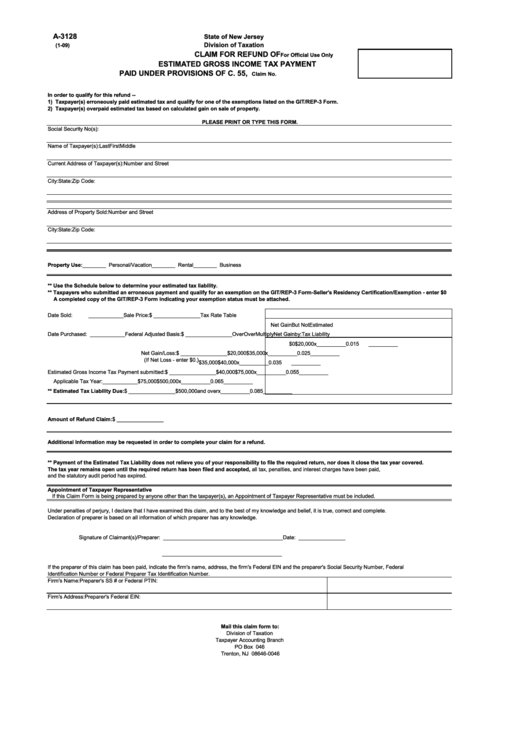

A-3128

State of New Jersey

Division of Taxation

(1-09)

CLAIM FOR REFUND OF

For Official Use Only

ESTIMATED GROSS INCOME TAX PAYMENT

PAID UNDER PROVISIONS OF C. 55, P.L. 2004

Claim No.

In order to qualify for this refund --

1) Taxpayer(s) erroneously paid estimated tax and qualify for one of the exemptions listed on the GIT/REP-3 Form.

2) Taxpayer(s) overpaid estimated tax based on calculated gain on sale of property.

PLEASE PRINT OR TYPE THIS FORM.

Social Security No(s):

Name of Taxpayer(s):

Last

First

Middle

Current Address of Taxpayer(s):

Number and Street

City:

State:

Zip Code:

Address of Property Sold:

Number and Street

City:

State:

Zip Code:

Property Use:

________ Personal/Vacation

________ Rental

________ Business

** Use the Schedule below to determine your estimated tax liability.

** Taxpayers who submitted an erroneous payment and qualify for an exemption on the GIT/REP-3 Form-Seller's Residency Certification/Exemption - enter $0

A completed copy of the GIT/REP-3 Form indicating your exemption status must be attached.

Date Sold:

____________

Sale Price:

$ ________________

Tax Rate Table

Net Gain

But Not

Estimated

Date Purchased: ____________

Federal Adjusted Basis:

$ ________________

Over

Over

Multiply

Net Gain

by:

Tax Liability

$0

$20,000

x

__________

0.015

__________

Net Gain/Loss:

$ ________________

$20,000

$35,000

x

__________

0.025

__________

(If Net Loss - enter $0.)

$35,000

$40,000

x

__________

0.035

__________

Estimated Gross Income Tax Payment submitted:

$ ________________

$40,000

$75,000

x

__________

0.055

__________

Applicable Tax Year:

____________

$75,000

$500,000

x

__________

0.065

__________

** Estimated Tax Liability Due:

$ ________________

$500,000

and over

x

__________

0.085

__________

Amount of Refund Claim:

$ ________________

Additional Information may be requested in order to complete your claim for a refund.

** Payment of the Estimated Tax Liability does not relieve you of your responsibility to file the required return, nor does it close the tax year covered.

The tax year remains open until the required return has been filed and accepted, all tax, penalties, and interest charges have been paid,

and the statutory audit period has expired.

Appointment of Taxpayer Representative

If this Claim Form is being prepared by anyone other than the taxpayer(s), an Appointment of Taxpayer Representative must be included.

Under penalties of perjury, I declare that I have examined this claim, and to the best of my knowledge and belief, it is true, correct and complete.

Declaration of preparer is based on all information of which preparer has any knowledge.

Signature of Claimant(s)/Preparer: _________________________________________

Date: ________________

_________________________________________

If the preparer of this claim has been paid, indicate the firm's name, address, the firm's Federal EIN and the preparer's Social Security Number, Federal

Identification Number or Federal Preparer Tax Identification Number.

Firm's Name:

Preparer's SS # or Federal PTIN:

Firm's Address:

Preparer's Federal EIN:

Mail this claim form to:

Division of Taxation

Taxpayer Accounting Branch

PO Box 046

Trenton, NJ 08646-0046

1

1 2

2