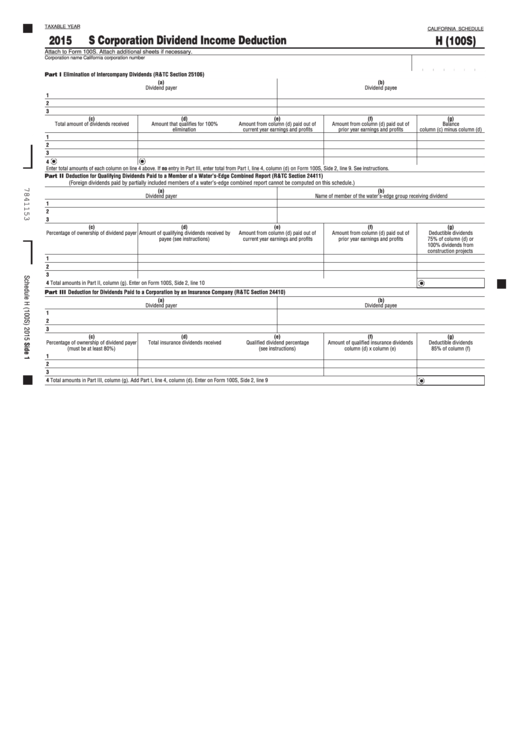

TAXABLE YEAR

CALIFORNIA SCHEDULE

S Corporation Dividend Income Deduction

2015

H (100S)

Attach to Form 100S. Attach additional sheets if necessary.

Corporation name

California corporation number

Part I

Elimination of Intercompany Dividends (R&TC Section 25106)

(a)

(b)

Dividend payer

Dividend payee

1

2

3

(c)

(d)

(e)

(f)

(g)

Total amount of dividends received

Amount that qualifies for 100%

Amount from column (d) paid out of

Amount from column (d) paid out of

Balance

elimination

current year earnings and profits

prior year earnings and profits

column (c) minus column (d)

1

2

3

4

Enter total amounts of each column on line 4 above. If no entry in Part III, enter total from Part I, line 4, column (d) on Form 100S, Side 2, line 9. See instructions.

Part II Deduction for Qualifying Dividends Paid to a Member of a Water’s-Edge Combined Report (R&TC Section 24411)

(Foreign dividends paid by partially included members of a water’s-edge combined report cannot be computed on this schedule.)

(a)

(b)

Dividend payer

Name of member of the water’s-edge group receiving dividend

1

2

3

(c)

(d)

(e)

(f)

(g)

Percentage of ownership of dividend payer

Amount of qualifying dividends received by

Amount from column (d) paid out of

Amount from column (d) paid out of

Deductible dividends

payee (see instructions)

current year earnings and profits

prior year earnings and profits

75% of column (d) or

100% dividends from

construction projects

1

2

3

4 Total amounts in Part II, column (g). Enter on Form 100S, Side 2, line 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Part III Deduction for Dividends Paid to a Corporation by an Insurance Company (R&TC Section 24410)

(a)

(b)

Dividend payer

Dividend payee

1

2

3

(c)

(d)

(e)

(f)

(g)

Percentage of ownership of dividend payer

Total insurance dividends received

Qualified dividend percentage

Amount of qualified insurance dividends

Deductible dividends

(must be at least 80%)

(see instructions)

column (d) x column (e)

85% of column (f)

1

2

3

4 Total amounts in Part III, column (g). Add Part I, line 4, column (d). Enter on Form 100S, Side 2, line 9 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

1