Form Uorf-1 - Uniform Oil Response And Prevention Fee Monthly Return

ADVERTISEMENT

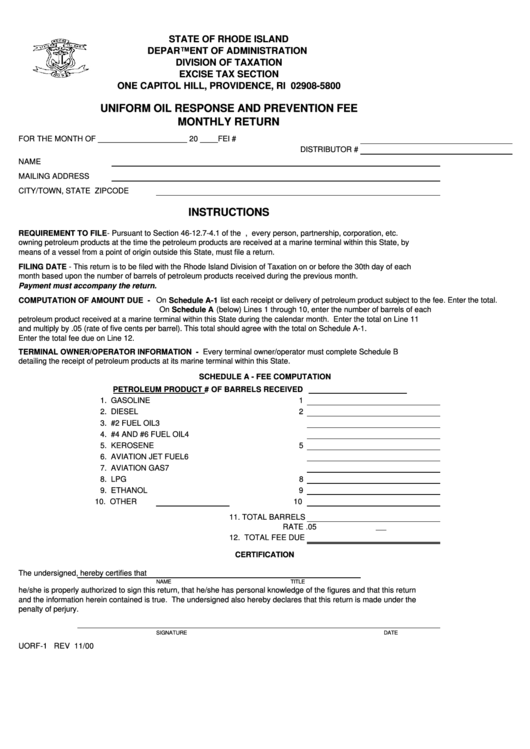

STATE OF RHODE ISLAND

DEPARTMENT OF ADMINISTRATION

DIVISION OF TAXATION

EXCISE TAX SECTION

ONE CAPITOL HILL, PROVIDENCE, RI 02908-5800

UNIFORM OIL RESPONSE AND PREVENTION FEE

MONTHLY RETURN

FOR THE MONTH OF ____________________ 20 ____

FEI #

DISTRIBUTOR #

NAME

MAILING ADDRESS

CITY/TOWN, STATE ZIPCODE

INSTRUCTIONS

REQUIREMENT TO FILE - Pursuant to Section 46-12.7-4.1 of the R.I.G.L., every person, partnership, corporation, etc.

owning petroleum products at the time the petroleum products are received at a marine terminal within this State, by

means of a vessel from a point of origin outside this State, must file a return.

FILING DATE - This return is to be filed with the Rhode Island Division of Taxation on or before the 30th day of each

month based upon the number of barrels of petroleum products received during the previous month.

Payment must accompany the return.

COMPUTATION OF AMOUNT DUE - On Schedule A-1 list each receipt or delivery of petroleum product subject to the fee. Enter the total.

On Schedule A (below) Lines 1 through 10, enter the number of barrels of each

petroleum product received at a marine terminal within this State during the calendar month. Enter the total on Line 11

and multiply by .05 (rate of five cents per barrel). This total should agree with the total on Schedule A-1.

Enter the total fee due on Line 12.

TERMINAL OWNER/OPERATOR INFORMATION - Every terminal owner/operator must complete Schedule B

detailing the receipt of petroleum products at its marine terminal within this State.

SCHEDULE A - FEE COMPUTATION

PETROLEUM PRODUCT

# OF BARRELS RECEIVED

1. GASOLINE

1

2. DIESEL

2

3. #2 FUEL OIL

3

4. #4 AND #6 FUEL OIL

4

5. KEROSENE

5

6. AVIATION JET FUEL

6

7. AVIATION GAS

7

8. LPG

8

9. ETHANOL

9

10. OTHER

10

11. TOTAL BARRELS

RATE

.05

12. TOTAL FEE DUE

CERTIFICATION

The undersigned

, hereby certifies that

NAME

TITLE

he/she is properly authorized to sign this return, that he/she has personal knowledge of the figures and that this return

and the information herein contained is true. The undersigned also hereby declares that this return is made under the

penalty of perjury.

SIGNATURE

DATE

UORF-1 REV 11/00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3