A

D

R

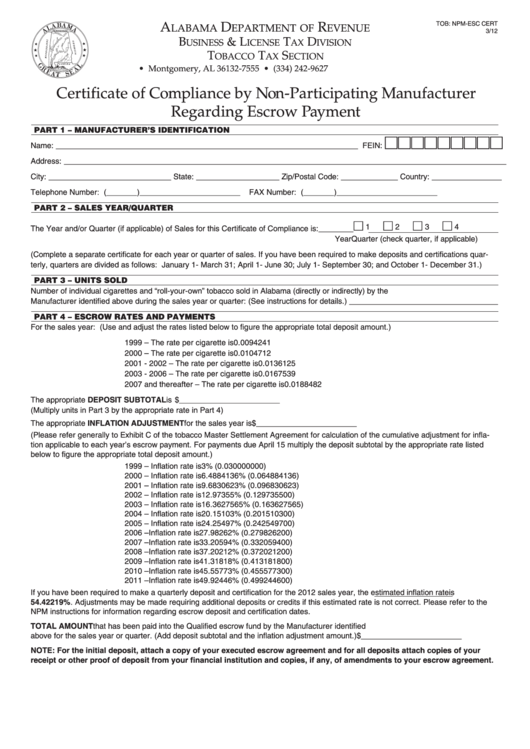

TOB: NPM-ESC CERT

LABAMA

EPARTMENT OF

EVENUE

3/12

B

& L

T

D

USINESS

ICENSE

AX

IVISION

Reset

T

T

S

OBACCO

AX

ECTION

P.O. Box 327555 • Montgomery, AL 36132-7555 • (334) 242-9627

Certificate of Compliance by Non-Participating Manufacturer

Regarding Escrow Payment

P RT 1 – M NUF CTURER’S IDENTIFIC TION

Name: _____________________________________________________________________ FEIN:

Address: _____________________________________________________________________________________________________

City: ____________________________ State: ___________________ Zip/Postal Code: _____________ Country: ________________

Telephone Number: (_______)_______________________

FAX Number: (_______)_______________________

P RT 2 – S LES YE R/QU RTER

1

2

3

4

The Year and/or Quarter (if applicable) of Sales for this Certificate of Compliance is: ________

Year

Quarter (check quarter, if applicable)

(Complete a separate certificate for each year or quarter of sales. If you have been required to make deposits and certifications quar-

terly, quarters are divided as follows: January 1- March 31; April 1- June 30; July 1- September 30; and October 1- December 31.)

P RT 3 – UNITS SOLD

Number of individual cigarettes and “roll-your-own” tobacco sold in Alabama (directly or indirectly) by the

Manufacturer identified above during the sales year or quarter: (See instructions for details.) __________________________________

P RT 4 – ESCROW R TES

ND P YMENTS

For the sales year: (Use and adjust the rates listed below to figure the appropriate total deposit amount.)

1999 – The rate per cigarette is . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0.0094241

2000 – The rate per cigarette is . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0.0104712

2001 - 2002 – The rate per cigarette is . . . . . . . . . . . . . . . . . . . . . . . 0.0136125

2003 - 2006 – The rate per cigarette is . . . . . . . . . . . . . . . . . . . . . . . 0.0167539

2007 and thereafter – The rate per cigarette is . . . . . . . . . . . . . . . . . 0.0188482

The appropriate DEPOSIT SUBTOTAL is . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $_______________________

(Multiply units in Part 3 by the appropriate rate in Part 4)

The appropriate INFLATION ADJUSTMENT for the sales year is . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $_______________________

(Please refer generally to Exhibit C of the tobacco Master Settlement Agreement for calculation of the cumulative adjustment for infla-

tion applicable to each year’s escrow payment. For payments due April 15 multiply the deposit subtotal by the appropriate rate listed

below to figure the appropriate total deposit amount.)

1999 – Inflation rate is . . . . . . . . . . . . . . . . . . . . . .

3% (0.030000000)

2000 – Inflation rate is . . . . . . . . . . . . . . . . . . . . . . 6.4884136% (0.064884136)

2001 – Inflation rate is . . . . . . . . . . . . . . . . . . . . . . 9.6830623% (0.096830623)

2002 – Inflation rate is . . . . . . . . . . . . . . . . . . . . . .

12.97355% (0.129735500)

2003 – Inflation rate is . . . . . . . . . . . . . . . . . . . . . . 16.3627565% (0.163627565)

2004 – Inflation rate is . . . . . . . . . . . . . . . . . . . . . .

20.15103% (0.201510300)

2005 – Inflation rate is . . . . . . . . . . . . . . . . . . . . . .

24.25497% (0.242549700)

2006 – Inflation rate is . . . . . . . . . . . . . . . . . . . . . .

27.98262% (0.279826200)

2007 – Inflation rate is . . . . . . . . . . . . . . . . . . . . . .

33.20594% (0.332059400)

2008 – Inflation rate is . . . . . . . . . . . . . . . . . . . . . .

37.20212% (0.372021200)

2009 – Inflation rate is . . . . . . . . . . . . . . . . . . . . . .

41.31818% (0.413181800)

2010 – Inflation rate is . . . . . . . . . . . . . . . . . . . . . .

45.55773% (0.455577300)

2011 – Inflation rate is . . . . . . . . . . . . . . . . . . . . . .

49.92446% (0.499244600)

If you have been required to make a quarterly deposit and certification for the 2012 sales year, the estimated inflation rate is

54.42219%. Adjustments may be made requiring additional deposits or credits if this estimated rate is not correct. Please refer to the

NPM instructions for information regarding escrow deposit and certification dates.

TOTAL AMOUNT that has been paid into the Qualified escrow fund by the Manufacturer identified

above for the sales year or quarter. (Add deposit subtotal and the inflation adjustment amount.) . . . . . . . $_______________________

NOTE: For the initial deposit, attach a copy of your executed escrow agreement and for all deposits attach copies of your

receipt or other proof of deposit from your financial institution and copies, if any, of amendments to your escrow agreement.

1

1 2

2 3

3 4

4