Form Mfa -12 - Instructions For Completing The Import Verification Tax Return

ADVERTISEMENT

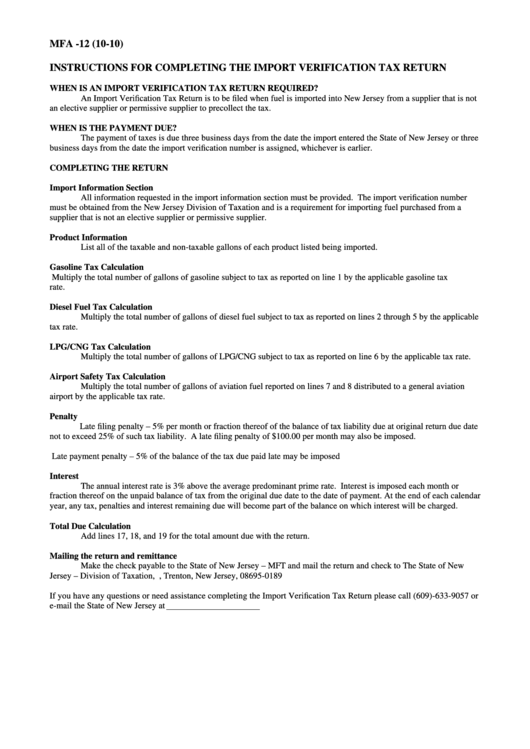

MFA -12 (10-10)

INSTRUCTIONS FOR COMPLETING THE IMPORT VERIFICATION TAX RETURN

WHEN IS AN IMPORT VERIFICATION TAX RETURN REQUIRED?

An Import Verification Tax Return is to be filed when fuel is imported into New Jersey from a supplier that is not

an elective supplier or permissive supplier to precollect the tax.

WHEN IS THE PAYMENT DUE?

The payment of taxes is due three business days from the date the import entered the State of New Jersey or three

business days from the date the import verification number is assigned, whichever is earlier.

COMPLETING THE RETURN

Import Information Section

All information requested in the import information section must be provided. The import verification number

must be obtained from the New Jersey Division of Taxation and is a requirement for importing fuel purchased from a

supplier that is not an elective supplier or permissive supplier.

Product Information

List all of the taxable and non-taxable gallons of each product listed being imported.

Gasoline Tax Calculation

Multiply the total number of gallons of gasoline subject to tax as reported on line 1 by the applicable gasoline tax

rate.

Diesel Fuel Tax Calculation

Multiply the total number of gallons of diesel fuel subject to tax as reported on lines 2 through 5 by the applicable

tax rate.

LPG/CNG Tax Calculation

Multiply the total number of gallons of LPG/CNG subject to tax as reported on line 6 by the applicable tax rate.

Airport Safety Tax Calculation

Multiply the total number of gallons of aviation fuel reported on lines 7 and 8 distributed to a general aviation

airport by the applicable tax rate.

Penalty

Late filing penalty – 5% per month or fraction thereof of the balance of tax liability due at original return due date

not to exceed 25% of such tax liability. A late filing penalty of $100.00 per month may also be imposed.

Late payment penalty – 5% of the balance of the tax due paid late may be imposed

Interest

The annual interest rate is 3% above the average predominant prime rate. Interest is imposed each month or

fraction thereof on the unpaid balance of tax from the original due date to the date of payment. At the end of each calendar

year, any tax, penalties and interest remaining due will become part of the balance on which interest will be

charged.

Total Due Calculation

Add lines 17, 18, and 19 for the total amount due with the return.

Mailing the return and remittance

Make the check payable to the State of New Jersey – MFT and mail the return and check to The State of New

Jersey – Division of Taxation, P.O. Box 189, Trenton, New Jersey, 08695-0189

If you have any questions or need assistance completing the Import Verification Tax Return please call (609)-633-9057 or

e-mail the State of New Jersey at fuel.tax@treas.state.nj.us

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1