Instructions for Form MI-1040-V

2014 Michigan Individual Income Tax e-file Payment Voucher

Mail this form with payments for e-file returns only. Do not file with your paper return.

You may make your individual income tax payment electronically using Michigan’s e-Payments service. Payment options

include direct debit (eCheck) from your checking or savings account, or payment by credit or debit card.

Visit for more information.

Important Information

Mailing Instructions

•

Make your check payable to the “State of Michigan.”

Mail Form MI-1040-V with your payment after you e-file

Print “2014 MI-1040-V” and the last four digits of the

your MI-1040 return.

your Social Security number on the check. If paying

on behalf of another filer, write the filer’s name and the

Do not use this voucher to make any other payments to

last four digits of filer’s Social Security number on the

the State of Michigan.

check. For accurate processing of your payment, do

Enter on Form MI-1040-V below the tax due as shown on

not combine this payment with any other payments.

your Individual Income Tax Return (MI-1040), line 32.

•

Detach Form MI-1040-V along the dotted line.

Your payment and MI-1040-V are due April 15, 2015. If

•

Do not attach your payment to Form MI-1040-V.

your payment is late, Treasury will send you a bill for the

Instead, place both items loose in the envelope and

amount due and add a penalty of 5 percent of the tax due for

mail to:

the first two months, then 5 percent for each month thereafter

Michigan Department of Treasury

until full payment is received. Maximum late penalty is

P.O. Box 30774

25 percent of the balance of tax due. If you pay late, you

Lansing, MI 48909-8274

must add penalty and interest to the amount due. The annual

•

Do not attach a copy of your return to the MI-1040-V.

interest rate is 1 percent above the current prime rate. The

Attaching a copy of your return will delay the

rate is adjusted on July 1 and January 1. For current interest

application of payment to your account.

rates, visit

•

Do not write notes on the MI-1040-V or submit the

If you do not owe any tax on your e-filed MI-1040, do not

voucher without payment.

file this form.

•

If you choose to make your payment electronically

you do not need to mail Form MI-1040V to Treasury.

If you choose to make your payment electronically, you

If you have questions, you may call (517) 636-4486.

do not need to mail Form MI-1040-V to Treasury.

Assistance is available using TTY through the Michigan

Relay Service by calling 1-800-649-3777 or 711.

Visit for additional information.

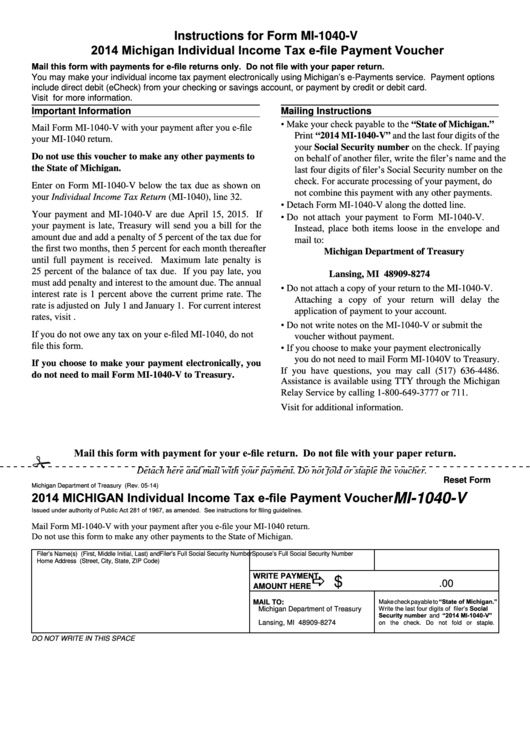

Mail this form with payment for your e-file return. Do not file with your paper return.

#

Detach here and mail with your payment. Do not fold or staple the voucher.

Reset Form

Michigan Department of Treasury (Rev. 05-14)

2014 MICHIGAN Individual Income Tax e-file Payment Voucher

MI-1040-V

Issued under authority of Public Act 281 of 1967, as amended. See instructions for filing guidelines.

Mail Form MI-1040-V with your payment after you e-file your MI-1040 return.

Do not use this form to make any other payments to the State of Michigan.

Filer’s Name(s) (First, Middle Initial, Last) and

Filer’s Full Social Security Number

Spouse’s Full Social Security Number

Home Address (Street, City, State, ZIP Code)

WRITE PAYMENT

a $

.00

AMOUNT HERE

Make check payable to “State of Michigan.”

MAIL TO:

Write the last four digits of filer’s Social

Michigan Department of Treasury

Security number and “2014 MI-1040-V”

P.O. Box 30774

Lansing, MI 48909-8274

on the check. Do not fold or staple.

DO NOT WRITE IN THIS SPACE

1

1