Auto Theft Prevention Surcharge Payment

M29

IMPORTANT:

Type in the required information while this form is on the screen and print a copy. A personalized scan

line will be printed on the voucher using the information you entered. To help ensure your payment is properly credited

to your account, verify that the period end date and Minnesota tax ID number are included in the scan line.

When you print this voucher, be sure to set the Page Scaling to “None” in your Print options. DO NOT check the “Auto-

rotate and center pages” or “Shrink to fit” boxes. If they are already checked, click on the box to uncheck them.

Companies licensed for auto insurance are

Pay by Credit or Debit Card

To register for a Minnesota tax ID number:

required to pay an auto theft prevention

• Go to payMNtax.com; or

• Go to or

surcharge. To calculate the surcharge, multiply

• Call 1‑855‑9‑IPAY‑MN.

• Register by phone at 651‑282‑5225 or

the number of insured vehicles with com-

1‑800‑657‑3605.

prehensive insurance coverage by $0.50 per

You will be charged a fee to use this service,

vehicle for six months of coverage. Include the

which goes directly to Value Payment

Pay Electronically

following types of vehicles: passenger automo-

Systems (a national company that partners

• Go to and log

biles, pickup trucks, vans (but not commuter

with federal, state and local governments to

vans), and motorcycles.

in to e-Services; or

provide credit/debit card payment services).

If you have questions, call 651-556-3024. TTY

• Call 1‑800‑570‑3329 to pay by phone.

The Department of Revenue does not have

users: Call 711 for Minnesota Relay.

You’ll need your Minnesota tax ID number,

any financial agreement with Value Payment

password and banking information. When

Systems and does not receive any of its fees.

Due Dates

paying electronically, you must use an ac-

Your quarterly payments are due May 1,

Pay by Check

count not associated with any foreign banks.

August 1, November 1 and February 1 of the

If you are not required to pay electroni-

After you authorize the payment, you’ll re-

following year. If there is zero surcharge for

cally, you may pay by check. Complete the

ceive a confirmation number. You can cancel

the period, there is nothing you need to do.

voucher below and mail it with your check.

a payment up to one business day before the

All information is required to process your

When the due date falls on a weekend or

scheduled payment date, if needed.

payment, including your Minnesota tax ID

legal holiday, payments electronically made

Do not send in the voucher below unless

number.

or postmarked on the next business day are

you are paying by check.

considered timely.

When you pay by check, your check autho-

rizes us to make a one-time electronic fund

Before You Can Make a

transfer from your account, and you may

Payment

not receive your cancelled check.

To ensure your payment is processed cor-

rectly, you must have a Minnesota tax ID

number.

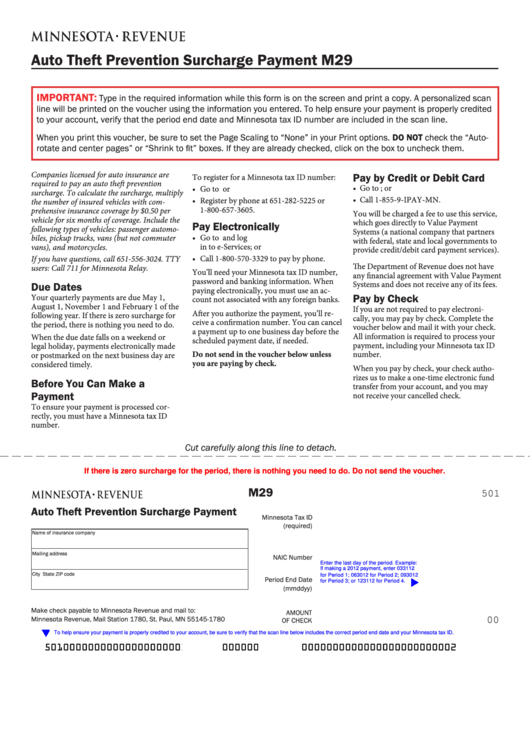

Cut carefully along this line to detach.

If there is zero surcharge for the period, there is nothing you need to do. Do not send the voucher.

M29

501

Auto Theft Prevention Surcharge Payment

Minnesota Tax ID

(required)

Name of insurance company

Mailing address

NAIC Number

Enter the last day of the period. Example:

If making a 2012 payment, enter 033112

City

State

ZIP code

for Period 1; 063012 for Period 2; 093012

Period End Date

u

for Period 3; or 123112 for Period 4.

(mmddyy)

Make check payable to Minnesota Revenue and mail to:

AMOUNT

Minnesota Revenue, Mail Station 1780, St. Paul, MN 55145-1780

OF CHECK

00

To help ensure your payment is properly credited to your account, be sure to verify that the scan line below includes the correct period end date and your Minnesota tax ID.

5010000000000000000000123110000000

000000

0000000000000000000000002

1

1