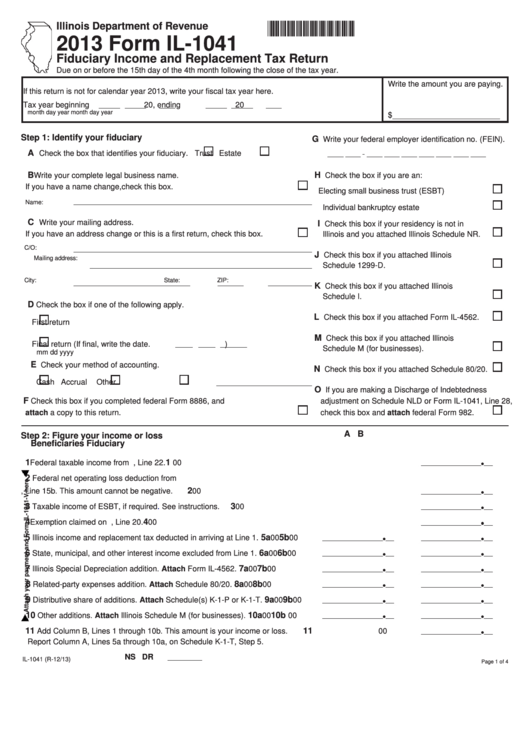

*363601110*

Illinois Department of Revenue

2013 Form IL-1041

Fiduciary Income and Replacement Tax Return

Due on or before the 15th day of the 4th month following the close of the tax year.

Write the amount you are paying.

If this return is not for calendar year 2013, write your fiscal tax year here.

Tax year beginning

20

, ending

20

month

day

year

month

day

year

$

Step 1:

Identify your fiduciary

G

Write your federal employer identification no. (FEIN).

A

Check the box that identifies your fiduciary.

Trust

Estate

B

H

Write your complete legal business name.

Check the box if you are an:

If you have a name change, check this box.

Electing small business trust (ESBT)

Name:

Individual bankruptcy estate

C

Write your mailing address.

I

Check this box if your residency is not in

If you have an address change or this is a first return, check this box.

Illinois and you attached Illinois Schedule NR.

C/O:

J

Check this box if you attached Illinois

Schedule 1299-D.

Mailing address:

City:

State:

ZIP:

K

Check this box if you attached Illinois

Schedule I.

D

Check the box if one of the following apply.

L

Check this box if you attached Form IL-4562.

First return

M

Check this box if you attached Illinois

Final return (If final, write the date.

)

Schedule M (for businesses).

mm

dd

yyyy

E

Check your method of accounting.

N

Check this box if you attached Schedule 80/20.

Cash

Accrual

Other

O

If you are making a Discharge of Indebtedness

F

Check this box if you completed federal Form 8886, and

adjustment on Schedule NLD or Form IL-1041, Line 28,

attach a copy to this return.

check this box and attach federal Form 982.

A

B

Step 2:

Figure your income or loss

Beneficiaries

Fiduciary

1

1

Federal taxable income from U.S. Form 1041, Line 22.

00

2

Federal net operating loss deduction from

2

U.S. Form 1041, Line 15b. This amount cannot be negative.

00

3

3

Taxable income of ESBT, if

required.

See instructions.

00

4

4

Exemption claimed on U.S. Form 1041, Line 20.

00

5

5a

5b

Illinois income and replacement tax deducted in arriving at Line 1.

00

00

6

6a

6b

State, municipal, and other interest income excluded from Line 1.

00

00

7

7a

7b

Illinois Special Depreciation addition. Attach Form IL-4562.

00

00

8

8a

8b

Related-party expenses addition. Attach Schedule 80/20.

00

00

9

9a

9b

Distributive share of additions. Attach Schedule(s) K-1-P or K-1-T.

00

00

10

10a

10b

Other additions. Attach Illinois Schedule M (for businesses).

00

00

11

11

Add Column B, Lines 1 through 10b. This amount is your income or loss.

00

Report Column A, Lines 5a through 10a, on Schedule K-1-T, Step 5.

NS

DR

IL-1041 (R-12/13)

Page 1 of 4

1

1 2

2 3

3 4

4