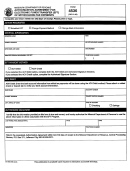

Instructions for Form EFT

Tax Type: Businesses may use electronic funds transfers

Section C – Complete this section only if you are choosing

(EFT) to file and pay Maryland withholding, motor fuel, and

the ACH Credit option.

corporate income taxes. Accepted corporate forms are 500,

Name and address of the bank: Provide the name and

500D and 500E only. Forms 510, 510D, 510E for Pass-

address of the bank you will be using for electronic funds

Through Entities are NOT accepted.

transfers.

Section A – This section must be completed by ALL

Printed name and signature of bank representative

taxpayers.

(include bank representative’s telephone number): You cannot

•

Business name - required.

use the ACH Credit option unless your bank can initiate

transactions in this format.

•

Maryland Central Registration Number - if registered.

Mail this completed form to:

•

Federal Employer Identification Number - required.

Electronic Funds Transfer Program

•

Motor Fuel Tax Account Number - if applicable.

P.O. Box 1509

•

EFT contact person: The primary contact person

Annapolis, MD 21404-1509

should be someone within your company who will be

directly involved in all phases of the EFT registration

process, system implementation, and the payment of

the tax. Instructions will be mailed to the contact person

designated on the agreement. You also should designate a

secondary contact person.

•

Address: Indicate the mailing address to be used for

correspondence regarding electronic funds transfer.

•

Telephone number: Indicate the telephone number(s)

for the EFT contact person.

•

Signature of owner, partner, or officer: Authorized

signature of owner, partner, or officer of the company.

Section B – Complete this section only if you are choosing

the ACH Debit option.

•

Bank name: Name of the bank you will be using for

electronic funds transfers.

•

Bank address: Indicate the address of the bank branch

you will be using.

•

Bank account number: The account number from which

the state will draw debit entries.

•

Type of account: Check the appropriate box for the type

of account (savings or checking) you will be using for

electronic funds transfer.

•

Bank routing transit number: Your bank’s nine-digit

routing/transit number is required.

•

Signature of owner, partner, or officer: Authorized

signature of owner, partner or officer of the company. This

signature will authorize the Comptroller of Maryland to

present debit entries.

Electronic Funds Transfer Program telephone number 410-260-7980 • Fax: 410-260-6214

Hearing impaired users call via Maryland Relay at 711 in Maryland

2

COM/RAD-072

13-49

Rev. 06/13

1

1 2

2 3

3