Form Dr-146 - Miami-Dade County Lake Belt Mitigation And Water Treatment Plant Upgrade Fees Tax Return

ADVERTISEMENT

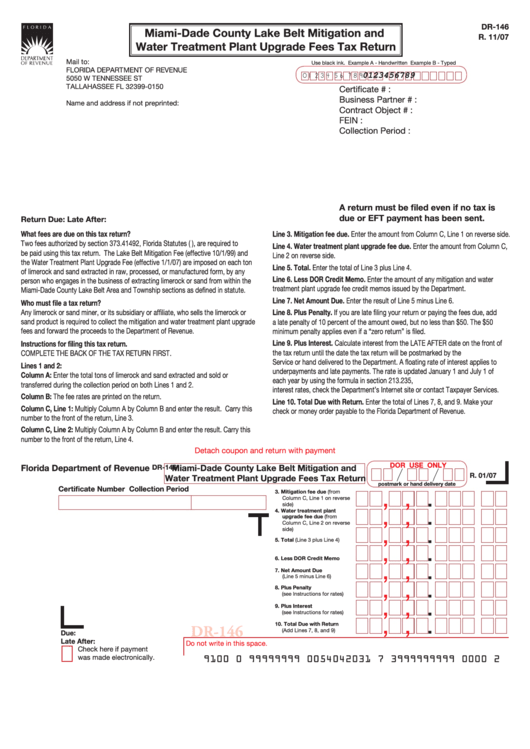

DR-146

Miami-Dade County Lake Belt Mitigation and

R. 11/07

Water Treatment Plant upgrade Fees Tax Return

Mail to:

use black ink. example a - handwritten example B - typed

Florida departMent oF revenue

0 1 2 3 4 5 6 7 8 9

0123456789

5050 W tennessee st

tallahassee Fl 32399-0150

Certificate # :

Business partner # :

name and address if not preprinted:

Contract object # :

Fein :

Collection period :

A return must be filed even if no tax is

due or eFT payment has been sent.

Return Due:

Late After:

What fees are due on this tax return?

Line 3. Mitigation fee due. enter the amount from Column C, line 1 on reverse side.

two fees authorized by section 373.41492, Florida statutes (F.s.), are required to

Line 4. Water treatment plant upgrade fee due. enter the amount from Column C,

be paid using this tax return. the lake Belt Mitigation Fee (effective 10/1/99) and

line 2 on reverse side.

the Water treatment plant upgrade Fee (effective 1/1/07) are imposed on each ton

Line 5. Total. enter the total of line 3 plus line 4.

of limerock and sand extracted in raw, processed, or manufactured form, by any

Line 6. Less DoR Credit Memo. enter the amount of any mitigation and water

person who engages in the business of extracting limerock or sand from within the

treatment plant upgrade fee credit memos issued by the department.

Miami-dade County lake Belt area and township sections as defined in statute.

Line 7. Net Amount Due. enter the result of line 5 minus line 6.

Who must file a tax return?

any limerock or sand miner, or its subsidiary or affiliate, who sells the limerock or

Line 8. Plus Penalty. if you are late filing your return or paying the fees due, add

sand product is required to collect the mitigation and water treatment plant upgrade

a late penalty of 10 percent of the amount owed, but no less than $50. the $50

fees and forward the proceeds to the department of revenue.

minimum penalty applies even if a “zero return” is filed.

Line 9. Plus Interest. Calculate interest from the late aFter date on the front of

Instructions for filing this tax return.

the tax return until the date the tax return will be postmarked by the u.s. postal

CoMplete the BaCk oF the tax return First.

service or hand delivered to the department. a floating rate of interest applies to

Lines 1 and 2:

underpayments and late payments. the rate is updated January 1 and July 1 of

Column A: enter the total tons of limerock and sand extracted and sold or

each year by using the formula in section 213.235, F.s. For current and prior period

transferred during the collection period on both lines 1 and 2.

interest rates, check the department’s internet site or contact taxpayer services.

Column B: the fee rates are printed on the return.

Line 10. Total Due with Return. enter the total of lines 7, 8, and 9. Make your

Column C, Line 1: Multiply Column a by Column B and enter the result. Carry this

check or money order payable to the Florida department of revenue.

number to the front of the return, line 3.

Column C, Line 2: Multiply Column a by Column B and enter the result. Carry this

number to the front of the return, line 4.

detach coupon and return with payment

DoR use oNLy

Florida Department of Revenue

Miami-Dade County Lake Belt Mitigation and

DR-146

R. 01/07

Water Treatment Plant upgrade Fees Tax Return

postmark or hand delivery date

,

,

.

Certificate Number

Collection Period

3. Mitigation fee due (from

Column C, line 1 on reverse

side)

,

,

.

4. Water treatment plant

upgrade fee due (from

Column C, line 2 on reverse

,

,

.

side)

5. Total (line 3 plus line 4)

,

,

.

6. Less DoR Credit Memo

,

,

.

7. Net Amount Due

(line 5 minus line 6)

,

,

.

8. Plus Penalty

(see instructions for rates)

,

,

.

9. Plus Interest

(see instructions for rates)

,

,

.

10. Total Due with Return

DR-146

(add lines 7, 8, and 9)

Due:

Late After:

do not write in this space.

Check here if payment

9100 0 99999999 0054042031 7 3999999999 0000 2

was made electronically.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2