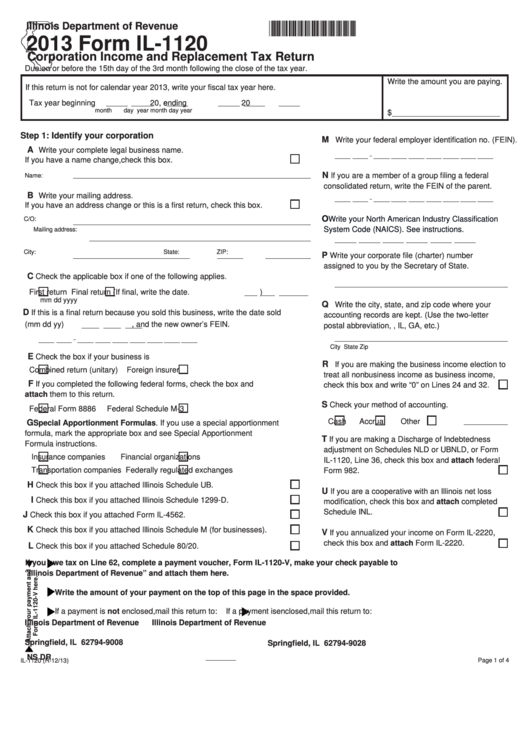

*363501110*

Illinois Department of Revenue

2013 Form IL-1120

Corporation Income and Replacement Tax Return

Due on or before the 15th day of the 3rd month following the close of the tax year.

Write the amount you are paying.

If this return is not for calendar year 2013, write your fiscal tax year here.

Tax year beginning

20

, ending

20

month

day

year

month

day

year

$

Step 1: Identify your corporation

M

Write your federal employer identification no. (FEIN).

A

Write your complete legal business name.

If you have a name change, check this box.

N

If you are a member of a group filing a federal

Name:

consolidated return, write the FEIN of the parent.

B

Write your mailing address.

If you have an address change or this is a first return, check this box.

O

Write your North American Industry Classification

C/O:

System Code (NAICS). See instructions.

Mailing address:

P

City:

State:

ZIP:

Write your corporate file (charter) number

assigned to you by the Secretary of State.

C

Check the applicable box if one of the following applies.

First return

Final return (If final, write the date.

)

mm

dd

yyyy

Q

Write the city, state, and zip code where your

D

If this is a final return because you sold this business, write the date sold

accounting records are kept. (Use the two-letter

(mm dd yy)

, and the new owner’s FEIN.

postal abbreviation, e.g., IL, GA, etc.)

City

State

Zip

E

Check the box if your business is

R

If you are making the business income election to

Combined return (unitary)

Foreign insurer

treat all nonbusiness income as business income,

F

If you completed the following federal forms, check the box and

check this box and write “0” on Lines 24 and 32.

attach them to this return.

S

Check your method of accounting.

Federal Form 8886

Federal Schedule M-3

Cash

Accrual

Other

G

Special Apportionment Formulas. If you use a special apportionment

formula, mark the appropriate box and see Special Apportionment

T

If you are making a Discharge of Indebtedness

Formula instructions.

adjustment on Schedules NLD or UBNLD, or Form

Insurance companies

Financial organizations

IL-1120, Line 36, check this box and attach federal

Transportation companies

Federally regulated exchanges

Form 982.

H

Check this box if you attached Illinois Schedule UB.

U

If you are a cooperative with an Illinois net loss

I

Check this box if you attached Illinois Schedule 1299-D.

modification, check this box and attach completed

Schedule INL.

J

Check this box if you attached Form IL-4562.

K

Check this box if you attached Illinois Schedule M (for businesses).

V

If you annualized your income on Form IL-2220,

check this box and attach Form IL-2220.

L

Check this box if you attached Schedule 80/20.

If you owe tax on Line 62, complete a payment voucher, Form IL-1120-V, make your check payable to

“Illinois Department of Revenue” and attach them here.

Write the amount of your payment on the top of this page in the space provided.

If a payment is not enclosed, mail this return to:

If a payment is enclosed, mail this return to:

Illinois Department of Revenue

Illinois Department of Revenue

P.O. Box 19008

P.O. Box 19028

Springfield, IL 62794-9008

Springfield, IL 62794-9028

NS

DR

IL-1120 (R-12/13)

Page 1 of 4

1

1 2

2 3

3 4

4