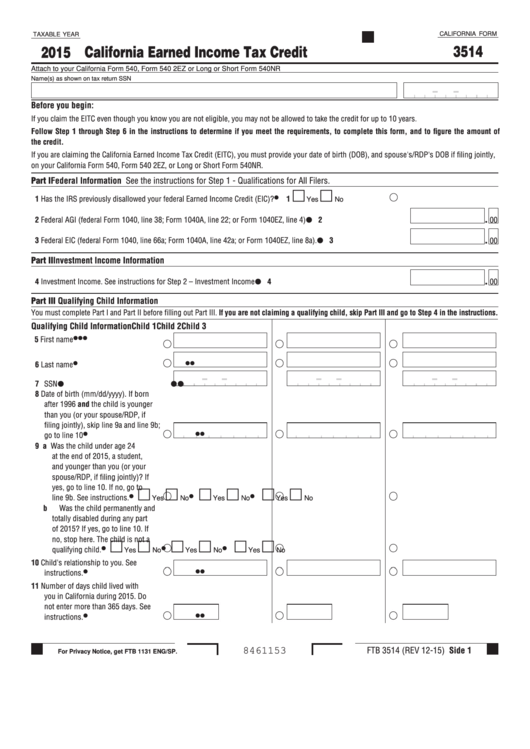

Form 3514 - California Earned Income Tax Credit - 2015

ADVERTISEMENT

CALIFORNIA FORM

TAXABLE YEAR

3514

2015

California Earned Income Tax Credit

Attach to your California Form 540, Form 540 2EZ or Long or Short Form 540NR

Name(s) as shown on tax return

SSN

Before you begin:

If you claim the EITC even though you know you are not eligible, you may not be allowed to take the credit for up to 10 years .

Follow Step 1 through Step 6 in the instructions to determine if you meet the requirements, to complete this form, and to figure the amount of

the credit.

If you are claiming the California Earned Income Tax Credit (EITC), you must provide your date of birth (DOB), and spouse's/RDP's DOB if filing jointly,

on your California Form 540, Form 540 2EZ, or Long or Short Form 540NR .

Part I Federal Information See the instructions for Step 1 - Qualifications for All Filers .

m

m

1 Has the IRS previously disallowed your federal Earned Income Credit (EIC)? . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

Yes

No

.

2 Federal AGI (federal Form 1040, line 38; Form 1040A, line 22; or Form 1040EZ, line 4) . . . . . . . . . . . . . . . . . . . . .

2

00

.

3 Federal EIC (federal Form 1040, line 66a; Form 1040A, line 42a; or Form 1040EZ, line 8a) . . . . . . . . . . . . . . . . . . .

3

00

Part II Investment Income Information

.

4 Investment Income . See instructions for Step 2 – Investment Income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

00

Part III Qualifying Child Information

You must complete Part I and Part II before filling out Part III . If you are not claiming a qualifying child, skip Part III and go to Step 4 in the instructions.

Qualifying Child Information

Child 1

Child 2

Child 3

5 First name . . . . . . . . . . . . . . . . . . . . .

6 Last name . . . . . . . . . . . . . . . . . . . . . .

7 SSN . . . . . . . . . . . . . . . . . . . . . . . . . .

8 Date of birth (mm/dd/yyyy) . If born

after 1996 and the child is younger

than you (or your spouse/RDP, if

filing jointly), skip line 9a and line 9b;

go to line 10 . . . . . . . . . . . . . . . . . . . .

9 a Was the child under age 24

at the end of 2015, a student,

and younger than you (or your

spouse/RDP, if filing jointly)? If

yes, go to line 10 . If no, go to

m

m

m

m

m

m

line 9b . See instructions . . . . . . . . .

Yes

No

Yes

No

Yes

No

b Was the child permanently and

totally disabled during any part

of 2015? If yes, go to line 10 . If

no, stop here . The child is not a

m

m

m

m

m

m

qualifying child . . . . . . . . . . . . . . . .

Yes

No

Yes

No

Yes

No

10 Child's relationship to you . See

instructions . . . . . . . . . . . . . . . . . . . .

11 Number of days child lived with

you in California during 2015 . Do

not enter more than 365 days . See

instructions . . . . . . . . . . . . . . . . . . . . .

FTB 3514 (REV 12-15) Side 1

8461153

For Privacy Notice, get FTB 1131 ENG/SP.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2