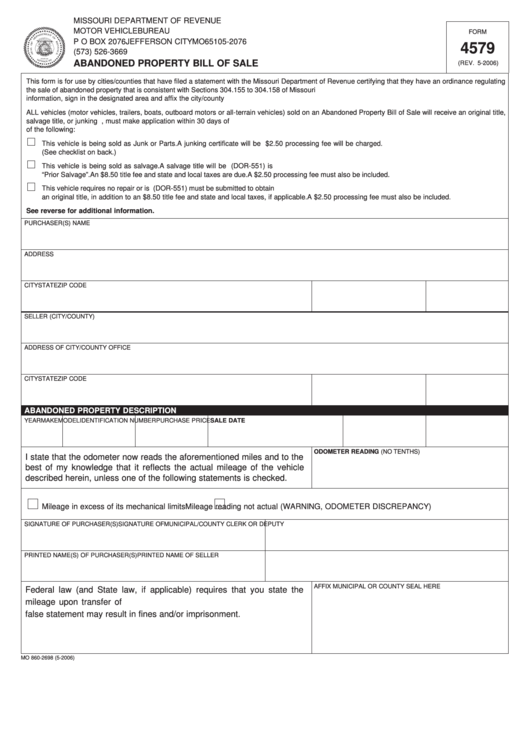

MISSOURI DEPARTMENT OF REVENUE

MOTOR VEHICLE BUREAU

FORM

P O BOX 2076 JEFFERSON CITY MO 65105-2076

4579

(573) 526-3669

Reset Form

Print Form

ABANDONED PROPERTY BILL OF SALE

(REV. 5-2006)

This form is for use by cities/counties that have filed a statement with the Missouri Department of Revenue certifying that they have an ordinance regulating

the sale of abandoned property that is consistent with Sections 304.155 to 304.158 of Missouri law. The city/county clerk/deputy must complete all applicable

information, sign in the designated area and affix the city/county seal. The purchaser must sign this form in the appropriate area.

ALL vehicles (motor vehicles, trailers, boats, outboard motors or all-terrain vehicles) sold on an Abandoned Property Bill of Sale will receive an original title,

salvage title, or junking certificate. The purchaser of this abandoned property, must make application within 30 days of purchase. The seller must check one

of the following:

This vehicle is being sold as Junk or Parts. A junking certificate will be issued. No title fee or taxes are due. A $2.50 processing fee will be charged.

(See checklist on back.)

This vehicle is being sold as salvage. A salvage title will be issued. An original title may be issued if a Vehicle Examination Certificate (DOR-551) is

submitted. The title will be branded “Prior Salvage”. An $8.50 title fee and state and local taxes are due. A $2.50 processing fee must also be included.

This vehicle requires no repair or is rebuildable. An original title will be issued. A Vehicle Examination Certificate (DOR-551) must be submitted to obtain

an original title, in addition to an $8.50 title fee and state and local taxes, if applicable. A $2.50 processing fee must also be included.

See reverse for additional information.

PURCHASER(S) NAME

ADDRESS

CITY

STATE

ZIP CODE

SELLER (CITY/COUNTY)

ADDRESS OF CITY/COUNTY OFFICE

CITY

STATE

ZIP CODE

ABANDONED PROPERTY DESCRIPTION

YEAR

MAKE

MODEL

IDENTIFICATION NUMBER

PURCHASE PRICE

SALE DATE

ODOMETER READING (NO TENTHS)

I state that the odometer now reads the aforementioned miles and to the

best of my knowledge that it reflects the actual mileage of the vehicle

described herein, unless one of the following statements is checked.

Mileage in excess of its mechanical limits

Mileage reading not actual (WARNING, ODOMETER DISCREPANCY)

SIGNATURE OF PURCHASER(S)

SIGNATURE OF MUNICIPAL/COUNTY CLERK OR DEPUTY

PRINTED NAME(S) OF PURCHASER(S)

PRINTED NAME OF SELLER

AFFIX MUNICIPAL OR COUNTY SEAL HERE

Federal law (and State law, if applicable) requires that you state the

mileage upon transfer of ownership. Failing to complete or providing a

false statement may result in fines and/or imprisonment.

MO 860-2698 (5-2006)

1

1 2

2