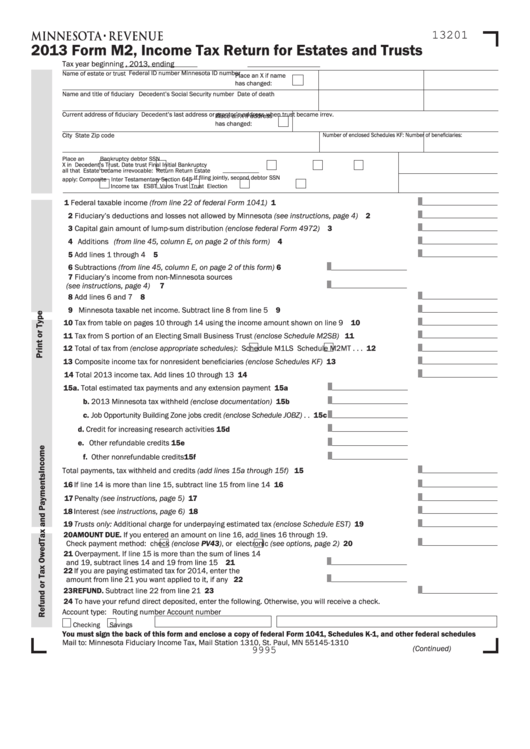

13201

2013 Form M2, Income Tax Return for Estates and Trusts

Tax year beginning

, 2013, ending

Federal ID number

Minnesota ID number

Name of estate or trust

Place an X if name

has changed:

Name and title of fiduciary

Decedent’s Social Security number

Date of death

Current address of fiduciary

Decedent’s last address or grantor’s address when trust became irrev.

Place an X if address

has changed:

Number of enclosed Schedules KF:

Number of beneficiaries:

City

State

Zip code

Place an

Bankruptcy debtor SSN

X in

Decedent’s

Trust. Date trust

Final

Initial

Bankruptcy

all that

Estate

became irrevocable:

Return

Return

Estate

If filing jointly, second debtor SSN

apply:

Composite

Inter

Testamentary

Section 645

Income tax

ESBT

Vivos Trust

Trust

Election

1 Federal taxable income (from line 22 of federal Form 1041) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

2 Fiduciary’s deductions and losses not allowed by Minnesota (see instructions, page 4) . . . . . . . . . . 2

3 Capital gain amount of lump-sum distribution (enclose federal Form 4972) . . . . . . . . . . . . . . . . . . .

3

4 Additions (from line 45, column E, on page 2 of this form) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5 Add lines 1 through 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6 Subtractions (from line 45, column E, on page 2 of this form) . . . . . . .

6

7 Fiduciary’s income from non-Minnesota sources

(see instructions, page 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

8 Add lines 6 and 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

9 Minnesota taxable net income. Subtract line 8 from line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

10 Tax from table on pages 10 through 14 using the income amount shown on line 9 . . . . . . . . . . . . . 10

11 Tax from S portion of an Electing Small Business Trust (enclose Schedule M2SB) . . . . . . . . . . . . . . 11

12 Total of tax from (enclose appropriate schedules):

Schedule M1LS

Schedule M2MT . . . 12

13 Composite income tax for nonresident beneficiaries (enclose Schedules KF) . . . . . . . . . . . . . . . . . . . 13

14 Total 2013 income tax. Add lines 10 through 13 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

15 a. Total estimated tax payments and any extension payment . . . . . . . 15a

b. 2013 Minnesota tax withheld (enclose documentation) . . . . . . . . . 15b

c. Job Opportunity Building Zone jobs credit (enclose Schedule JOBZ) . . 15c

d. Credit for increasing research activities . . . . . . . . . . . . . . . . . . . . . . . 15d

e. Other refundable credits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15e

f. Other nonrefundable credits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15f

Total payments, tax withheld and credits (add lines 15a through 15f) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

16 If line 14 is more than line 15, subtract line 15 from line 14 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

17 Penalty (see instructions, page 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

18 Interest (see instructions, page 6) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

19 Trusts only: Additional charge for underpaying estimated tax (enclose Schedule EST) . . . . . . . . . . . . 19

20 AMOUNT DUE. If you entered an amount on line 16, add lines 16 through 19.

check (enclose PV43), or

Check payment method:

electronic (see options, page 2) . . . . . . . . 20

21 Overpayment. If line 15 is more than the sum of lines 14

and 19, subtract lines 14 and 19 from line 15 . . . . . . . . . . . . . . . . . . . . 21

22 If you are paying estimated tax for 2014, enter the

amount from line 21 you want applied to it, if any . . . . . . . . . . . . . . . . . 22

23 REFUND. Subtract line 22 from line 21 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23

24 To have your refund direct deposited, enter the following. Otherwise, you will receive a check.

Account type:

Routing number

Account number

Checking

Savings

You must sign the back of this form and enclose a copy of federal Form 1041, Schedules K-1, and other federal schedules

Mail to: Minnesota Fiduciary Income Tax, Mail Station 1310, St. Paul, MN 55145-1310

(Continued)

9995

1

1 2

2