Print

Reset

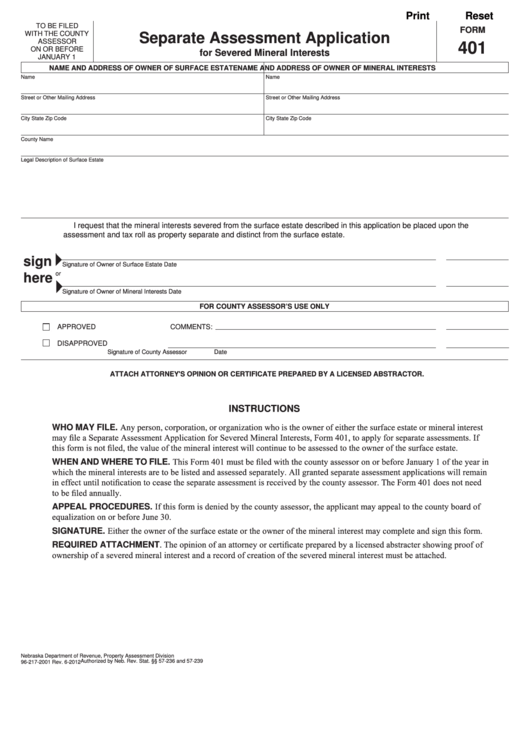

TO BE FILED

FORM

WITH THE COUNTY

Separate Assessment Application

ASSESSOR

401

ON OR BEFORE

for Severed Mineral Interests

JANUARY 1

NAME AND ADDRESS OF OWNER OF SURFACE ESTATE

NAME AND ADDRESS OF OWNER OF MINERAL INTERESTS

Name

Name

Street or Other Mailing Address

Street or Other Mailing Address

City

State

Zip Code

City

State

Zip Code

County Name

Legal Description of Surface Estate

I request that the mineral interests severed from the surface estate described in this application be placed upon the

assessment and tax roll as property separate and distinct from the surface estate.

sign

Signature of Owner of Surface Estate

Date

or

here

Signature of Owner of Mineral Interests

Date

FOR COUNTY ASSESSOR’S USE ONLY

APPROVED

COMMENTS:

DISAPPROVED

Signature of County Assessor

Date

ATTACH ATTORNEY'S OPINION OR CERTIFICATE PREPARED BY A LICENSED ABSTRACTOR.

INSTRUCTIONS

WHO MAY FILE. Any person, corporation, or organization who is the owner of either the surface estate or mineral interest

may file a Separate Assessment Application for Severed Mineral Interests, Form 401, to apply for separate assessments. If

this form is not filed, the value of the mineral interest will continue to be assessed to the owner of the surface estate.

WHEN AND WHERE TO FILE. This Form 401 must be filed with the county assessor on or before January 1 of the year in

which the mineral interests are to be listed and assessed separately. All granted separate assessment applications will remain

in effect until notification to cease the separate assessment is received by the county assessor. The Form 401 does not need

to be filed annually.

APPEAL PROCEDURES. If this form is denied by the county assessor, the applicant may appeal to the county board of

equalization on or before June 30.

SIGNATURE. Either the owner of the surface estate or the owner of the mineral interest may complete and sign this form.

REQUIRED ATTACHMENT. The opinion of an attorney or certificate prepared by a licensed abstracter showing proof of

ownership of a severed mineral interest and a record of creation of the severed mineral interest must be attached.

Nebraska Department of Revenue, Property Assessment Division

Authorized by Neb. Rev. Stat. §§ 57-236 and 57-239

96-217-2001 Rev. 6-2012

1

1