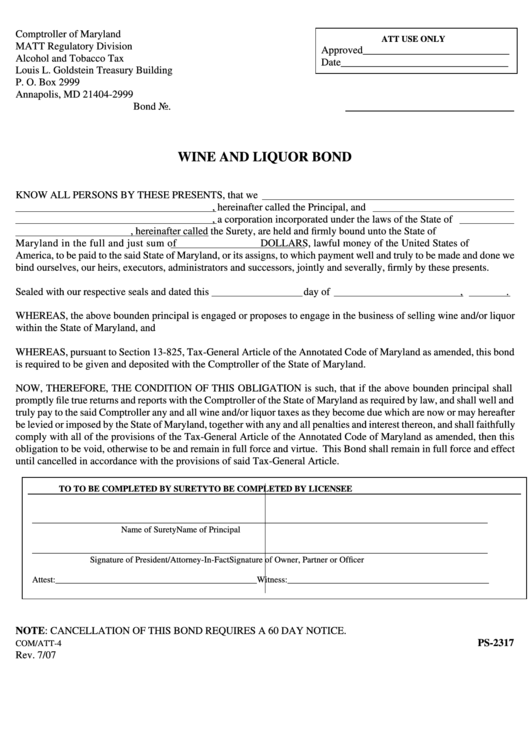

Comptroller of Maryland

ATT USE ONLY

MATT Regulatory Division

Approved____________________________

Alcohol and Tobacco Tax

Date________________________________

Louis L. Goldstein Treasury Building

P. O. Box 2999

Annapolis, MD 21404-2999

Bond No.

WINE AND LIQUOR BOND

KNOW ALL PERSONS BY THESE PRESENTS, that we

, hereinafter called the Principal, and

, a corporation incorporated under the laws of the State of

, hereinafter called the Surety, are held and firmly bound unto the State of

Maryland in the full and just sum of

DOLLARS, lawful money of the United States of

America, to be paid to the said State of Maryland, or its assigns, to which payment well and truly to be made and done we

bind ourselves, our heirs, executors, administrators and successors, jointly and severally, firmly by these presents.

Sealed with our respective seals and dated this

day of

,

.

WHEREAS, the above bounden principal is engaged or proposes to engage in the business of selling wine and/or liquor

within the State of Maryland, and

WHEREAS, pursuant to Section 13-825, Tax-General Article of the Annotated Code of Maryland as amended, this bond

is required to be given and deposited with the Comptroller of the State of Maryland.

NOW, THEREFORE, THE CONDITION OF THIS OBLIGATION is such, that if the above bounden principal shall

promptly file true returns and reports with the Comptroller of the State of Maryland as required by law, and shall well and

truly pay to the said Comptroller any and all wine and/or liquor taxes as they become due which are now or may hereafter

be levied or imposed by the State of Maryland, together with any and all penalties and interest thereon, and shall faithfully

comply with all of the provisions of the Tax-General Article of the Annotated Code of Maryland as amended, then this

obligation to be void, otherwise to be and remain in full force and virtue. This Bond shall remain in full force and effect

until cancelled in accordance with the provisions of said Tax-General Article.

TO

TO BE COMPLETED BY SURETY

TO BE COMPLETED BY LICENSEE

___________________________________________________

_____________________________________________________

Name of Surety

Name of Principal

___________________________________________________

_____________________________________________________

Signature of President/Attorney-In-Fact

Signature of Owner, Partner or Officer

Attest:______________________________________________

Witness:______________________________________________

NOTE: CANCELLATION OF THIS BOND REQUIRES A 60 DAY NOTICE.

PS-2317

COM/ATT-4

Rev. 7/07

1

1