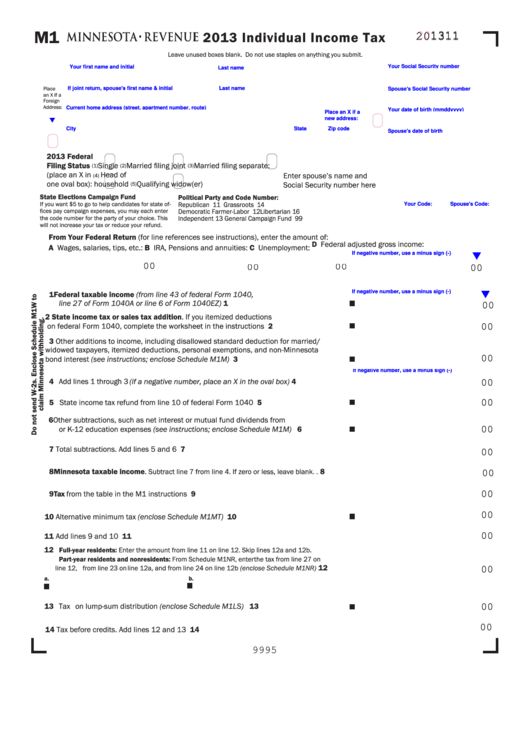

M1

2013 Individual Income Tax

20

1311

201311

Leave unused boxes blank . Do not use staples on anything you submit .

Your Social Security number

Your first name and initial

Last name

Place

If joint return, spouse's first name & initial

Last name

Spouse's Social Security number

an X If a

Foreign

Address:

Current home address (street, apartment number, route)

Your date of birth (mmddyyyy)

Place an X if a

t

new address:

City

State

Zip code

Spouse's date of birth

2013 Federal

Filing Status

Single

Married filing joint

Married filing separate:

(1)

(2)

(3)

(place an X in

Head of

Enter spouse’s name and

(4)

one oval box):

household

Qualifying widow(er)

Social Security number here

(5)

State Elections Campaign Fund

Political Party and Code Number:

Republican . . . . . . . . . . . 11 Grassroots . . . . . . . . . . . 14

If you want $5 to go to help candidates for state of-

Spouse's Code:

Your Code:

fices pay campaign expenses, you may each enter

Democratic Farmer-Labor 12 Libertarian . . . . . . . . . . . 16

the code number for the party of your choice . This

Independent . . . . . . . . . . 13 General Campaign Fund 99

will not increase your tax or reduce your refund .

From Your Federal Return (for line references see instructions), enter the amount of:

D Federal adjusted gross income:

A Wages, salaries, tips, etc.:

B IRA, Pensions and annuities:

C Unemployment:

If negative number, use a minus sign (-)

t

00

00

00

00

1 Federal taxable income (from line 43 of federal Form 1040,

If negative number, use a minus sign (-)

t

line 27 of Form 1040A or line 6 of Form 1040EZ) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

00

2 State income tax or sales tax addition . If you itemized deductions

on federal Form 1040, complete the worksheet in the instructions . . . . . . . . . . . . . . . . 2

00

3 Other additions to income, including disallowed standard deduction for married/

widowed taxpayers, itemized deductions, personal exemptions, and non-Minnesota

bond interest (see instructions; enclose Schedule M1M) . . . . . . . . . . . . . . . . . . . . . . . . 3

00

If negative number, use a minus sign (-)

4 Add lines 1 through 3 (if a negative number, place an X in the oval box) . . . . . . . . . . . . . 4

00

5 State income tax refund from line 10 of federal Form 1040 . . . . . . . . . . . . . . . . . . . . . . 5

00

6 Other subtractions, such as net interest or mutual fund dividends from U .S . bonds

or K-12 education expenses (see instructions; enclose Schedule M1M) . . . . . . . . . . . . 6

00

7 Total subtractions . Add lines 5 and 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

00

8 Minnesota taxable income .

8

Subtract line 7 from line 4 . If zero or less, leave blank . . . . . .

00

9 Tax from the table in the M1 instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

00

10 Alternative minimum tax (enclose Schedule M1MT) . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

00

11 Add lines 9 and 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

00

12

Full-year residents: Enter the amount from line 11 on line 12 . Skip lines 12a and 12b .

Part-year residents and nonresidents: From Schedule M1NR, enter the tax from line 27 on

. . . . . 12

line 12, from line 23 on line 12a, and from line 24 on line 12b (enclose Schedule M1NR)

00

a.

b.

13 Tax on lump-sum distribution (enclose Schedule M1LS) . . . . . . . . . . . . . . . . . . . . . . . . 13

00

00

14 Tax before credits . Add lines 12 and 13 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

9995

1

1 2

2