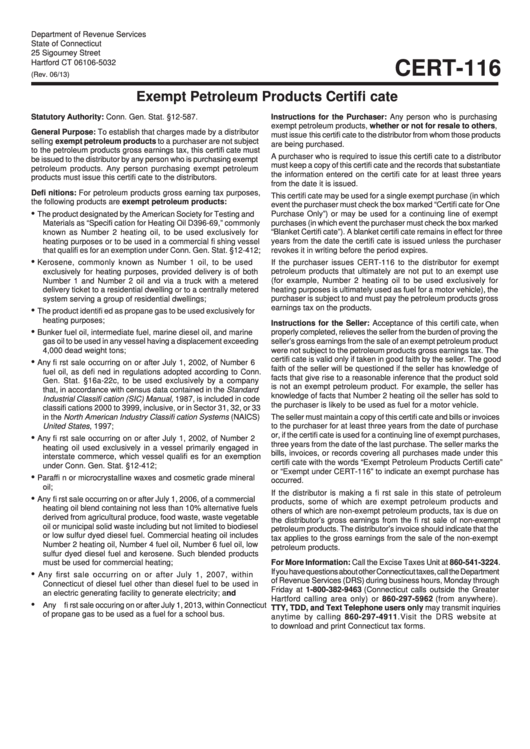

Form Cert-116 - Exempt Petroleum Products Certificate

ADVERTISEMENT

Department of Revenue Services

State of Connecticut

25 Sigourney Street

Hartford CT 06106-5032

CERT-116

(Rev. 06/13)

Exempt Petroleum Products Certifi cate

Statutory Authority: Conn. Gen. Stat. §12-587.

Instructions for the Purchaser: Any person who is purchasing

exempt petroleum products, whether or not for resale to others,

General Purpose: To establish that charges made by a distributor

must issue this certifi cate to the distributor from whom those products

selling exempt petroleum products to a purchaser are not subject

are being purchased.

to the petroleum products gross earnings tax, this certifi cate must

A purchaser who is required to issue this certifi cate to a distributor

be issued to the distributor by any person who is purchasing exempt

must keep a copy of this certifi cate and the records that substantiate

petroleum products. Any person purchasing exempt petroleum

the information entered on the certifi cate for at least three years

products must issue this certifi cate to the distributors.

from the date it is issued.

Defi nitions: For petroleum products gross earning tax purposes,

This certifi cate may be used for a single exempt purchase (in which

the following products are exempt petroleum products:

event the purchaser must check the box marked “Certifi cate for One

•

Purchase Only”) or may be used for a continuing line of exempt

The product designated by the American Society for Testing and

purchases (in which event the purchaser must check the box marked

Materials as “Specifi cation for Heating Oil D396-69,” commonly

“Blanket Certifi cate”). A blanket certifi cate remains in effect for three

known as Number 2 heating oil, to be used exclusively for

years from the date the certifi cate is issued unless the purchaser

heating purposes or to be used in a commercial fi shing vessel

that qualifi es for an exemption under Conn. Gen. Stat. §12-412;

revokes it in writing before the period expires.

•

Kerosene, commonly known as Number 1 oil, to be used

If the purchaser issues CERT-116 to the distributor for exempt

exclusively for heating purposes, provided delivery is of both

petroleum products that ultimately are not put to an exempt use

(for example, Number 2 heating oil to be used exclusively for

Number 1 and Number 2 oil and via a truck with a metered

heating purposes is ultimately used as fuel for a motor vehicle), the

delivery ticket to a residential dwelling or to a centrally metered

purchaser is subject to and must pay the petroleum products gross

system serving a group of residential dwellings;

earnings tax on the products.

•

The product identifi ed as propane gas to be used exclusively for

heating purposes;

Instructions for the Seller: Acceptance of this certifi cate, when

•

properly completed, relieves the seller from the burden of proving the

Bunker fuel oil, intermediate fuel, marine diesel oil, and marine

seller’s gross earnings from the sale of an exempt petroleum product

gas oil to be used in any vessel having a displacement exceeding

were not subject to the petroleum products gross earnings tax. The

4,000 dead weight tons;

certifi cate is valid only if taken in good faith by the seller. The good

•

Any fi rst sale occurring on or after July 1, 2002, of Number 6

faith of the seller will be questioned if the seller has knowledge of

fuel oil, as defi ned in regulations adopted according to Conn.

facts that give rise to a reasonable inference that the product sold

Gen. Stat. §16a-22c, to be used exclusively by a company

is not an exempt petroleum product. For example, the seller has

that, in accordance with census data contained in the Standard

knowledge of facts that Number 2 heating oil the seller has sold to

Industrial Classifi cation (SIC) Manual, 1987, is included in code

the purchaser is likely to be used as fuel for a motor vehicle.

classifi cations 2000 to 3999, inclusive, or in Sector 31, 32, or 33

The seller must maintain a copy of this certifi cate and bills or invoices

in the North American Industry Classifi cation Systems (NAICS)

to the purchaser for at least three years from the date of purchase

United States, 1997;

or, if the certifi cate is used for a continuing line of exempt purchases,

•

Any fi rst sale occurring on or after July 1, 2002, of Number 2

three years from the date of the last purchase. The seller marks the

heating oil used exclusively in a vessel primarily engaged in

bills, invoices, or records covering all purchases made under this

interstate commerce, which vessel qualifi es for an exemption

certifi cate with the words “Exempt Petroleum Products Certifi cate”

under Conn. Gen. Stat. §12-412;

or “Exempt under CERT-116” to indicate an exempt purchase has

•

Paraffi n or microcrystalline waxes and cosmetic grade mineral

occurred.

oil;

If the distributor is making a fi rst sale in this state of petroleum

•

Any fi rst sale occurring on or after July 1, 2006, of a commercial

products, some of which are exempt petroleum products and

heating oil blend containing not less than 10% alternative fuels

others of which are non-exempt petroleum products, tax is due on

derived from agricultural produce, food waste, waste vegetable

the distributor’s gross earnings from the fi rst sale of non-exempt

oil or municipal solid waste including but not limited to biodiesel

petroleum products. The distributor’s invoice should indicate that the

or low sulfur dyed diesel fuel. Commercial heating oil includes

tax applies to the gross earnings from the sale of the non-exempt

Number 2 heating oil, Number 4 fuel oil, Number 6 fuel oil, low

petroleum products.

sulfur dyed diesel fuel and kerosene. Such blended products

must be used for commercial heating;

For More Information: Call the Excise Taxes Unit at 860-541-3224.

If you have questions about other Connecticut taxes, call the Department

•

Any first sale occurring on or after July 1, 2007, within

of Revenue Services (DRS) during business hours, Monday through

Connecticut of diesel fuel other than diesel fuel to be used in

Friday at 1-800-382-9463 (Connecticut calls outside the Greater

an electric generating facility to generate electricity; and

Hartford calling area only) or 860-297-5962 (from anywhere).

•

Any fi rst sale occuring on or after July 1, 2013, within Connecticut

TTY, TDD, and Text Telephone users only may transmit inquiries

of propane gas to be used as a fuel for a school bus.

anytime by calling 860-297-4911. Visit the DRS website at

to download and print Connecticut tax forms.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2