Form Tt-114 - Quarterly Report Of Wisconsin Tax-Paid Tobacco Products Purchased

ADVERTISEMENT

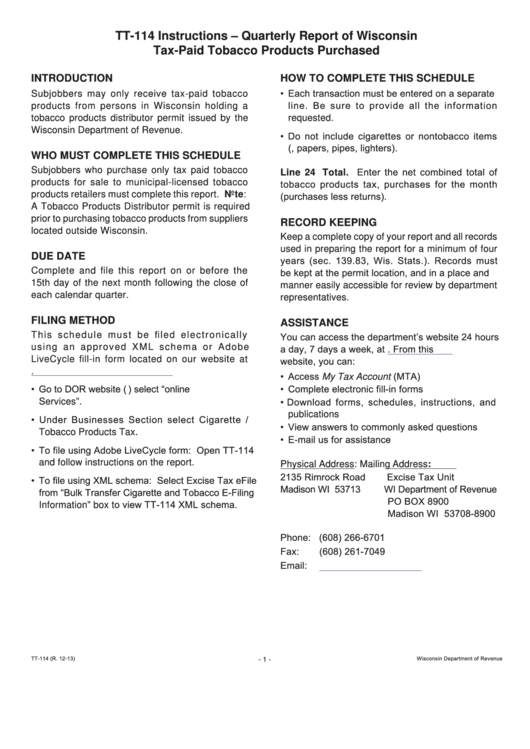

TT-114 Instructions – Quarterly Report of Wisconsin

Tax-Paid Tobacco Products Purchased

INTRODUCTION

HOW TO COMPLETE THIS SCHEDULE

• Each transaction must be entered on a separate

Subjobbers may only receive tax-paid tobacco

line. Be sure to provide all the information

products from persons in Wisconsin holding a

tobacco products distributor permit issued by the

requested.

Wisconsin Department of Revenue.

• Do not include cigarettes or nontobacco items

(e.g., papers, pipes, lighters).

WHO MUST COMPLETE THIS SCHEDULE

Subjobbers who purchase only tax paid tobacco

Line 24 Total. Enter the net combined total of

tobacco products tax, purchases for the month

products for sale to municipal-licensed tobacco

products retailers must complete this report. Note:

(purchases less returns).

A Tobacco Products Distributor permit is required

prior to purchasing tobacco products from suppliers

RECORD KEEPING

located outside Wisconsin.

Keep a complete copy of your report and all records

used in preparing the report for a minimum of four

DUE DATE

years (sec. 139.83, Wis. Stats.). Records must

Complete and file this report on or before the

be kept at the permit location, and in a place and

15th day of the next month following the close of

manner easily accessible for review by department

each calendar quarter.

representatives.

FILING METHOD

ASSISTANCE

You can access the department’s website 24 hours

This schedule must be filed electronically

using an approved XML schema or Adobe

a day, 7 days a week, at revenue.wi.gov. From this

LiveCycle fill-in form located on our website at

website, you can:

revenue.wi.gov/html/cigtob1.html.

• Access My Tax Account (MTA)

• Go to DOR website (revenue.wi.gov) select “online

• Complete electronic fill-in forms

• Download forms, schedules, instructions, and

Services”.

publications

• Under Businesses Section select Cigarette /

• View answers to commonly asked questions

Tobacco Products Tax.

• E-mail us for assistance

• To file using Adobe LiveCycle form: Open TT-114

and follow instructions on the report.

Physical Address:

Mailing Address:

2135 Rimrock Road

Excise Tax Unit

• To file using XML schema: Select Excise Tax eFile

Madison WI 53713

WI Department of Revenue

from “Bulk Transfer Cigarette and Tobacco E-Filing

PO BOX 8900

Information” box to view TT-114 XML schema.

Madison WI 53708-8900

Phone: (608) 266-6701

Fax:

(608) 261-7049

Email:

excise@revenue.wi.gov

TT-114 (R. 12-13)

Wisconsin Department of Revenue

- 1 -

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2