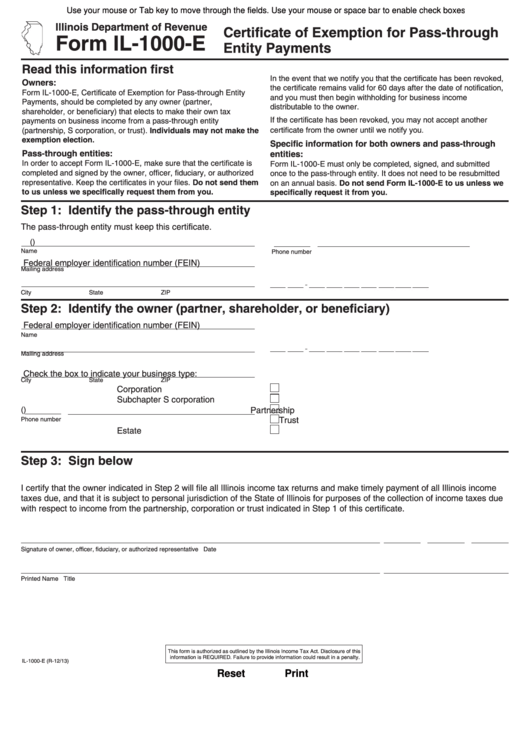

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

Certificate of Exemption for Pass-through

Form IL-1000-E

Entity Payments

Read this information first

In the event that we notify you that the certificate has been revoked,

Owners:

the certificate remains valid for 60 days after the date of notification,

Form IL-1000-E, Certificate of Exemption for Pass-through Entity

and you must then begin withholding for business income

Payments, should be completed by any owner (partner,

distributable to the owner.

shareholder, or beneficiary) that elects to make their own tax

If the certificate has been revoked, you may not accept another

payments on business income from a pass-through entity

(partnership, S corporation, or trust). Individuals may not make the

certificate from the owner until we notify you.

exemption election.

Specific information for both owners and pass-through

Pass-through entities:

entities:

In order to accept Form IL-1000-E, make sure that the certificate is

Form IL-1000-E must only be completed, signed, and submitted

completed and signed by the owner, officer, fiduciary, or authorized

once to the pass-through entity. It does not need to be resubmitted

representative. Keep the certificates in your files. Do not send them

on an annual basis. Do not send Form IL-1000-E to us unless we

to us unless we specifically request them from you.

specifically request it from you.

Step 1: Identify the pass-through entity

The pass-through entity must keep this certificate.

(

)

Name

Phone number

Federal employer identification number (FEIN)

Mailing address

City

State

ZIP

Step 2: Identify the owner (partner, shareholder, or beneficiary)

Federal employer identification number (FEIN)

Name

Mailing address

Check the box to indicate your business type:

City

State

ZIP

Corporation

Subchapter S corporation

(

)

Partnership

Trust

Phone number

Estate

Step 3: Sign below

I certify that the owner indicated in Step 2 will file all Illinois income tax returns and make timely payment of all Illinois income

taxes due, and that it is subject to personal jurisdiction of the State of Illinois for purposes of the collection of income taxes due

with respect to income from the partnership, corporation or trust indicated in Step 1 of this certificate.

Signature of owner, officer, fiduciary, or authorized representative

Date

Printed Name

Title

This form is authorized as outlined by the Illinois Income Tax Act. Disclosure of this

information is REQUIRED. Failure to provide information could result in a penalty.

IL-1000-E (R-12/13)

Reset

Print

1

1