Form Mvu-25 - Affidavit In Support Of A Claim For Exemption From Sales Or Use Tax For A Motor Vehicle Transferred By A Business Entity

ADVERTISEMENT

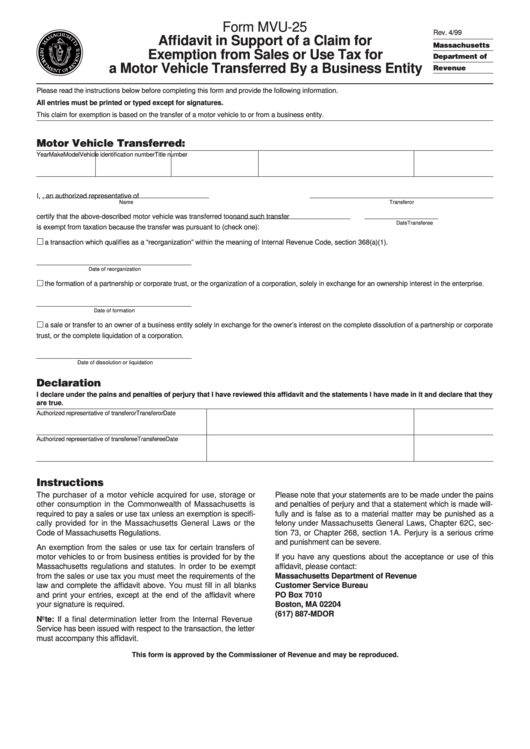

Form MVU-25

Rev. 4/99

Affidavit in Support of a Claim for

Massachusetts

Exemption from Sales or Use Tax for

Department of

a Motor Vehicle Transferred By a Business Entity

Revenue

Please read the instructions below before completing this form and provide the following information.

All entries must be printed or typed except for signatures.

This claim for exemption is based on the transfer of a motor vehicle to or from a business entity.

Motor Vehicle Transferred:

Year

Make

Model

Vehicle identification number

Title number

I,

, an authorized representative of

Name

Transferor

certify that the above-described motor vehicle was transferred to

on

and such transfer

Transferee

Date

is exempt from taxation because the transfer was pursuant to (check one):

a transaction which qualifies as a “reorganization” within the meaning of Internal Revenue Code, section 368(a)(1).

Date of reorganization

the formation of a partnership or corporate trust, or the organization of a corporation, solely in exchange for an ownership interest in the enterprise.

Date of formation

a sale or transfer to an owner of a business entity solely in exchange for the owner’s interest on the complete dissolution of a partnership or corporate

trust, or the complete liquidation of a corporation.

Date of dissolution or liquidation

Declaration

I declare under the pains and penalties of perjury that I have reviewed this affidavit and the statements I have made in it and declare that they

are true.

Authorized representative of transferor

Transferor

Date

Authorized representative of transferee

Transferee

Date

Instructions

The purchaser of a motor vehicle acquired for use, storage or

Please note that your statements are to be made under the pains

other consumption in the Commonwealth of Massachusetts is

and penalties of perjury and that a statement which is made will-

required to pay a sales or use tax unless an exemption is specifi-

fully and is false as to a material matter may be punished as a

cally provided for in the Massachusetts General Laws or the

felony under Massachusetts General Laws, Chapter 62C, sec-

Code of Massachusetts Regulations.

tion 73, or Chapter 268, section 1A. Perjury is a serious crime

and punishment can be severe.

An exemption from the sales or use tax for certain transfers of

motor vehicles to or from business entities is provided for by the

If you have any questions about the acceptance or use of this

Massachusetts regulations and statutes. In order to be exempt

affidavit, please contact:

from the sales or use tax you must meet the requirements of the

Massachusetts Department of Revenue

law and complete the affidavit above. You must fill in all blanks

Customer Service Bureau

and print your entries, except at the end of the affidavit where

PO Box 7010

your signature is required.

Boston, MA 02204

(617) 887-MDOR

Note: If a final determination letter from the Internal Revenue

Service has been issued with respect to the transaction, the letter

must accompany this affidavit.

This form is approved by the Commissioner of Revenue and may be reproduced.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1