spouse's Social Security Number

Address (number, street and apartment number)

City, State and Zip Code

1

1