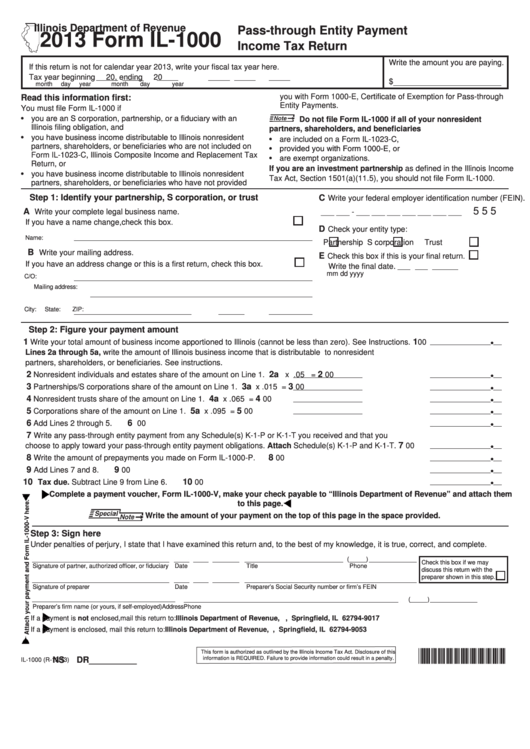

Illinois Department of Revenue

Pass-through Entity Payment

2013 Form IL-1000

Income Tax Return

Write the amount you are paying.

If this return is not for calendar year 2013, write your fiscal tax year here.

Tax year beginning

20

, ending

20

$

month

day

year

month

day

year

you with Form 1000-E, Certificate of Exemption for Pass-through

Read this information first:

Entity Payments.

You must file Form IL-1000 if

• you are an S corporation, partnership, or a fiduciary with an

Do not file Form IL-1000 if all of your nonresident

Illinois filing obligation, and

partners, shareholders, and beneficiaries

• you have business income distributable to Illinois nonresident

• are included on a Form IL-1023-C,

partners, shareholders, or beneficiaries who are not included on

• provided you with Form 1000-E, or

Form IL-1023-C, Illinois Composite Income and Replacement Tax

• are exempt organizations.

Return, or

If you are an investment partnership as defined in the Illinois Income

• you have business income distributable to Illinois nonresident

Tax Act, Section 1501(a)(11.5), you should not file Form IL-1000.

partners, shareholders, or beneficiaries who have not provided

Step 1:

Identify your partnership, S corporation, or trust

C

Write your federal employer identification number (FEIN).

5 5 5

A

Write your complete legal business name.

___ ___ - ___ ___ ___ ___ ___ ___ ___

If you have a name change, check this box.

D

Check your entity type:

Name:

Partnership

S corporation

Trust

B

Write your mailing address.

E

Check this box if this is your final return.

If you have an address change or this is a first return, check this box.

Write the final date.

mm dd

yyyy

C/O:

Mailing address:

City:

State:

ZIP:

Step 2:

Figure your payment amount

1

1

Write your total amount of business income apportioned to Illinois (cannot be less than zero). See Instructions.

00

Lines 2a through 5a, write the amount of Illinois business income that is distributable to nonresident

partners, shareholders, or beneficiaries. See instructions.

2

2a

2

Nonresident individuals and estates share of the amount on Line 1.

x .05 =

00

3

3a

3

Partnerships/S corporations share of the amount on Line 1.

x .015 =

00

4

4a

4

Nonresident trusts share of the amount on Line 1.

x .065 =

00

5

5a

5

Corporations share of the amount on Line 1.

x .095 =

00

6

6

Add Lines 2 through 5.

00

7

Write any pass-through entity payment from any Schedule(s) K-1-P or K-1-T you received and that you

7

choose to apply toward your pass-through entity payment obligations. Attach Schedule(s) K-1-P and K-1-T.

00

8

8

Write the amount of prepayments you made on Form IL-1000-P.

00

9

9

Add Lines 7 and 8.

00

10

10

Tax due. Subtract Line 9 from Line 6.

00

Complete a payment voucher, Form IL-1000-V, make your check payable to “Illinois Department of Revenue” and attach them

to this page.

Write the amount of your payment on the top of this page in the space provided.

Step 3:

Sign here

Under penalties of perjury, I state that I have examined this return and, to the best of my knowledge, it is true, correct, and complete.

(

)

Check this box if we may

Signature of partner, authorized officer, or fiduciary

Date

Title

Phone

discuss this return with the

preparer shown in this step.

Signature of preparer

Date

Preparer’s Social Security number or firm’s FEIN

(

)

Preparer’s firm name (or yours, if self-employed)

Address

Phone

If a payment is not enclosed, mail this return to: Illinois Department of Revenue, P.O. Box 19017, Springfield, IL 62794-9017

If a payment is enclosed, mail this return to: Illinois Department of Revenue, P.O. Box 19053, Springfield, IL 62794-9053

*359801110*

This form is authorized as outlined by the Illinois Income Tax Act. Disclosure of this

information is REQUIRED. Failure to provide information could result in a penalty.

NS

DR__________

IL-1000 (R-12/13)

1

1