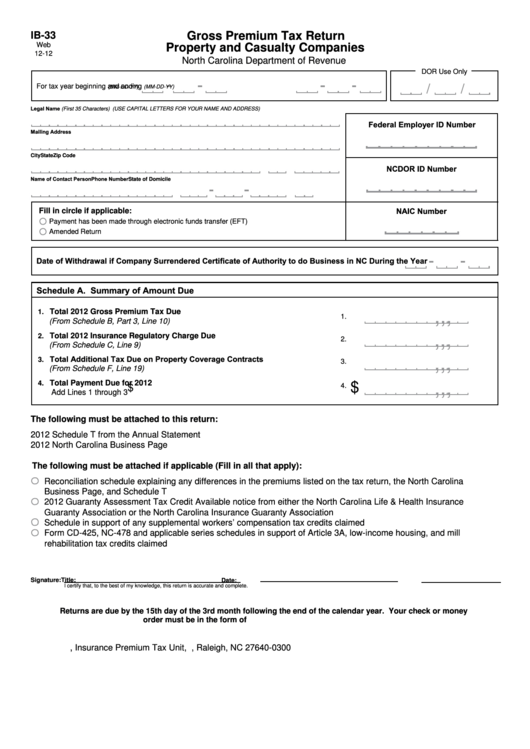

IB-33

Gross Premium Tax Return

Web

Property and Casualty Companies

12-12

North Carolina Department of Revenue

DOR Use Only

For tax year beginning

and ending

(MM-DD-YY)

(MM-DD-YY)

Legal Name (First 35 Characters)

(USE CAPITAL LETTERS FOR YOUR NAME AND ADDRESS)

Federal Employer ID Number

Mailing Address

City

State

Zip Code

NCDOR ID Number

Name of Contact Person

Phone Number

State of Domicile

NAIC Number

Fill in circle if applicable:

Payment has been made through electronic funds transfer (EFT)

Amended Return

Date of Withdrawal if Company Surrendered Certificate of Authority to do Business in NC During the Year

Schedule A. Summary of Amount Due

,

,

,

.

Total 2012 Gross Premium Tax Due

1.

00

1.

(From Schedule B, Part 3, Line 10)

,

,

,

.

Total 2012 Insurance Regulatory Charge Due

2.

2.

00

(From Schedule C, Line 9)

,

,

,

.

Total Additional Tax Due on Property Coverage Contracts

3.

3.

00

(From Schedule F, Line 19)

,

,

,

.

$

Total Payment Due for 2012

4.

4.

$

00

Add Lines 1 through 3

The following must be attached to this return:

2012 Schedule T from the Annual Statement

2012 North Carolina Business Page

The following must be attached if applicable (Fill in all that apply):

Reconciliation schedule explaining any differences in the premiums listed on the tax return, the North Carolina

Business Page, and Schedule T

2012 Guaranty Assessment Tax Credit Available notice from either the North Carolina Life & Health Insurance

Guaranty Association or the North Carolina Insurance Guaranty Association

Schedule in support of any supplemental workers’ compensation tax credits claimed

Form CD-425, NC-478 and applicable series schedules in support of Article 3A, low-income housing, and mill

rehabilitation tax credits claimed

Signature:

Title:

Date:

I certify that, to the best of my knowledge, this return is accurate and complete.

Returns are due by the 15th day of the 3rd month following the end of the calendar year. Your check or money

order must be in the form of U.S. currency from a domestic bank.

N.C. Department of Revenue, Insurance Premium Tax Unit, P.O. Box 25000, Raleigh, NC 27640-0300

1

1 2

2 3

3 4

4