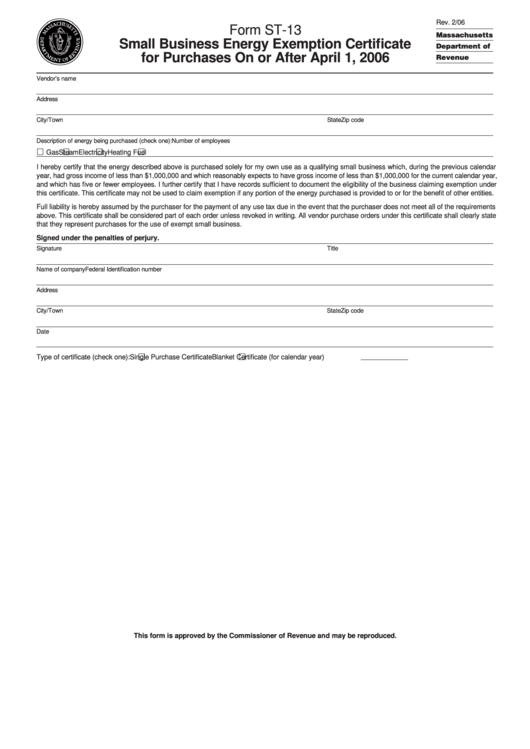

Form St-13 - Small Business Energy Exemption Certificate For Purchases - 2006

ADVERTISEMENT

Rev. 2/06

Form ST-13

Massachusetts

Small Business Energy Exemption Certificate

Department of

for Purchases On or After April 1, 2006

Revenue

Vendor’s name

Address

City/Town

State

Zip code

Description of energy being purchased (check one):

Number of employees

Gas

Steam

Electricity

Heating Fuel

I hereby certify that the energy described above is purchased solely for my own use as a qualifying small business which, during the previous calendar

year, had gross income of less than $1,000,000 and which reasonably expects to have gross income of less than $1,000,000 for the current calendar year,

and which has five or fewer employees. I further certify that I have records sufficient to document the eligibility of the business claiming exemption under

this certificate. This certificate may not be used to claim exemption if any portion of the energy purchased is provided to or for the benefit of other entities.

Full liability is hereby assumed by the purchaser for the payment of any use tax due in the event that the purchaser does not meet all of the requirements

above. This certificate shall be considered part of each order unless revoked in writing. All vendor purchase orders under this certificate shall clearly state

that they represent purchases for the use of exempt small business.

Signed under the penalties of perjury.

Signature

Title

Name of company

Federal Identification number

Address

City/Town

State

Zip code

Date

Type of certificate (check one):

Single Purchase Certificate

Blanket Certificate (for calendar year

)

This form is approved by the Commissioner of Revenue and may be reproduced.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2