Form Dr-504ha - Ad Valorem Tax Exemption Application And Return Homes For The Aged

ADVERTISEMENT

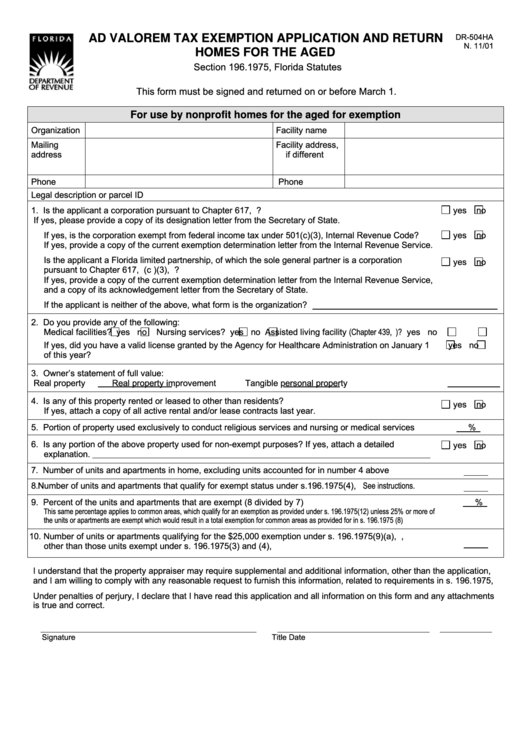

DR-504HA

AD VALOREM TAX EXEMPTION APPLICATION AND RETURN

N. 11/01

HOMES FOR THE AGED

Section 196.1975, Florida Statutes

This form must be signed and returned on or before March 1.

For use by nonprofit homes for the aged for exemption

Organization

Facility name

Mailing

Facility address,

address

if different

Phone

Phone

Legal description or parcel ID

1. Is the applicant a corporation pursuant to Chapter 617, F.S.?

yes

no

If yes, please provide a copy of its designation letter from the Secretary of State.

If yes, is the corporation exempt from federal income tax under 501(c)(3), Internal Revenue Code?

yes

no

If yes, provide a copy of the current exemption determination letter from the Internal Revenue Service.

Is the applicant a Florida limited partnership, of which the sole general partner is a corporation

yes

no

pursuant to Chapter 617, F.S. and exempt from federal income tax under 501(c )(3), I.R.C.?

If yes, provide a copy of the current exemption determination letter from the Internal Revenue Service,

and a copy of its acknowledgement letter from the Secretary of State.

If the applicant is neither of the above, what form is the organization?

2. Do you provide any of the following:

Medical facilities?

yes

no Nursing services?

yes

no Assisted living facility (Chapter 439, F.S.)?

yes

no

If yes, did you have a valid license granted by the Agency for Healthcare Administration on January 1

yes

no

of this year?

3. Owner’s statement of full value:

Real property

Real property improvement

Tangible personal property

4. Is any of this property rented or leased to other than residents?

yes

no

If yes, attach a copy of all active rental and/or lease contracts last year.

5. Portion of property used exclusively to conduct religious services and nursing or medical services

%

6. Is any portion of the above property used for non-exempt purposes? If yes, attach a detailed

yes

no

explanation.

7. Number of units and apartments in home, excluding units accounted for in number 4 above

8. Number of units and apartments that qualify for exempt status under s.196.1975(4), F.S. See instructions.

9. Percent of the units and apartments that are exempt (8 divided by 7)

%

This same percentage applies to common areas, which qualify for an exemption as provided under s. 196.1975(12) unless 25% or more of

the units or apartments are exempt which would result in a total exemption for common areas as provided for in s. 196.1975 (8)

10. Number of units or apartments qualifying for the $25,000 exemption under s. 196.1975(9)(a), F.S.,

other than those units exempt under s. 196.1975(3) and (4), F.S.

I understand that the property appraiser may require supplemental and additional information, other than the application,

and I am willing to comply with any reasonable request to furnish this information, related to requirements in s. 196.1975, F.S.

Under penalties of perjury, I declare that I have read this application and all information on this form and any attachments

is true and correct.

Signature

Title

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2