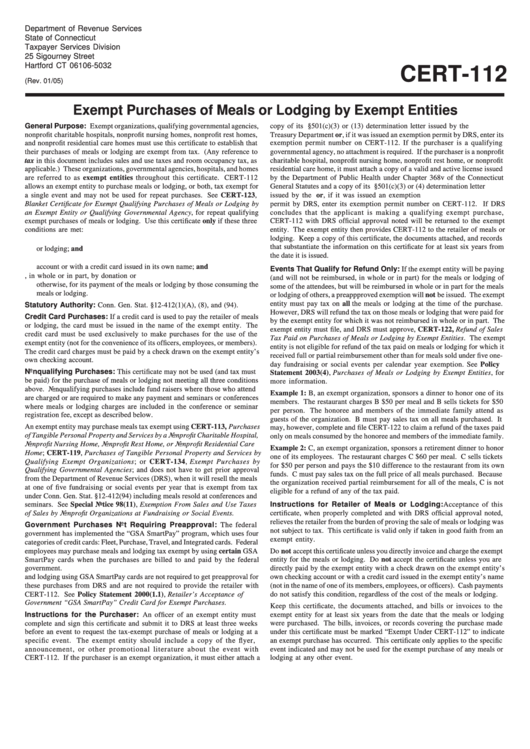

Department of Revenue Services

State of Connecticut

Taxpayer Services Division

25 Sigourney Street

Hartford CT 06106-5032

CERT-112

(Rev. 01/05)

Exempt Purchases of Meals or Lodging by Exempt Entities

General Purpose: Exempt organizations, qualifying governmental agencies,

copy of its I.R.C. §501(c)(3) or (13) determination letter issued by the U.S.

nonprofit charitable hospitals, nonprofit nursing homes, nonprofit rest homes,

Treasury Department or, if it was issued an exemption permit by DRS, enter its

and nonprofit residential care homes must use this certificate to establish that

exemption permit number on CERT-112. If the purchaser is a qualifying

their purchases of meals or lodging are exempt from tax. (Any reference to

governmental agency, no attachment is required. If the purchaser is a nonprofit

tax in this document includes sales and use taxes and room occupancy tax, as

charitable hospital, nonprofit nursing home, nonprofit rest home, or nonprofit

applicable.) These organizations, governmental agencies, hospitals, and homes

residential care home, it must attach a copy of a valid and active license issued

are referred to as exempt entities throughout this certificate. CERT-112

by the Department of Public Health under Chapter 368v of the Connecticut

allows an exempt entity to purchase meals or lodging, or both, tax exempt for

General Statutes and a copy of its I.R.C. §501(c)(3) or (4) determination letter

a single event and may not be used for repeat purchases. See CERT-123,

issued by the U.S. Treasury Department or, if it was issued an exemption

Blanket Certificate for Exempt Qualifying Purchases of Meals or Lodging by

permit by DRS, enter its exemption permit number on CERT-112. If DRS

an Exempt Entity or Qualifying Governmental Agency, for repeat qualifying

concludes that the applicant is making a qualifying exempt purchase,

exempt purchases of meals or lodging. Use this certificate only if these three

CERT-112 with DRS official approval noted will be returned to the exempt

conditions are met:

entity. The exempt entity then provides CERT-112 to the retailer of meals or

lodging. Keep a copy of this certificate, the documents attached, and records

1. The retailer directly invoices and charges the exempt entity for the meals

that substantiate the information on this certificate for at least six years from

or lodging; and

the date it is issued.

2. The exempt entity directly pays the retailer with a check drawn on its own

account or with a credit card issued in its own name; and

Events That Qualify for Refund Only: If the exempt entity will be paying

3. The exempt entity is not reimbursed, in whole or in part, by donation or

(and will not be reimbursed, in whole or in part) for the meals or lodging of

otherwise, for its payment of the meals or lodging by those consuming the

some of the attendees, but will be reimbursed in whole or in part for the meals

meals or lodging.

or lodging of others, a preappproved exemption will not be issued. The exempt

entity must pay tax on all the meals or lodging at the time of the purchase.

Statutory Authority: Conn. Gen. Stat. §12-412(1)(A), (8), and (94).

However, DRS will refund the tax on those meals or lodging that were paid for

Credit Card Purchases: If a credit card is used to pay the retailer of meals

by the exempt entity for which it was not reimbursed in whole or in part. The

or lodging, the card must be issued in the name of the exempt entity. The

exempt entity must file, and DRS must approve, CERT-122, Refund of Sales

credit card must be used exclusively to make purchases for the use of the

Tax Paid on Purchases of Meals or Lodging by Exempt Entities. The exempt

exempt entity (not for the convenience of its officers, employees, or members).

entity is not eligible for refund of the tax paid on meals or lodging for which it

The credit card charges must be paid by a check drawn on the exempt entity’s

received full or partial reimbursement other than for meals sold under five one-

own checking account.

day fundraising or social events per calendar year exemption. See Policy

Nonqualifying Purchases: This certificate may not be used (and tax must

Statement 2003(4), Purchases of Meals or Lodging by Exempt Entities, for

be paid) for the purchase of meals or lodging not meeting all three conditions

more information.

above. Nonqualifying purchases include fund raisers where those who attend

Example 1: B, an exempt organization, sponsors a dinner to honor one of its

are charged or are required to make any payment and seminars or conferences

members. The restaurant charges B $50 per meal and B sells tickets for $50

where meals or lodging charges are included in the conference or seminar

per person. The honoree and members of the immediate family attend as

registration fee, except as described below.

guests of the organization. B must pay sales tax on all meals purchased. It

An exempt entity may purchase meals tax exempt using CERT-113, Purchases

may, however, complete and file CERT-122 to claim a refund of the taxes paid

of Tangible Personal Property and Services by a Nonprofit Charitable Hospital,

only on meals consumed by the honoree and members of the immediate family.

Nonprofit Nursing Home, Nonprofit Rest Home, or Nonprofit Residential Care

Example 2: C, an exempt organization, sponsors a retirement dinner to honor

Home; CERT-119, Purchases of Tangible Personal Property and Services by

one of its employees. The restaurant charges C $60 per meal. C sells tickets

Qualifying Exempt Organizations; or CERT-134, Exempt Purchases by

for $50 per person and pays the $10 difference to the restaurant from its own

Qualifying Governmental Agencies; and does not have to get prior approval

funds. C must pay sales tax on the full price of all meals purchased. Because

from the Department of Revenue Services (DRS), when it will resell the meals

the organization received partial reimbursement for all of the meals, C is not

at one of five fundraising or social events per year that is exempt from tax

eligible for a refund of any of the tax paid.

under Conn. Gen. Stat. §12-412(94) including meals resold at conferences and

seminars. See Special Notice 98(11), Exemption From Sales and Use Taxes

Instructions for Retailer of Meals or Lodging: Acceptance of this

of Sales by Nonprofit Organizations at Fundraising or Social Events.

certificate, when properly completed and with DRS official approval noted,

relieves the retailer from the burden of proving the sale of meals or lodging was

Government Purchases Not Requiring Preapproval: The federal

not subject to tax. This certificate is valid only if taken in good faith from an

government has implemented the “GSA SmartPay” program, which uses four

exempt entity.

categories of credit cards: Fleet, Purchase, Travel, and Integrated cards. Federal

employees may purchase meals and lodging tax exempt by using certain GSA

Do not accept this certificate unless you directly invoice and charge the exempt

SmartPay cards when the purchases are billed to and paid by the federal

entity for the meals or lodging. Do not accept the certificate unless you are

government. U.S. government agencies making tax-exempt purchases of meals

directly paid by the exempt entity with a check drawn on the exempt entity’s

and lodging using GSA SmartPay cards are not required to get preapproval for

own checking account or with a credit card issued in the exempt entity’s name

these purchases from DRS and are not required to provide the retailer with

(not in the name of one of its members, employees, or officers). Cash payments

CERT-112. See Policy Statement 2000(1.1), Retailer’s Acceptance of U.S.

do not satisfy this condition, regardless of the cost of the meals or lodging.

Government “GSA SmartPay” Credit Card for Exempt Purchases.

Keep this certificate, the documents attached, and bills or invoices to the

Instructions for the Purchaser: An officer of an exempt entity must

exempt entity for at least six years from the date that the meals or lodging

complete and sign this certificate and submit it to DRS at least three weeks

were purchased. The bills, invoices, or records covering the purchase made

before an event to request the tax-exempt purchase of meals or lodging at a

under this certificate must be marked “Exempt Under CERT-112” to indicate

specific event. The exempt entity should include a copy of the flyer,

an exempt purchase has occurred. This certificate only applies to the specific

announcement, or other promotional literature about the event with

event indicated and may not be used for the exempt purchase of any meals or

CERT-112. If the purchaser is an exempt organization, it must either attach a

lodging at any other event.

1

1 2

2